Fiscal pressures on Qatar are expected to ease from 2017, as modest gains in hydrocarbon prices result in a recovery in revenues and the government’s diversification efforts start to pay off, a new report has shown.

The government will maintain its efforts to increase its revenue base and to rationalise spending, BMI Research said in a report yesterday.

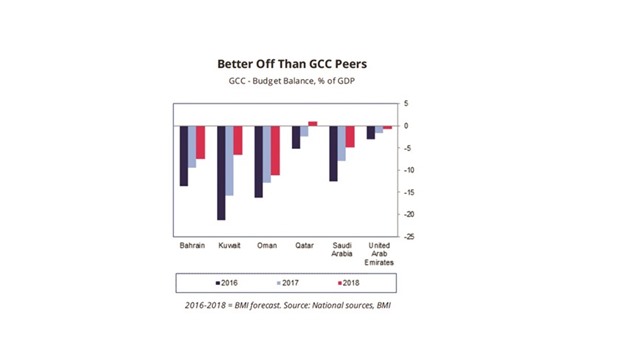

“We forecast the budget deficit to come in at 2.4% of GDP in 2017, compared with 5.2% in 2016. As Qatar continues to issue debt to finance its deficit, avoiding drawing down on reserves to mitigate liquidity pressures on the economy, we see public debt peaking at 53.2% of GDP in 2016 before gradually declining in the following years,” the Fitch Group company said.

According to BMI Research, the recovery in oil prices in 2017 would have a “positive” impact on Qatar’s public finances. Hydrocarbons accounted for around 60% of total government revenues before the slump in oil prices since late 2014. With BMI’s Oil and Gas team expecting Brent prices to average $55 per barrel in 2017, up from $45.5 in 2016, government revenues will return to positive territory.

The government will continue efforts to diversify revenue and rationalise expenditures. In August 2016, Doha introduced a QR35 ($10) airport tax for passengers leaving the country (including those in transit).

The planned introduction of a value-added tax at the Gulf Cooperation Council (GCC) level in 2018 will be an additional source of revenue, allowing the budget to return to surplus in that year.

In parallel, the government will seek to rationalise spending, while maintaining a welfare system for Qatari citizens. Earlier this month, HH the Emir Sheikh Tamim bin Hamad al-Thani announced that health and education projects would be delegated to the private sector, and called for a move away from ‘simple social welfare policies’ towards a ‘state of action’.

Nonetheless, given Qatar’s large fiscal buffers and small citizen population (Qataris account for less than 20% of the population), BMI believes that the government will not make any significant welfare cuts for citizens.

According to BMI, the government announced on November 7 that it would raise public sector salaries in 2017, with some basic salaries set to double for Qatari citizens.

BMI believes that Qatar will continue to issue debt over the next year, in order to avoid depleting reserves or liquidating some of its assets. Qatar boasts tremendous financial buffers, with foreign reserves currently covering more than 13 months of imports - only Saudi Arabia benefits from a more favourable import cover ratio in the GCC.

So far, Qatar has relied on domestic and international debt markets to finance its deficit, benefiting from the most favourable borrowing rates in the Gulf, in order to limit liquidity pressures at domestic banks.

BMI believes that the Qatari government will keep financing its deficit through debt, although the pace of issuance will slow from 2017 as funding needs head lower and borrowing rates rise as the US Federal Reserve resumes.

Business / Eco./Bus. News

Qatar fiscal pressures may ease from 2017 on oil rebound, diversification: BMI

FISCAL