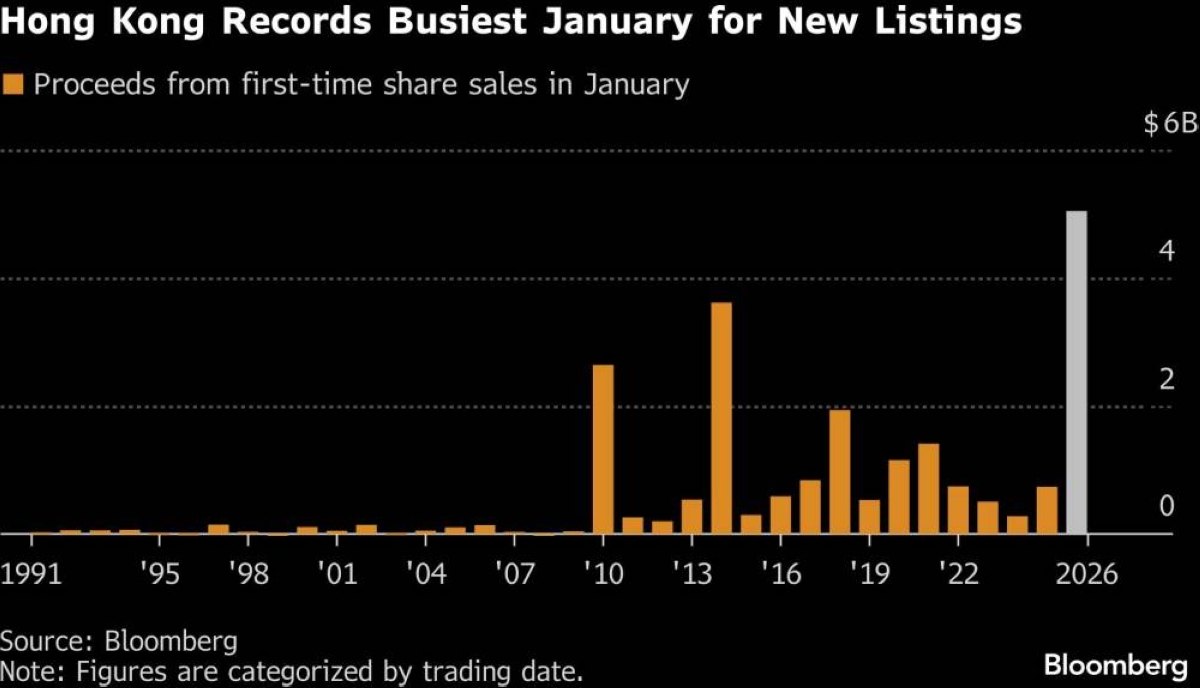

It has never been this busy at the start of a year for new listings in Hong Kong.Maiden share sales fetched about $5bn last month, the highest total for any January on record, according to data compiled by Bloomberg. The city hosted 13 listings, including artificial-intelligence chip designers, large-language-model developers and a snack retailer.The rapid pace of offerings is a promising sign that Hong Kong can build on the recovery last year, when listing proceeds were the highest since 2021. The pipeline is brimming, with more than 350 companies waiting to list their shares in the city, Hong Kong Exchanges & Clearing Ltd Chief Executive Officer Bonnie Chan said in an interview last month. Proceeds this year may reach a six-year high of $45bn, according to KPMG LLP.“This year should, all else being equal, be busier and more active than last year,” said Saurabh Dinakar, head of Asia-Pacific global capital markets at Morgan Stanley.Developments in the technology, media and telecommunications space in China, as well as innovation in the health-care sector, have helped boost sentiment, Dinakar said. Cheaper valuations in Hong Kong and mainland China have also helped entice investors to the region, he added. A gauge of Hong Kong-listed Chinese companies is trading at about 11 times estimated earnings, roughly half of S&P 500’s multiple.The January record was largely driven by Chinese technology companies like OpenAI challenger MiniMax Group Inc. and chip designer Shanghai Biren Technology Co, deals that highlight Beijing’s support for technological self-reliance in the face of an intensifying competition with the US.Sustaining that momentum for the rest of the year would cement Hong Kong’s comeback from a years-long lull. A technology crackdown in China had put an end to a listings rush in 2021, when ultra low lending costs sent investors clamouring for shares. This time around, the demand appears to be more measured, Dinakar said.“This is not the kind of exuberance we saw in 2021, when deals were heavily oversubscribed and the market quickly moved on from one transaction to the next,” Dinakar said. “The companies coming to market today are, by and large, very good companies, and interest is being driven by fundamentals.”This year’s cadence and quality of deals have led Franklin Templeton portfolio manager Nicholas Chui to participate in about a third of January’s listings and about a dozen in the past year, the most he said he had ever done. Chui said he gained confidence partly from natural selection: Companies tapping the market now have survived the height of investor concerns about China’s investability.The current boom is also different from that of years past, when IPOs would suck up liquidity and hurt the secondary market, said Chui, whose China-focused funds manage about $700mn. “There’s a lot of capacity that’s been able to absorb this new demand,” he added.Investors have been rewarded with handsome returns: this month’s listings outperformed broader indexes with a weighted-average gain of more than 70%. The deals have attracted US investors, even with Washington’s efforts to constrain Beijing’s access to cutting-edge technology simmering in the background. JPMorgan Asset Management Holdings Inc. recently signed on to be a key investor in the upcoming listing of Chinese chip designer Montage Technology Co.Bankers are setting their sights on more big-ticket deals. Investors are eyeing the potential IPOs of the AI chip units of Alibaba Group Holding Ltd and Baidu Inc. Second listings of Chinese companies — the bread and butter of last year’s deals boom — have continued to fill the pipeline.The frenetic pace has also spilled over to deals involving bonds that can be converted into stock. About $5.9bn worth of bonds denominated in greenback or Hong Kong dollar were sold by Asia-Pacific companies last month, marking the best January since 2018. These include Chinese miners that were pouncing on soaring metal prices.How many deals bankers will print by the end of the year may ultimately depend on forces they can’t control, such as surprise regulation. China’s securities regulator has been deliberating on raising regulatory and compliance thresholds for firms pursuing so-called H-share listings in Hong Kong, people familiar with the matter have said.Many companies seeking to list shares early in the year received their green light from the China Securities Regulatory Commission in December and are aiming to complete their deals by the Lunar New Year holiday in mid-February while the market is sizzling, said Richard Wang, a partner and head of China equity capital markets at the law firm Freshfields.

Sunday, February 15, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.