The brave few who waded back into emerging markets in March reaped substantial rewards, but investors say it is too soon to tell whether the recent bounce will become a sustained rally.

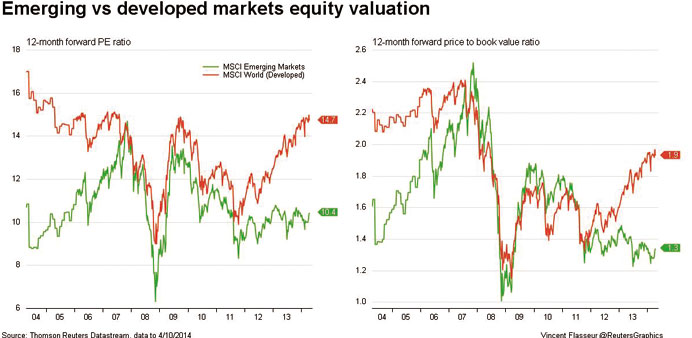

After three years of underperformance had left them at rock-bottom valuations, emerging markets enjoyed a surge in the early days of the northern spring.

Sovereign debt spreads closed to their narrowest over US Treasuries since May 2013 - just before then-Federal Reserve Chairman Ben Bernanke hinted the Fed would scale back its monetary stimulus, frightening investors in risky assets.

After falling 5% in 2013, emerging stocks bounced 9% and moved into the black for 2014. Now they are beating developed-world stocks.

Emerging market equity funds saw their biggest inflow in over a year last week, according to Boston-based fund tracker EPFR. Banks such as Barclays, Citi, HSBC, Morgan Stanley and Societe Generale started to recommend buying emerging markets by the beginning of this month.

“Performance has been particularly good in the very short term,” said Iain Stealey, who manages global bond strategies at JPMorgan Asset Management and has been adding emerging debt positions since the start of the year, though he also said that “volatility is going to be quite high”.

Not everyone took advantage of the rebound. The average allocation to emerging markets by international equity funds rose marginally in February, according to Lipper data - to 10.7% from 10.15%. Only four funds raised exposure to emerging markets by 2 percentage points or more over that time, Lipper’s most recent data show.

But a Bank of America-Merrill Lynch survey showed investors cut their extreme bets against emerging markets in April, suggesting many more investors have latched on to the trend.

A net 2% of fund managers are underweight emerging markets, compared with a net 21% in March. The net reading is the difference between overweight and underweight positions. The survey also showed investors thought emerging markets to be the most undervalued in 13 years.

One investor who profited was Loomis, Sayles & Co, which opened an emerging debt fund in February, its first US mutual fund focused on developing economies.

Emerging market funds had been going out of fashion, though, with only 10 new ones launched in the first three months of 2014, according to Lipper.

In 2011, a strong year for the sector, 200 new emerging market funds launched.

But Shaw Wagener, a portfolio manager at US investor American Funds, opened an emerging growth and income fund only last month.

“It’s a great time to launch a fund if you have a long-term focus in mind,” he said. “A lot of companies have cut back on capital expenditure, people are starting to manage more for profit and we may see earnings growth bottom out.”

Others are implementing tactical and sophisticated trades to benefit from volatility in hotspots like Turkey, whose reliance on external capital has led to a sharp decline since last year.

Andy Warwick, who manages a multi-portfolio fund at BlackRock, has made a number of long and short trades in Turkish equities - buying and selling in a matter of weeks - since September to benefit from volatility, before putting in place a long position in January.

“From a tactical point of view, Turkey looked very cheap and the central bank was tough in fighting the currency. It made markets more comfortable there’s value there,” Warwick said.