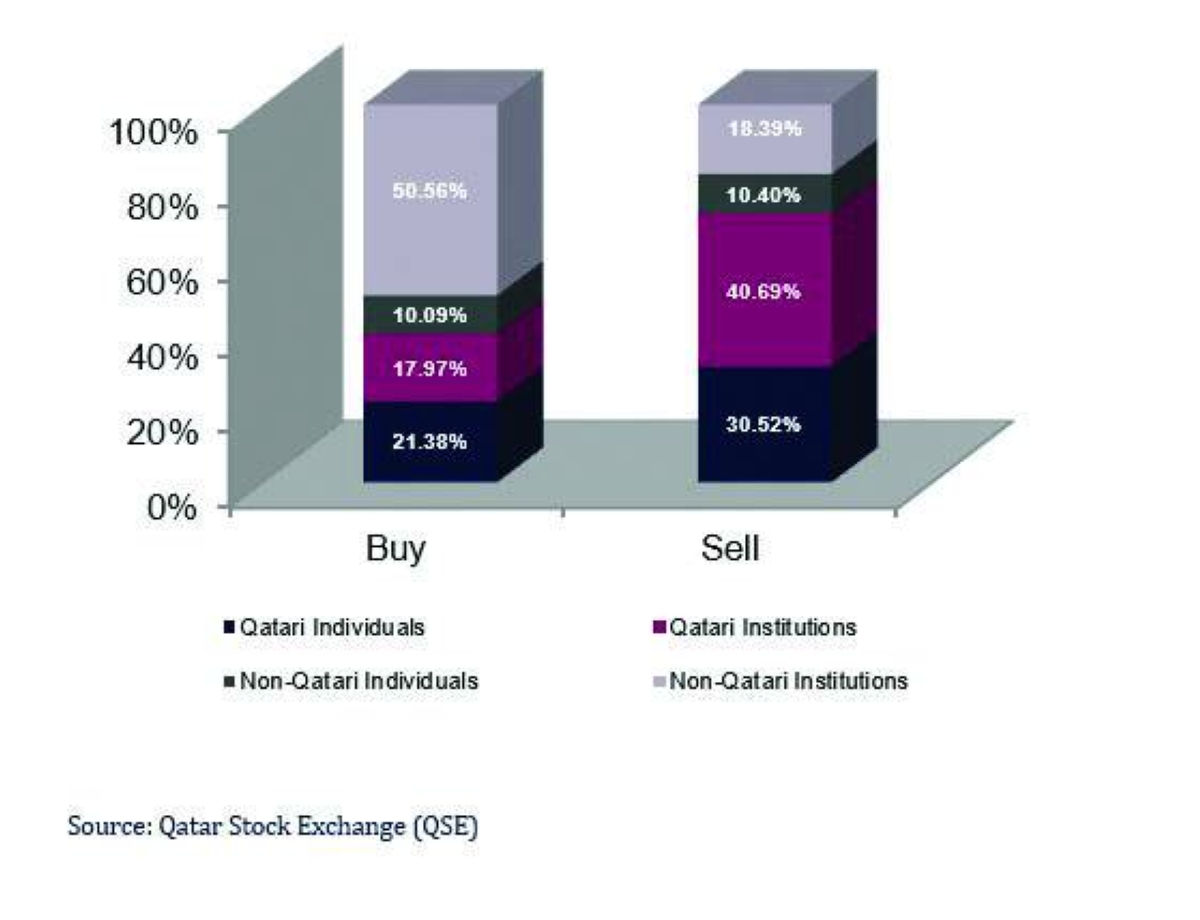

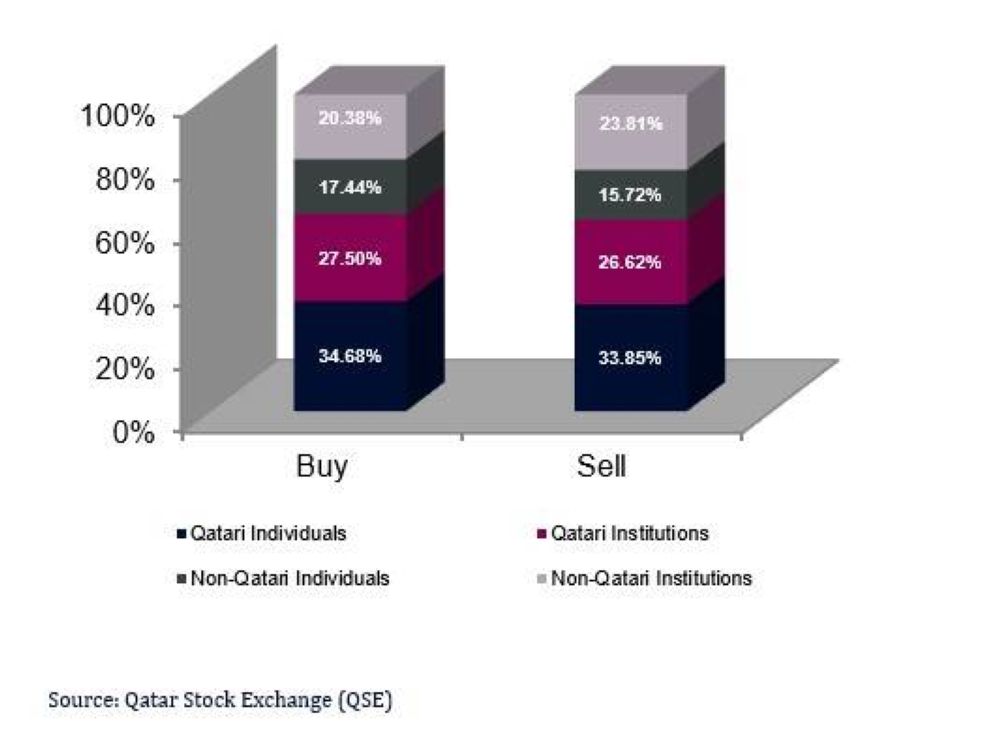

The Qatar Stock Exchange (QSE) gained by 160.45 points or 1.4% to close at 11,515.81 for the week. Market capitalisation increased 1.0% to QR686.5bn from QR679.8bn at the end of the previous trading week. Of the 54 companies traded, 44 ended the week higher, nine ended lower and one remained unchanged. Widam (WDAM) was the best performing stock for the week, rising 15.3%. Meanwhile, Mosanada (MFMS) was the worst performing stock for the week, falling 4.9%. Qatar Islamic Bank (QIBK), Dukhan Bank (DUBK) and Qatar Navigation/Milaha (QNNS) were the main contributors to the weekly index increase. They contributed 36.22, 22.12 and 21.04 points to the index’s increase, respectively. Traded value during the week increased by 22.4% to QR2,291.5mn vs QR1,872.6mn in the prior trading week. Qatar National Bank (QNBK) was the top value stock traded during the week with total traded value of QR294.5mn. **media[417042]** Traded volume increased 21.3% to 704.5mn shares compared with 580.9mn shares in the prior trading week. The number of transactions moved up by 10.5% to 134,260 vs 121,531 in the prior week. Baladna (BLDN was the top volume stock traded during the week with total traded volume of 118.9mn shares. **media[417043]** Foreign institutions remained bullish, ending the week with net buying of QR737.1mn vs net buying of QR227.4mn in the prior week. Qatari institutions remained bearish with net selling of QR520.5mn vs net selling of QR167.7mn in the week before. Foreign retail investors ended the week with net selling of QR24.4mn vs net selling of QR2.4mn in the prior week. Qatari retail investors recorded net selling of QR192.2mn vs net selling of QR57.3mn. Global foreign institutions are net buyers of Qatari equities by $496.9mn YTD, while GCC institutions are long by $112.5mn. QE Index**media[417036]** The QE Index closed up by 1.4% to 11,515.81 from the week before. The Index, after pausing its rally for the past two weeks, moved higher on the back of its bullish momentum. Last week we mentioned the trend of the index remains on the upside which manifested in this week’s movement. Any corrections can be used for accumulation purposes to strengthen the position. We maintain our support level at 10,500 points and our immediate resistance level to the 11,740 level. DEFINITIONS OF KEY TERMS USED IN TECHNICAL ANALYSIS RSI (Relative Strength Index) indicator – RSI is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between 0 to 100. The index is deemed to be overbought once the RSI approaches the 70 level, indicating that a correction is likely. On the other hand, if the RSI approaches 30, it is an indication that the index may be getting oversold and therefore likely to bounce back. MACD (Moving Average Convergence Divergence) indicator – The indicator consists of the MACD line and a signal line. The divergence or the convergence of the MACD line with the signal line indicates the strength in the momentum during the uptrend or downtrend, as the case may be. When the MACD crosses the signal line from below and trades above it, it gives a positive indication. The reverse is the situation for a bearish trend. Candlestick chart – A candlestick chart is a price chart that displays the high, low, open, and close for a security. The ‘body’ of the chart is portion between the open and close price, while the high and low intraday movements form the ‘shadow’. The candlestick may represent any time frame. We use a one-day candlestick chart (every candlestick represents one trading day) in our analysis. Doji candlestick pattern – A Doji candlestick is formed when a security's open and close are practically equal. The pattern indicates indecisiveness, and based on preceding price actions and future confirmation, may indicate a bullish or bearish trend reversal. Shooting Star/Inverted Hammer candlestick patterns – These candlestick patterns have a small real body (open price and close price are near to each other), and a long upper shadow (large intraday movement on the upside). The Shooting Star is a bearish reversal pattern that forms after a rally. The Inverted Hammer looks exactly like a Shooting Star, but forms after a downtrend. Inverted Hammers represent a potential bullish trend reversal.**media[417032]**DisclaimerThis publication has been prepared by QNB Financial Services Co WLL (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (QPSC). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (QPSC) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. Gulf Times and QNBFS accept no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision.

Friday, February 20, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.