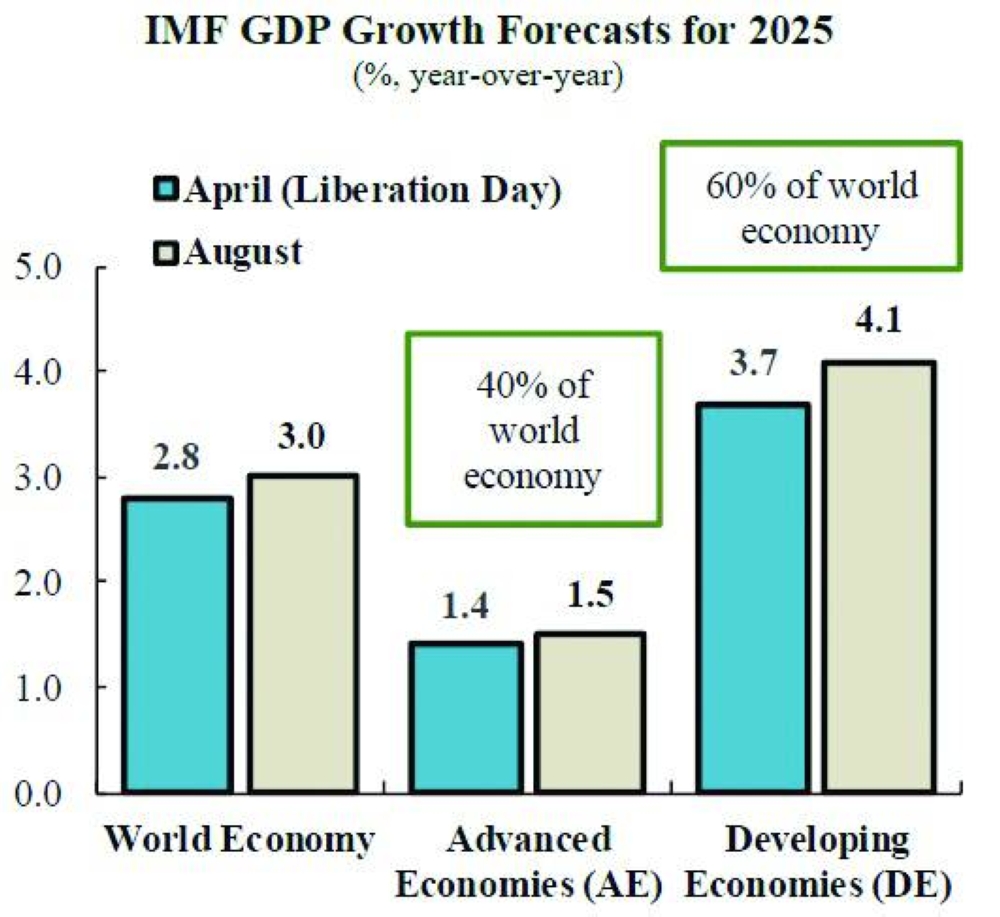

Despite the challenges posed by higher US tariff rates, the global economy will remain largely resilient against the uncertainty and the disruptions in global trade flows, according to QNB.At the beginning of the year, the global outlook pointed to steady economic growth, against a backdrop of cautious optimism. Tailwinds included the policy rate cutting cycles by major central banks, resilient growth of the US economy, cyclical recoveries in China and the Euro Area, and constructive overall investor sentiment, QNB noted in an economic commentary.Growth in both Advanced Economies (AE) and Developing Economies (DE) was initially expected to remain unchanged compared to last year, adding up to a world economic expansion rate of 3.3%.But the optimistic tone began to shift as the new US administration embarked on an aggressive agenda of policy change, with sweeping implications for the global macroeconomic landscape.On April 2, a day that came to be known as “Liberation Day,” President Trump announced sweeping tariffs, including a 10% baseline levy on all imports, and higher rates on selected countries.Financial markets reacted sharply to the announcements, with global stocks tumbling on fears of broader and deeper trade wars, as well as tainted policy credibility.The outlook narrative then debated the odds of a world recession. At its worst moment, growth expectations for the global economy dropped from the recent peak by 0.5 percentage point (p.p.) to 2.8%, a significant downgrade in a very short period of time.Since then, asset prices have recovered, with key indices reaching new highs, as the more negative trade-war scenarios were ruled out, AI-driven growth tailwinds regained the spotlight, and corporate profits remained robust.According to QNB, growth expectations have stabilised and even slightly recovered. The group of AE, which represents 40% of the world economy, is now expected to grow 1.5% this year, from a low of 1.4%.More significantly, after falling 0.5 p.p. to 3.7%, expectations for growth in the Developing Economies (DE) climbed to 4.1%, re-gaining most of the previous losses.Thus, recovering growth projections across the AE and DE groups are contributing to improving the outlook for global economic growth, which is expected to reach 3%.In QNB’s view, despite the challenges posed by higher US tariff rates, the global economy will remain largely resilient against the uncertainty and the disruptions in global trade flows.QNB has discussed two key factors that support its view of an improving global economic outlook.First, the US administration has concluded a first set of negotiations, which helped moderate uncertainty and discard the most extreme negative scenarios. The initially unyielding position of President Trump shifted towards pragmatism as deals were reached with the UK, Japan, Indonesia, Vietnam, the Philippines, and the EU, among others, narrowing the range of potential tariff rates for the rest of the world. Furthermore, even as the US has become more protectionist, the rest of the world is largely continuing to move in the opposite direction.From the European Union (EU) to Asia and Latin America, most major economies continue to view trade as essential to their growth models, and are actively pursuing deeper integration via new or deeper trade agreements. Even as the world adjusts to a more protectionist US, the outlook on global trade has improved, contributing to a less pessimistic growth scenario.Second, monetary policy easing cycles by major central banks will contribute to improve overall financial conditions and the stability of the global economy. Bringing inflation under control has allowed the US Federal Reserve and the European Central Bank (ECB), the two most important central banks in the AE, to start their interest rate cutting cycles.In the US, the Federal Reserve is set to cut its policy interest rate by 125 basis points over the next year, while the ECB could implement one more cut, bringing its benchmark rate to 1.75%. Stock markets have staged a notable recovery backed by resilient corporate earnings, while corporate credit spreads are narrowing, signalling improved market sentiment and easier credit for firms.The Financial Conditions Index (FCI) provides an informative summary of the overall state of markets, and is signalling that improving conditions are reducing borrowing costs for households and business, adding support to consumption and investment.“All in all, the global outlook initially deteriorated sharply after the US tariff announcements, but pessimism has gradually subsided on the back of improving prospects for international trade and better financial conditions supporting consumption and investment, leading to a broad based upgrade of performance expected across the AE and the DE,” QNB added.