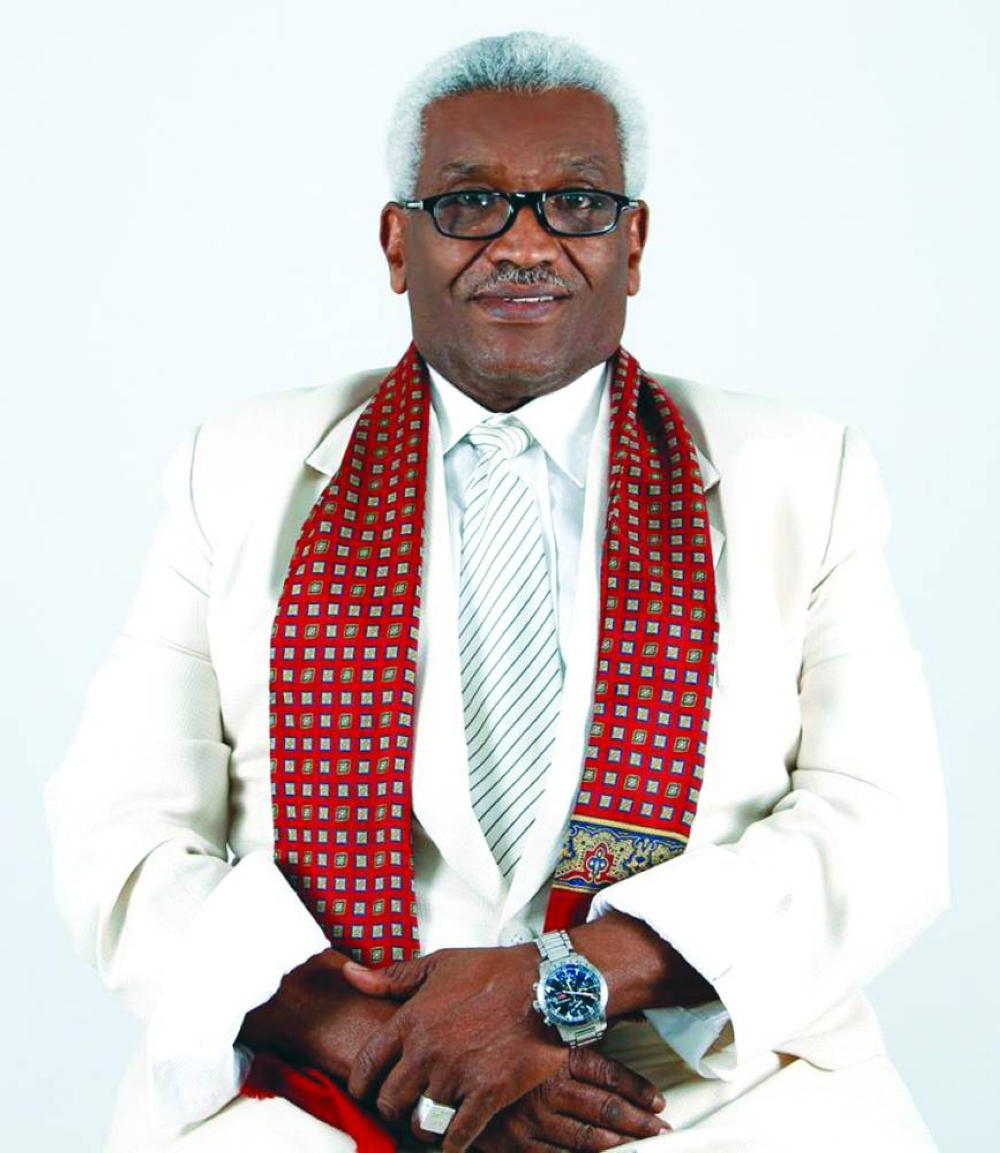

Chairman of the Board of Commissioners of the Syrian Commission on Financial Markets and Securities (SCFMS), Dr Abdul Razzaq Qassem, said Syria seeks to benefit from Qatar's advanced expertise in financial markets and the regulation of joint-stock companies, a step he said would support the development of the Damascus Securities Exchange, enhance its efficiency, and boost its ability to attract investment.In a statement to Qatar News Agency (QNA), Qassem said that co-operation with the Qatar Financial Markets Authority (QFMA) represents an important opportunity for the exchange of expertise and the strengthening of institutional capacity. He added that the upcoming conference of the Union of Arab Securities Authorities, scheduled to be held in Tunisia, will include meetings with Qatari officials to discuss prospects for joint co-operation.He noted that the discussions are expected to focus on enhancing co-operation in key areas, including training, capacity building, and knowledge transfer, with the aim of benefiting from Qatar's pioneering experience in regulating, developing, and modernising financial markets.He explained that the resumption of trading on the Damascus Securities Exchange came after the adoption of a comprehensive set of regulatory and precautionary measures aimed at ensuring an acceptable level of disclosure for investors and protecting them from unjustified or irregular trading practices. He noted that a number of conditions and rules were imposed, which companies must fully comply with before being allowed to resume trading, as part of broader efforts to restore stability and order to the market.He added that among the most prominent requirements was the mandatory publication of audited and duly approved financial statements for 2025. The Authority also required the submission of governance reports and insider lists to ensure the availability of sufficient, transparent, and reliable information for investors prior to the resumption of trading.Qassem further pointed out that, during the initial phase of reopening, trading was limited to three sessions per week in order to maintain control and curb potential sharp price fluctuations. In addition, large transactions were prohibited during the first month following the resumption of trading. He emphasised that these measures were implemented to safeguard investors and preserve market balance.The Chairman of the Board of Commissioners affirmed that the Syrian Commission on Financial Markets and Securities (SCFMS) carries out rigorous daily monitoring of market activity, noting that all recorded prices are reviewed at the close of each trading session. He explained that price controls have been adjusted by increasing the number of shares required to influence a company’s share price, a measure aimed at curbing manipulation and regulating price movements. Combined with continuous monitoring, he said, these steps contribute to maintaining orderly and regular trading.He also revealed that a draft law on Islamic bonds (sukuk) has been prepared and submitted to the relevant authorities, with the aim of establishing the legislative framework necessary to allow for the issuance or listing of such instruments upon their introduction. In addition, a law governing investment funds, including their establishment and management, has been finalised and referred to the competent authorities, expressing hope for its prompt approval.Qassem further emphasised that the Damascus Securities Exchange is open to both Arab and foreign investment, stressing that there are currently no restrictions on market entry. He explained that limitations imposed under the previous system will be lifted, enabling investors to move funds into and out of the country with greater ease and flexibility, without procedural obstacles. Such measures, he said, are expected to strengthen investor confidence and enhance the attractiveness of the Syrian market.

Friday, February 13, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.