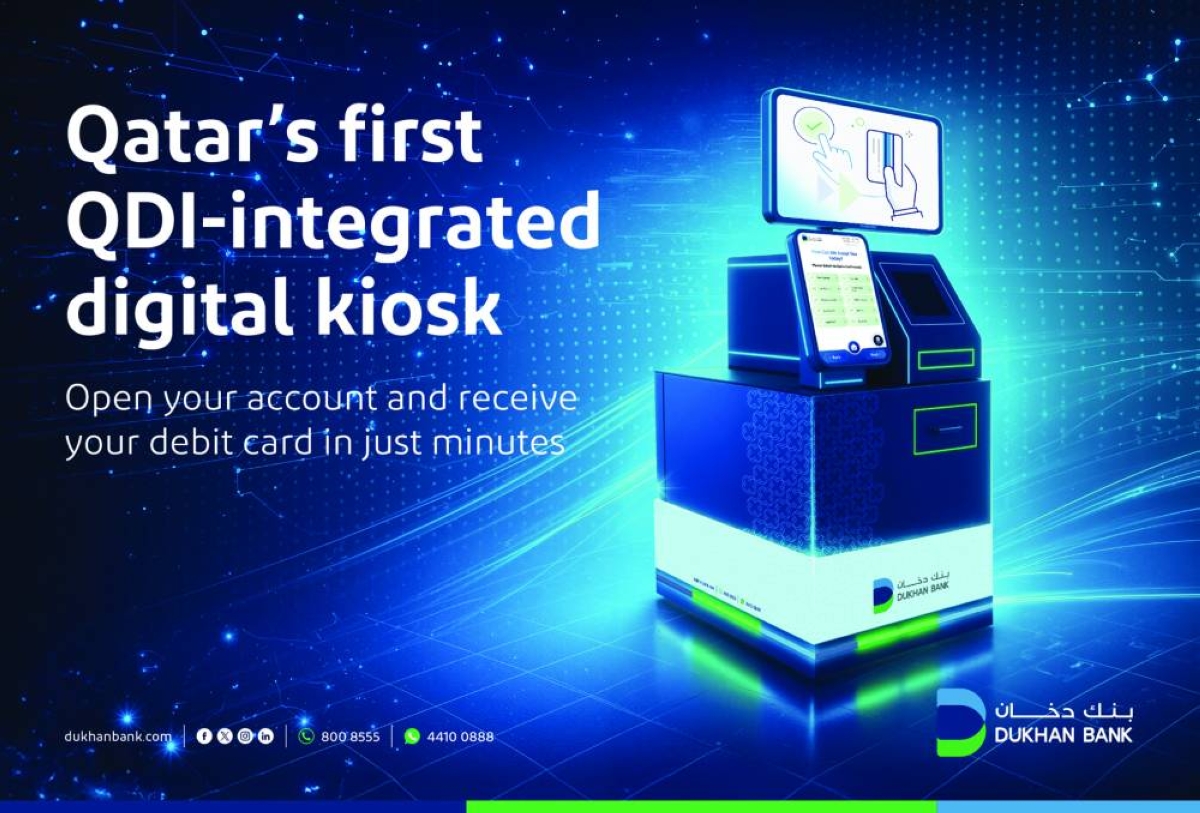

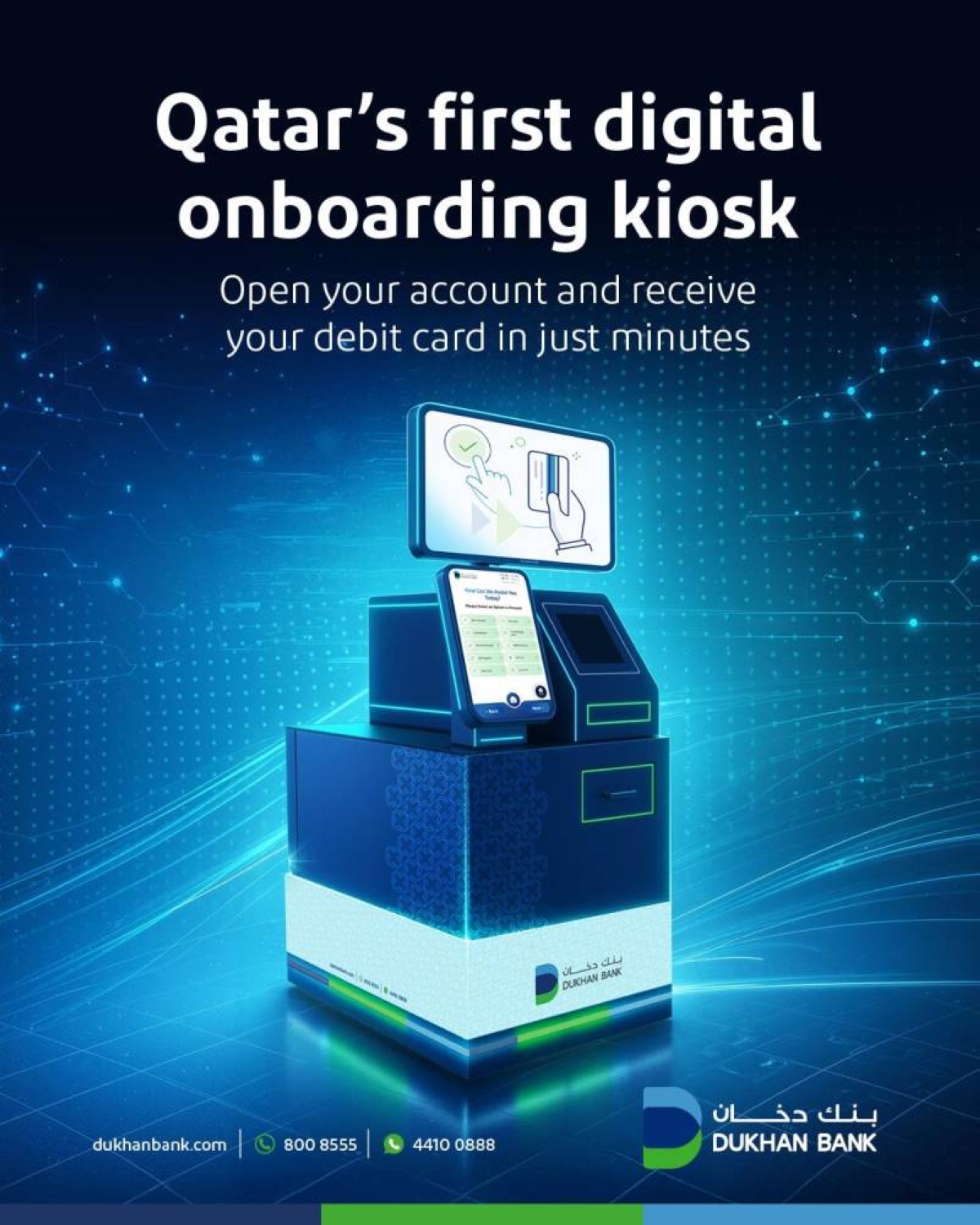

Dukhan Bank has launched Qatar’s first digital onboarding kiosk integrated with Qatar Digital Identity (QDI), marking a national first in secure, government-linked customer onboarding and reinforcing the bank’s leadership in digital Islamic banking innovation.The self-service kiosk, available 24/7 at Dukhan Bank’s headquarters in Lusail, enables customers to open accounts through a fully digital, paperless journey. By leveraging direct integration with QDI, the solution delivers faster onboarding, enhanced identity assurance, and a trusted experience aligned with national digital infrastructure.Powered by the Qatar Digital Identity platform developed by the Ministry of Interior, the kiosk enables real-time identity verification through biometric authentication and secure data validation. This direct integration allows customers to complete account opening within minutes and receive their bank card instantly through on-site printing, setting a new benchmark for secure digital onboarding in Qatar.Beyond onboarding, the kiosk offers a range of self-service banking features, including card replacement, account statements, and IBAN certificate issuance, with additional services to be introduced as part of Dukhan Bank’s ongoing digital roadmap.Following its initial deployment at the Lusail headquarters, Dukhan Bank plans to roll out the QDI-integrated digital onboarding kiosks across key locations in Qatar, extending round-the-clock access to secure, nationally integrated banking services.

Thursday, February 12, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.