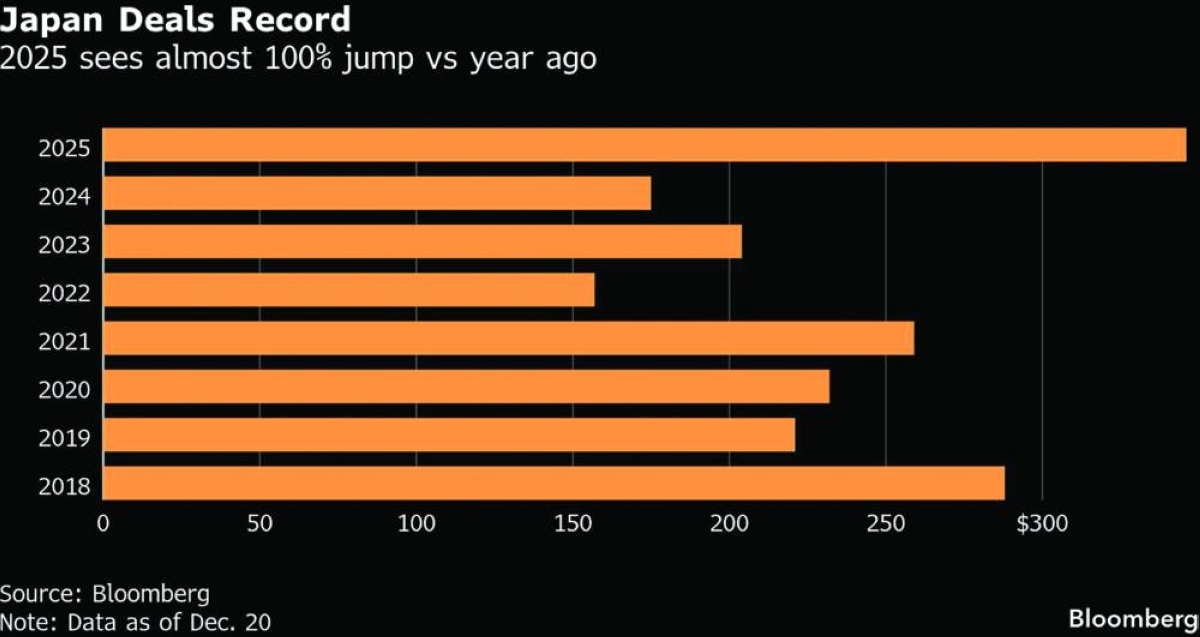

It’s been a record year for deals involving Japanese companies, with transaction volume approaching $350bn as December draws to a close. And next year is poised to be even busier.Corporate governance reforms aimed at improving shareholder returns are helping to transform Japan into a hive of activity — the days when it was seen as a slow market with an occasional megadeal thrown in are disappearing fast.“Dealmaking in Japan is incredibly busy,” said Chris Laskowski, head of Asia investment banking at Jefferies Financial Group Inc. “I spend a lot more time talking to our colleagues there now than any time before.”The ground is fertile, with conglomerates selling non-core assets and private equity firms hungry to deploy capital. Activism is also playing a stronger role — take Elliott Investment Management’s battle with none other than Toyota Motor Corp around a blockbuster plan to privatise Toyota Industries Corp.“Japan is going through a wave of M&A like we’ve not seen for a long time,” said Mayooran Elalingam, head of investment banking & capital markets in Asia Pacific at Deutsche Bank AG.Just this Friday, Mitsubishi UFJ Financial Group Inc confirmed it will take a 20% stake in India’s Shriram Finance Ltd for about $4.4bn.Japan is one of Asia’s most mature markets and home to some of the biggest transactions, so mergers and acquisitions can translate into higher fees for dealmakers. No surprise, then, that global firms including Citigroup Inc, Goldman Sachs Group Inc and Jefferies are bulking up their teams.This year has been bookended by a takeover fight between global buyout firms KKR & Co and Bain Capital over software firm Fuji Soft Inc and now Carlyle Group Inc launching a takeover offer for Hogy Medical Co.“We’re likely to see many more take-privates in Japan,” said Rohit Chatterji, head of M&A in APAC at JPMorgan Chase & Co. They’ll include “listed affiliates that are deemed core to the parent, or of standalone companies where traded valuations are not reflective of intrinsic value.”One of the biggest deals involved Nippon Telegraph and Telephone Corp taking over NTT Data Group Corp for more than $16bn. Meanwhile, Nippon Steel Corp finally closed its acquisition of United States Steel Corp.There are still some challenges with transactions in Japan, according Ian Ho, a partner at law firm Simpson Thacher & Bartlett in Hong Kong.“Having deep business relationships and local talent are key,” said Ho, who is also co-head of the firm in Asia. “While the interest and opportunities are real, it may take some time for some of the newcomers to gain significant traction.”One headline deal casualty this year involved the Japanese operator of 7-Eleven stores. Canada’s Alimentation Couche-Tard Inc ended up abandoning its $46bn bid after a roughly yearlong campaign, saying that Seven & i Holdings Co had refused meaningful engagement. The Japanese firm rejected that charge.Ultimately, though, 2025 is a big success story for Japan-related deals. Other multibillion-dollar cases include SoftBank Group Corp acquiring Ampere Computing from a consortium including Carlyle and Oracle Corp for $6.5bn, as well as a $5.8bn buyout of SCSK Corp by Sumitomo Corp. SoftBank has also been part of massive funding rounds for OpenAI and is eyeing more data centre deals.Financial sponsors focused on buyouts in the lower-to-mid tier have been prolific too, with investors allocating more capital to Japan, as well as markets such as India and South Korea.“While the deals may be smaller in value, they are generating solid returns,” said Adam Furber, also at Simpson Thacher as a partner and co-head of Asia.On dealmaking channels, a fruitful corridor is emerging between Japan and India, as Friday’s MUFJ-Shriram Finance deal shows. Another Japanese bank, Mizuho Financial Group Inc, also announced it is buying a controlling stake in KKR-backed investment bank Avendus Capital Pvt.Adding to the M&A pile leading into 2026, Taiyo Holdings Co is up for grabs, with KKR the frontrunner among private equity firms vying for the chemical manufacturer, people familiar with the matter said on Friday.

Saturday, February 14, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.