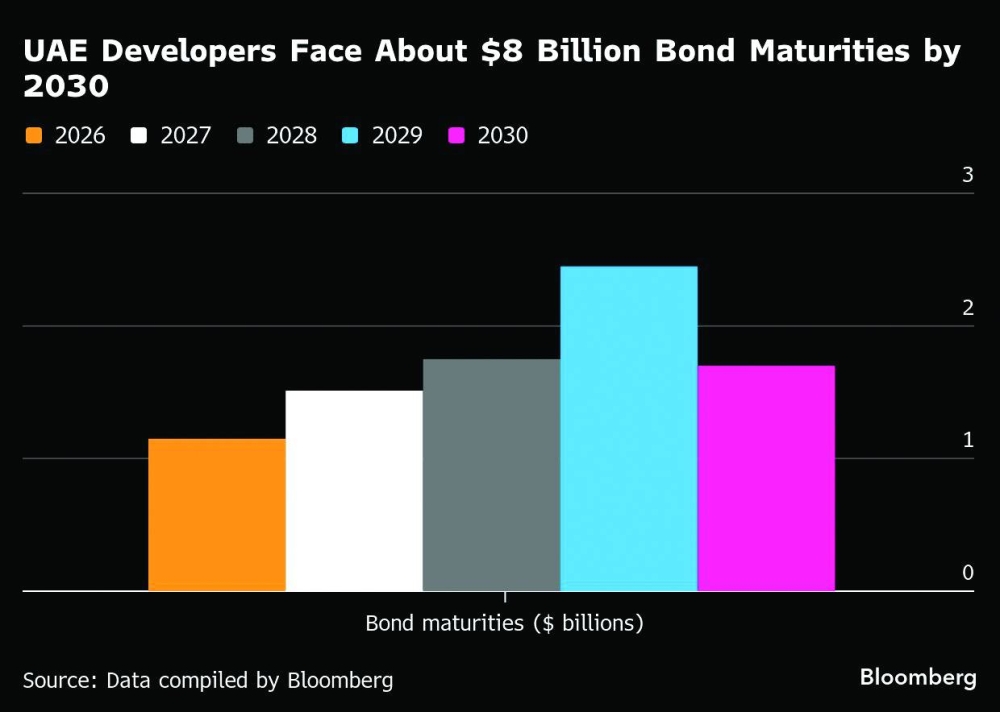

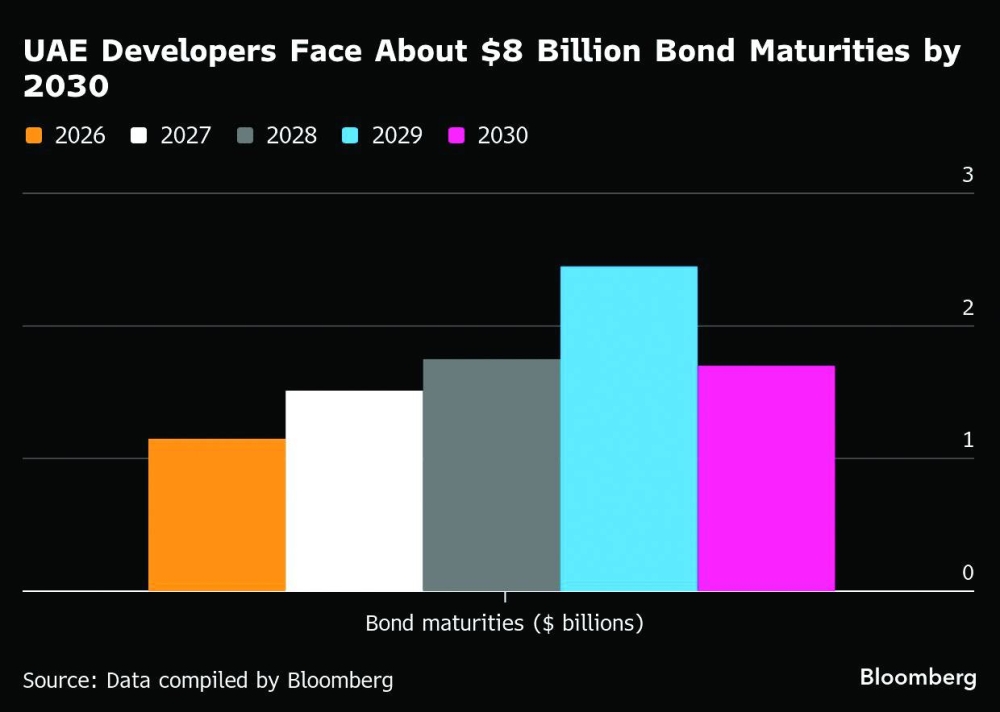

Property developers in the United Arab Emirates are raising billions through a growing arsenal of funding tools — from Islamic bonds to private credit — as they ride one of the Gulf country’s longest real estate booms in years. Data compiled by Bloomberg show dollar bond and sukuk issuance alone has grown more than twelve-fold to $6bn since 2021, underscoring how widely developers have accessed the market in a short time.Names once unknown to international debt capital markets, including Arada Developments, Binghatti Holding and Omniyat Holdings, are now regular sukuk issuers, joining heavyweights like Emaar Properties, Aldar Properties, and Damac Properties. More new names like Samana Developers are planning to test capital markets, and Arada is even weighing a convertible sukuk, a rare move in a region still new to equity-linked financing. Many firms are racing to get more cash to buy land as the competition to secure prime locations in the UAE intensifies. Their push into new pockets of the credit market highlights a growing role for local and international bond investors in Dubai real estate. Property prices have already risen more than 70% since 2019 in the city, and are also surging in the emirates of Abu Dhabi and Sharjah. Still, the flood of issuances has created a growing wall of maturities, with about $8bn due by 2030. Some analysts have flagged rising risks from Dubai’s extended boom, though most say the sector’s fundamentals remain solid for now. The emirate continues to see record pre-sales and strong inflows from wealthy overseas buyers, boosting developers’ profitability and cash buffers. “The demand for UAE real estate bonds and sukuk is unlikely to dry up anytime soon,” said Apostolos Bantis, managing director of fixed income advisory at Union Bancaire Privee. “Global investors remain attracted to higher-quality developers offering yields that stand out compared to developed markets.” At the same time, a global slowdown, regional unrest, or a drop in oil prices could sap confidence and leave some homebuyers exposed if any developers struggle to deliver. A wave of new property supply has also led Fitch Ratings to forecast a “moderate correction” in late 2025 into 2026. UBS Group AG has warned that Dubai’s bubble risk has surged since 2022, though the city still sits below the bank’s “high-risk” category, helped by strong rental yields and comparatively affordable home prices. In debt markets, the flood of new real-estate sukuk deals could test market appetite, particularly as investors look to avoid over-exposure to a single sector. Fady Gendy, fixed-income portfolio manager at Arqaam Capital, said the large volume of deals this year has led to some signs of “investor fatigue,” apparent in how some recent deals have been trading below their re-offer price and with higher new issue premiums paid.“This is to be expected after the large volume printed from the sector this year, and that being concentrated across a few names,” he said. None of that is deterring developers who want to raise money in the short term. For many, private credit has emerged as a vital new source of liquidity as traditional banks approach their real estate exposure limits.Omniyat tapped Nomura for a $100mn private credit facility earlier this year, and private credit specialists say most of the current demand in the UAE is coming from developers. “Banks have hit sector limits and are prioritising lending to large, government-backed developers,” said David Beckett, head of origination and Middle East business development at asset manager SC Lowy. “That leaves private developers underfunded, but they’re seeing strong returns and are willing to pay private credit spreads.” Some firms are looking beyond debt markets to potential listings, although no definitive plans have been announced yet. Binghatti, Samana and Arada are among those weighing possible initial public offerings.Gendy would see a rise in IPOs as a welcome shift, not only to potentially provide fresh injections of capital, but also to strengthen transparency and corporate governance. One key risk to watch, he added, will be dividend policy, to ensure developers maintain sufficient buffers for any future downturns. Investors are no strangers to the Dubai property sector’s swings: Damac Properties was taken private in 2022 at a sharp discount to its original listing value. Despite potential challenges, real estate investors and developers are counting on demand to hold up, partly because expats continue to pour into Dubai and the nearby emirates. Gendy stressed that near-term sector fundamentals remain intact, and concerns about a potential supply glut in 2026 or 2027 may be overblown, as actual new developments typically fall short of projections. “That said, if there is a more severe correction, we would expect to see some dispersion in market pricing between the various real estate issuers, on account of differences in their business models, and operating and financial metrics,” Gendy said about the bonds the builders are issuing.