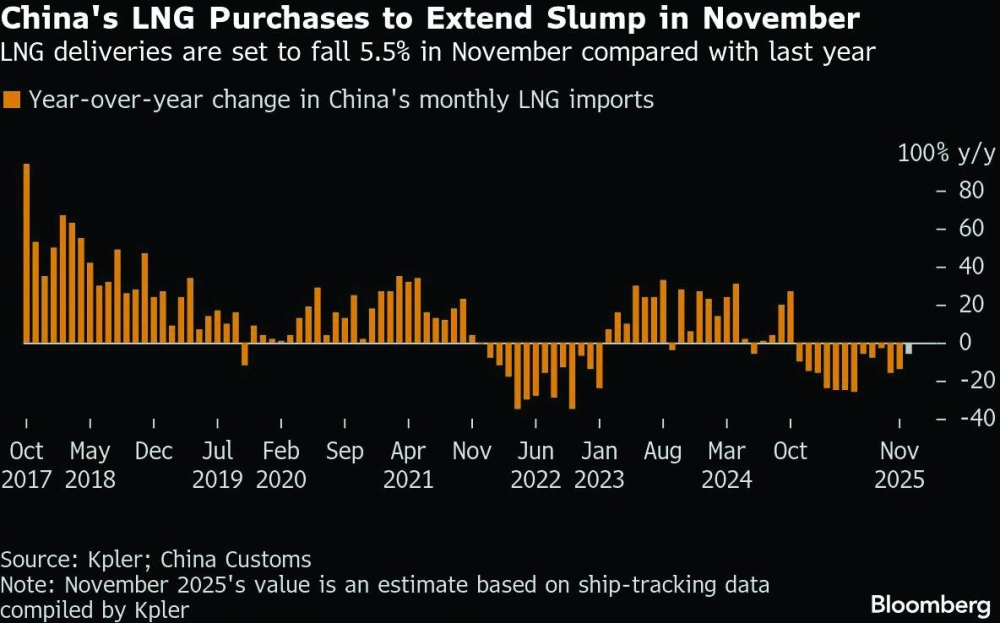

Seaborne shipments of liquefied natural gas (LNG) to China in November are set to drop for a 13th straight month on an annual basis, extending a slump in purchases as domestic output and piped imports remain strong.Deliveries are expected to be around 5.81mn tons, according to Kpler, an analytics firm that tracks shipping data to make forecasts. That’s about 5.5% lower than the same month last year, according to Chinese customs data.China’s LNG demand has been soft this year, with buyers shying away from expensive seaborne cargoes of the super-chilled fuel in favour of cheaper piped gas from Russia and Central Asia. Domestic production has also been robust.There will likely be no urgent need for China to dip into the spot market even as winter sets in. Early forecasts show normal to mild temperatures across the country, which has already secured the heating fuel it will need for the next few months via long-term contracts.China was the world’s top importer of the fuel last year, and sluggish demand is raising concerns about a global glut later in the decade as new projects come online in several countries. Even if lower prices entice Chinese importers, the country is still unlikely to absorb all the new LNG and an oversupply would persist in the coming years, according to analysts from Goldman Sachs Group Inc.

Tuesday, February 10, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.