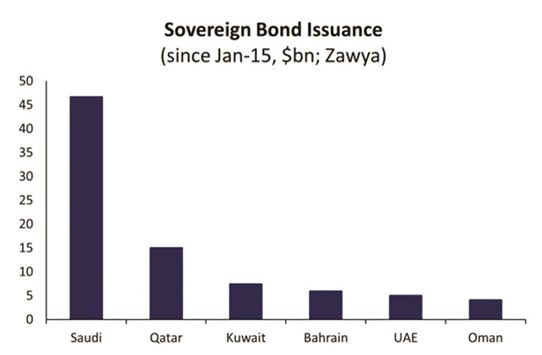

GCC sovereigns have raised $87bn in both domestic and international bonds and sukuks since January 2015, Samba Financial Group has said in a report.

Bond markets have seen a flurry of sovereign issuance as GCC governments look to plug the holes in their finances resulting from a fall in hydrocarbon revenues, it said.

The largest international issuance so far is the $9bn offering from Qatar in laate May. Abu Dhabi also issued eurobonds worth $5bn in May in both five and 10 year tenors, while Oman issued $2.5bn of bonds in May, in its first international bond sale in almost two decades.

The markets are waiting on a Saudi issuance, which Samba thinks will be around $15bn later this year, though the government has already secured a syndicated loan worth $10bn.

Corporate international debt issuance is also on the rise, with the vast majority of offerings coming from financial institutions. Since January 2015, UAE banks (and a small number of corporates) have issued $10.9bn in bonds, the largest in the GCC by a distance.

Interbank rates have risen across the region as liquidity has tightened, the report noted. This has been caused by the slowdown or reversal of deposit growth, caused in turn by governments running down their domestic savings.

In some countries, Samba said “liquidity has been further drained” by the issuance of government debt, most of which has been taken on by commercial banks. This in turn has meant less credit for the private sector, though in some countries where the government has been delaying payments to private contractors.

According to Samba GCC stock markets suffered large losses (some as much as 20%) at the beginning of the year, owing to the generalised risk-off sentiment, which pervaded global financial markets, and a further decline in oil prices.

Much of these losses were recovered in the second quarter as oil prices recovered, but from May onwards the long-standing correlation between the markets’ performance and oil prices began to breakdown.

Thus, even though oil prices continued to rise (albeit modestly) GCC bourses trended down again. This is probably attributable to the growing realisation among investors that the recovery of oil prices is unlikely to herald a meaningful increase in government spending — for this year at least.

Given the close links between government spending and private sector performance, corporate earnings seem likely to remain under pressure.

Other asset price data are hard to come by, Samba noted. Real estate data are available for Qatar and for the UAE, though they can be inconsistent. These data suggest that Dubai’s property prices have fallen back to 2012 levels, though the decline in Abu Dhabi has not been as dramatic.

In Qatar, the central bank’s real estate index posted a second consecutive monthly decline in May for the first time since 2009, it said.