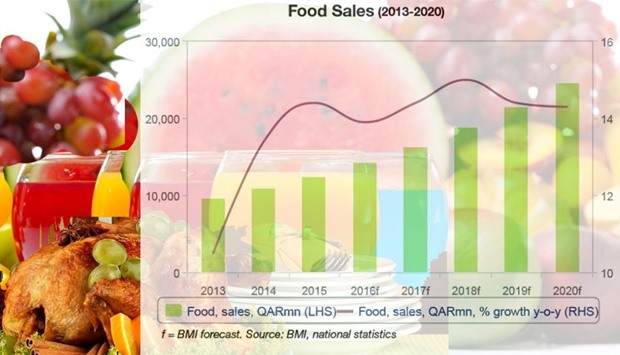

BMI forecasts that in five years up to 2020, food sales in local currency terms will grow by a compound annual growth rate of 14.4%.

In BMI’s view, Qatar will experience sustained growth in its food and drink sector, especially through premiumisation, even though its consumer outlook for the country has deteriorated in recent months.

Nonetheless, the small consumer base will limit the attractiveness of the Qatari market for food and drink manufacturers, as well as mass grocery retailers.

In its latest ‘Qatar Food & Drink Report’ the Fitch Group company noted that “Qatar will remain one of the best performing economies in the Gulf, and we still forecast rapid growth in food and non-alcoholic drinks sales.”

The mineral water segment will remain one of the best performing categories over the coming years, benefiting from a hot and arid climate, as well as rising incomes, it said.

BMI has cited some of Qatar's strengths in terms of sectoral growth including high income consumer base, well developed premiumisation channels and a strong business environment.

Qatar has a sizeable and growing high-spending expatriate population. The country is one of the world's highest per capita soft drinks consumers.

High spending market makes Qatar a strong candidate for premiumised food retailing, BMI noted.

On opportunities in Qatar, BMI said scope for even greater premiumisation could lead to growth across the food and drink sector.

Rising health consciousness has significantly increased opportunities for food and drink producers that are able to introduce 'healthy' or 'light' options in Qatar.

The demand for organic food is steadily increasing in the country as the food-processing industry becomes more segmented.

The FIFA World Cup in 2022 will provide exposure to Qatar as a tourist destination, BMI noted.

In Qatar’s retail segment, busier lifestyles are opening up opportunities for “neighbourhood convenience store launches” as consumers seek alternatives to busy mall-attached outlets.

That said, the consumer outlook for Qatar has “deteriorated” since Q2, 2016, as BMI now forecasts private consumption to expand by 2% in real terms in 2016 and 5% in 2017. The slump in global energy prices will lead to a more conservative stance from the government, and will weigh on the influx of higher-income expatriate workers in Doha.

According to BMI’s Middle East Country Risk team, the slowdown in government spending - to mitigate the effects of declining hydrocarbon revenues - will weigh on consumer spending through subsidy cuts. Nevertheless, the Qatari economy is set to remain a “regional outperformer” over the coming years, marked by strong and broad-based growth in the non-hydrocarbons sector, BMI said.

As the world's largest exporter of liquefied natural gas, Qatar is “less exposed” than other Gulf Cooperation Council (GCC) countries to weaker oil prices, BMI said.

In sectoral terms, services will remain the largest contributor to growth, fuelled by rapid growth in the migrant population and the opening of new infrastructure developments.

New large-scale shopping centres are scheduled to open this year and in 2017, BMI Research said.

The favourable outlook for the services sector underpins BMI’s strong view on Qatar’s consumer sector.

The share of private consumption in the economy (17.5% in 2015) remains low even by the standards of the rest of the Gulf, and is set to rise over the coming decade as the economy continues to diversify away from the capital-intensive oil and gas sector.

Consumption gains will come on the back of further labour force expansion and the rising services economy, with the retail, real estate, transportation, hospitality, and business and financial services all set to see continued growth, BMI said.

Qatar will experience sustained growth in its food and drink sector, especially through premiumisation, predicts BMI

Qatar’s food and drink sector will see sustained growth spurred by a surging population and rising spending power, BMI Research has said in a new report.