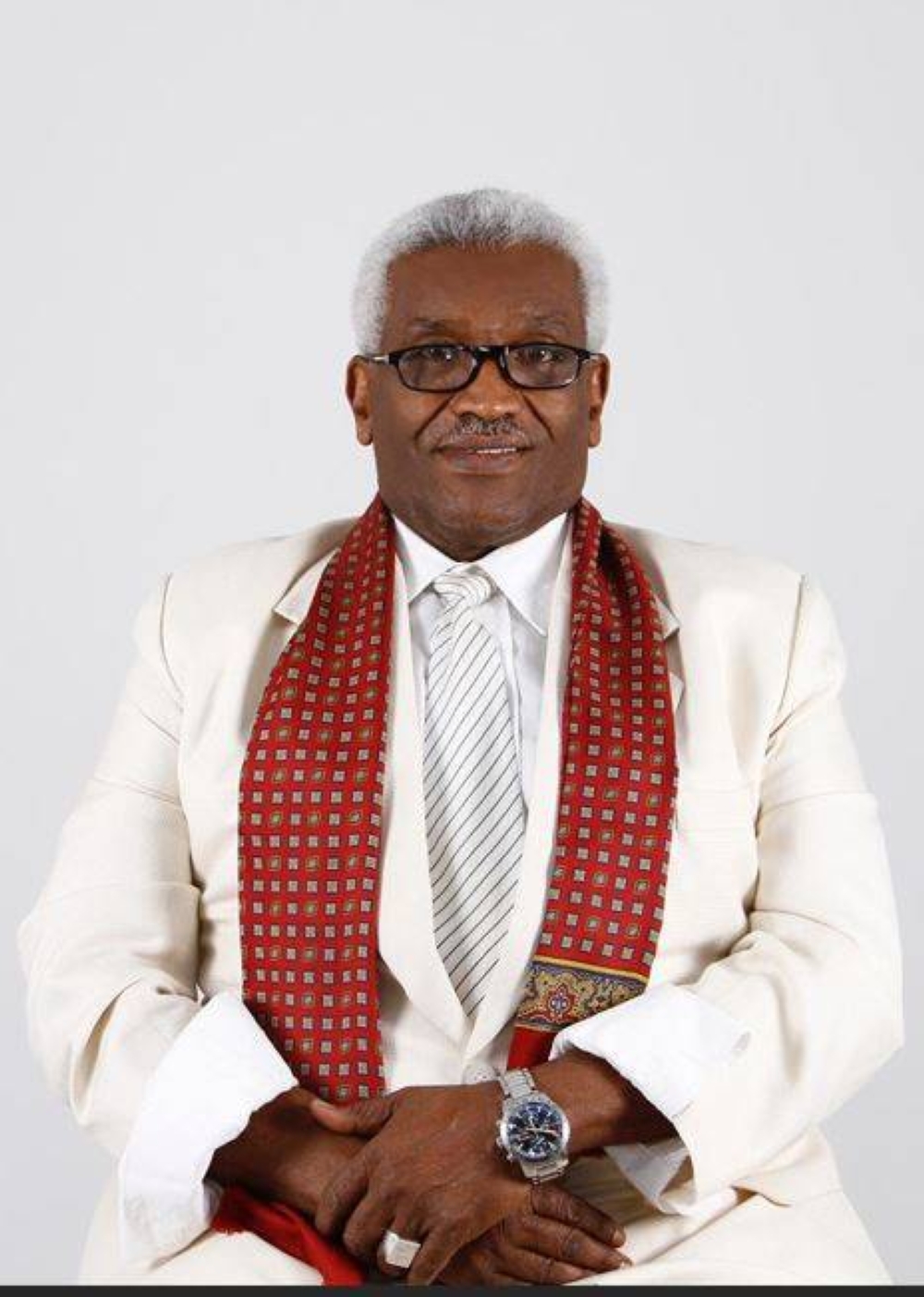

Legal PerspectiveDuties of an agent to the principal are normally derived from the contract and or the law of agency. While most agency relationships arise out of the contract, the agency contract, especially oral, may state little more than the general purpose of the agency. Ali being away, may ask Ahmed to sell his car. In such cases the duties of the agent owe to his principal must be found in the law.Certain duties exist in the law, even when the agency contract is silent. They include, inter alia, the duty of loyalty, duty to obey instructions, to exercise care and skill, to communicate info, duty of accountability. However, the most important duty is the fiduciary duty of loyalty.A fiduciary, is one who is trusted to act in the best interests of another rather than pursuing his own interests. While all of the other law duties can be reduced by the terms of the agency contract, the duty of loyalty cannot be eliminated.The duty of loyalty, is in need of complete honesty from agents in all dealings with principals. Further, the duty requires either avoidance of conflicts between the interests of the agent and those of the principal or full disclosure of any such conflict to the principal. If, after disclosure, the principal is willing to continue the relationship, the agent is shielded from liability for breach of the duty of loyalty.Such disclosure, should include notification of all compensation that the agent expects to receive in the course of fulfilling functions, because the agent is not permitted to make a secret profit. Anything of value that comes to the agent because of the agency relationship belongs to the principal. Thus if Ali, is a purchasing agent for Ahmed company and receives kickbacks or secret gifts from suppliers from whom he purchased goods for Ahmed company, the company is entitled to those gifts or whatever received.Agents breach their duty of loyalty by buying for the principal from themselves even if they charge a fair price. The duty of loyalty demands that the agent avoids even appearance of impropriety. Such purchases are permissible only when the agent has informed the principal, in advance of the potential conflict and discloses other pertinent facts. Same is true of sales to the agent. In all actions, full loyalty is a must.All such points shall be taken in consideration by both parties. We noticed that, many agency relationships continue to the point of close friendship or respectable relation, however, for different reasons this relation de tour and go to the contrary and the parties became enemies. So, carefulness is highly needed from the start, so as to escape bitter endless disputes rather than benefits to both parties.Dr AbdelGadir Warsama Ghalib is a legal counsel. Email: [email protected]

Saturday, February 14, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.