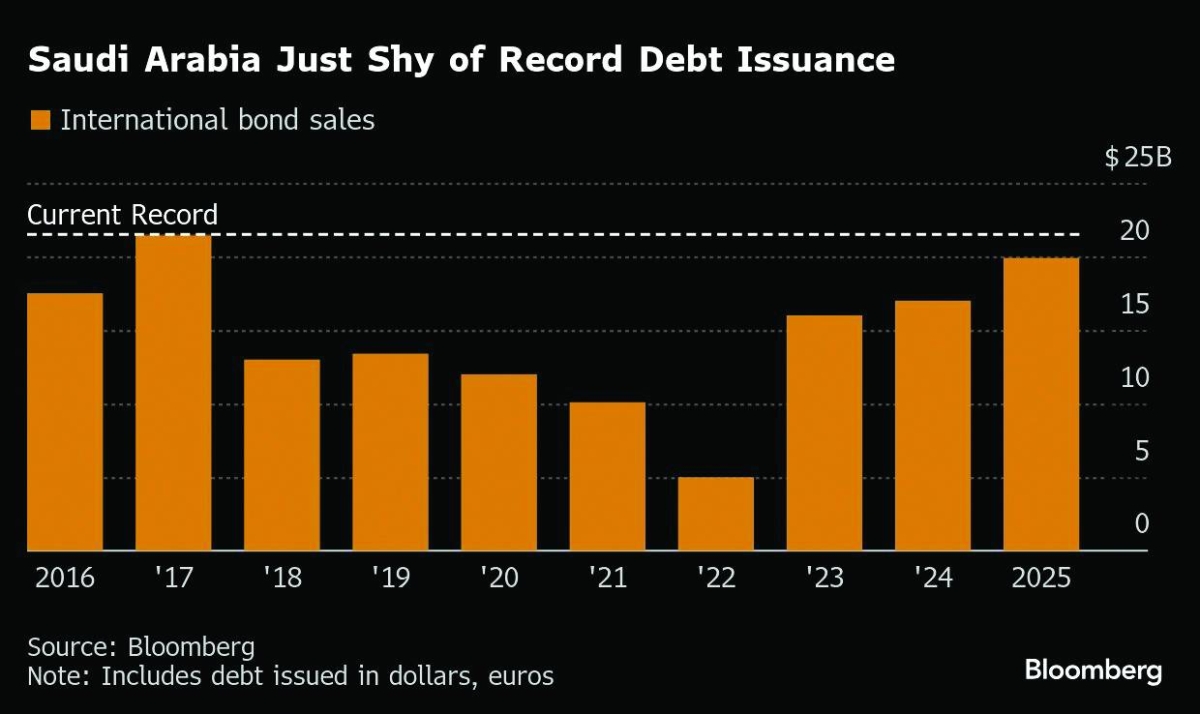

Saudi Arabia says it can slash its budget deficit in 2026 after a year in which spending and bond issuance soared to fund huge infrastructure projects. Wall Street isn’t convinced.While the Saudi government sees the fiscal shortfall at 3.3% of gross domestic product for next year, analysts at Goldman Sachs Group Inc and Bank of America Corp estimate the figure will be far higher.Goldman predicts the gap coming in at 6%, even wider than this year’s projected figure of 5.3%. The result, according to the bank’s analysts, will be a further $25bn of international borrowing, which would be a record for the kingdom in terms of annual issuance. Bank of America forecasts a deficit of about 5% in 2026.**media[392464]**The government, which published its latest spending plans last week, said revenue should recover next year, helped by a robust non-oil economy. In addition, production of oil — still the source of around 60% of government earnings — is set to be higher after increases agreed to by Opec+.With spending, Saudi Arabia has cut back or delayed some of its economic transformation projects, including parts of the new city of Neom, to avoid overheating the economy.Foreign analysts, however, think the kingdom will struggle to reduce its deficit given that Brent crude is down to around $63 a barrel. Bloomberg Economics estimates Saudi Arabia needs a price of almost $100 to balance its budget.Saudi Arabia has sold around $20bn in dollar- and euro-denominated bonds on international markets this year. That excludes deals from the likes of the sovereign wealth fund and oil giant Aramco.Finance Minister Mohammed al-Jadaan, speaking last week, emphasised the government would prefer to bridge its fiscal gap by borrowing instead of running down reserves. In its favour, its debt levels amount to around 30% of GDP, lower than most other sovereigns.He added that the government will be “very careful to not oversupply the market.”Razan Nasser, a sovereign analyst at T Rowe Price, which manages roughly $1.8tn of assets, says the market can absorb the kingdom’s levels of issuance for now.“Harder questions may need to be asked in the medium term as they use up that space, but we are not there yet,” she said.Still, to minimise the impact on borrowing costs, the government is likely to diversify its funding sources and may look at syndicated loans and tapping investors in Asia, according to Jean-Michel Saliba of Bank of America.“Large and persistent issuance of Saudi Arabia external debt could weaken investor appetite and impact borrowing costs,” said Saliba, who estimates the Saudi Arabia will sell $18bn of Eurobonds next year.

Thursday, February 19, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.