Nuclear power would “free up” more oil and gas for export in the GCC region, Apicorp Energy Research said in a report.

On the other hand, net energy-importing countries such as Egypt and Jordan would be able to secure long-term energy and reduce their import bills by utilising nuclear power, it said.

In the face of rising electricity demand, Apicorp Energy Research said nuclear power should enable Mena states to “diversify their sources of energy and reduce their carbon footprint.”

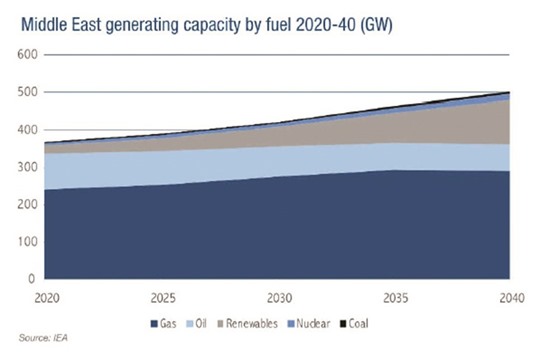

“But the outlook is mixed. While six countries have nuclear projects under way, planned or proposed, raising power generation capacity by 39GW, three Gulf countries have cancelled proposed nuclear projects in the wake of the Fukushima disaster. Fiscal constraints are one of the major barriers to progress, and the expectation is that nuclear power will account for only 3% of Middle East electricity generating capacity by 2040,” Apicorp Energy Research said.

Sustained increases in electricity demand in tandem with continuing demographic growth have prompted a number of Mena states to consider alternative sources of power generation, including nuclear. Yet at present, nuclear power facilities with capacity of just 5.6GW are under construction. Only a further 6.4GW are likely to come online by2030. The International Energy Agency (IEA) estimates that by 2040, the region’s nuclear industry will account for only 3% of electricity generation, with oil and gas accounting for 70%.

Several factors make the nuclear option attractive. Nuclear plants emit considerably less greenhouse gases compared with fossil fuel-fired capacity and help countries reduce their carbon footprint.

Cost competitiveness has improved in recent decades, allowing nuclear technology to become a serious component of energy diversification strategies. Nuclear also advances human capital and promotes employment in a new energy sector.

But development of the nuclear sector to a level at which it competes with oil and natural gas will be both complex and expensive.

Countries with ambitions to build nuclear power plants will need to find funding, attract human capital and put in place clear and stable regulatory frameworks.

Governments will need to prove to the global community that their nuclear programmes are peaceful and ensure public acceptance of their programmes.

Public acceptance in the region is generally higher than that in Europe, and in the UAE, this helped support the implementation of its programme.

According to Apicorp Research, nuclear projects require substantial upfront capital but exhibit lower operational and fuel costs over their lifetime- typically 50 years.

Upfront capital costs range from $3bn-6bn/GW of installed capacity, more than double the cost of equivalent coal- or gas-fired plants. Investment decisions are therefore heavily dependent on the availability of finance and government support.

Nuclear can be competitive against other sources of base load power. The levelised cost of electricity (LCOE) for nuclear increases at higher discount rates, given nuclear is capital intensive. At a discount rate of 3%, nuclear is more competitive than coal and gas. At 7%, nuclear remains competitive. Only at 10% does nuclear become less attractive.

While nuclear is often seen as a source of long-term power supply, this is contingent on the ability of project owners to secure large stocks of uranium.

“Currently, only four countries in Mena have proven uranium reserves. But, at an average price of $69/kg this year, production in the region remains uneconomical. Therefore, countries considering nuclear will have to rely on uranium supplied largely from outside the region,” Apicorp Energy Research said.

..