By Santhosh V Perumal/Business Reporter

Global credit rating agency Standard & Poor’s (S&P) has said Basel III offered an opportunity for Islamic banks to strengthen their capitalisation and liquidity management.

The new norms are likely to address some of the industry’s long-standing weaknesses, particularly the lack of high quality liquid assets (HQLA). The new capital buffers may also make the Islamic finance industry more resilient to the cyclical nature of its operations.

Basel III implementation may also encourage highly-rated sovereigns and corporates to list their sukuk on developed and liquid markets to make them eligible for HQLA inclusion, the report said, adding the implementation of Basel III will also test the treatment of profit sharing investment accounts (PSIAs) from a liquidity and funding perspective.

Highlighting that Basel III’s primary goal is to increase the level, quality, and global consistency of regulatory capital and standardise the required deductions and adjustments, S&P said “we expect the revision of the capital definitions to have a limited impact on Islamic banks’ quality of capital as most of their capital already comprises common equity.”

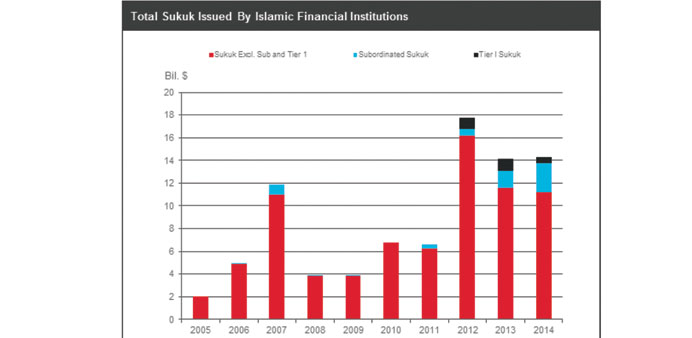

The recourse to Tier 2 capital instruments - primarily subordinated sukuk issuance - has been limited over the past 10 years, and Tier 3 capital instruments are nonexistent, it said, finding that over this period, Islamic banks have issued $86.1bn of sukuk in total, $6.2bn of which comprised Tier 2 instruments issued mainly by banks in Saudi Arabia, Malaysia, and Turkey.

Observing that higher Basel III capital requirements are neutral for Islamic banks; the rating agency said “we think that the impact of these additional capital requirements on Islamic financial institutions will be minimal, given their limited use of derivatives and securitisations.”

On the alpha factor - the requirement that banks hold regulatory capital to cover their displaced commercial risk -, it said “we believe that there is a strong incentive for Islamic banks to support PSIA holders through a reduction in the mudharib fee - the fee the bank takes for managing PSIA holders’ funds - through the use of profit equalisation reserves and investment risk reserves if they have been set aside, or through direct support from shareholders to PSIA holders.”

Basel III introduced a consistent leverage ratio measure, and the IFSB-15 standard outlines its calculation for Islamic banks, S&P said, adding leverage for Islamic banks is less problematic than for conventional financial institutions.

Two Islamic finance principles limit leverage - the asset backing principle and the prohibition of speculation.