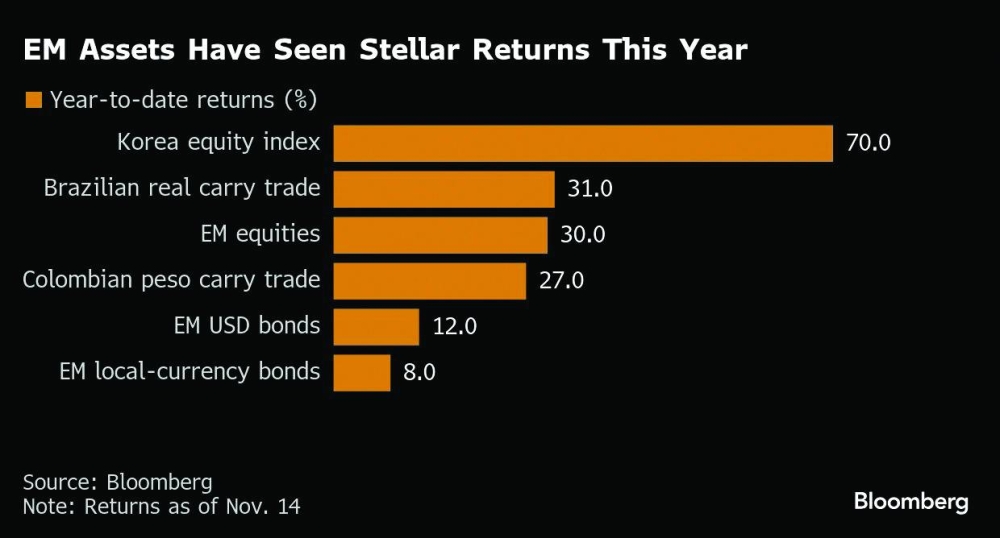

Some of the year’s most popular emerging-market trades such as betting on the Brazilian real and stocks linked to artificial intelligence are becoming a source of concern as money managers warn of risks from overcrowding.Wells Fargo Securities sees valuations for Latin American currencies — among 2025’s top carry trade performers — as detached from fundamentals. Fidelity International is concerned about less liquid markets in Africa that it sees at risk should global volatility spike. Lazard Asset Management meanwhile is keeping its guard up after early November’s firesale in Asian tech stocks — the worst since April.“Investors are too complacent on emerging markets,” said Brendan McKenna, an emerging-market economist and FX strategist at Wells Fargo in New York. “FX valuations, for most if not all, are stretched and not capturing a lot of the risks hovering over markets. They can continue to perform well in the near-term, but I do feel a correction will be unavoidable.”Such caution isn’t without reason. Many parts of the developing-markets universe look overheated after a heady cocktail of Federal Reserve rate cuts, a softer dollar and an AI boom drove stellar gains. The very flows that propelled the rally are now posing the risk of sudden drawdowns that have the potential to ripple through global sentiment and tighten liquidity across asset classes.A quarterly HSBC Holdings Plc survey of 100 investors representing a total $423bn of developing-nation assets showed in September that 61% of them had a net overweight position in local-currency EM bonds, up from minus 15% in June. A Bloomberg gauge of the debt is on track for its best returns in six years.The MSCI Emerging Markets Index of stocks has risen each month this year through October — the longest run in over two decades. Up almost 30%, the gauge is headed for its best annual gain since 2017, when it rallied 34%. That was followed by a 17% slump in 2018 when a more hawkish than expected Fed, a US-China trade war and a surging dollar took the wind out of overcrowded EM stocks as well as popular carry — in which traders borrow in lower-yielding currencies to buy those that offer higher yields — and local-bond trades.“As we approach year-end, there is a risk that some investors look to take profits on what has been a successful trade in 2025 and that this leads to a rise in volatility in FX markets,” Anthony Kettle, senior portfolio manager at RBC BlueBay Asset Management in London, said in reference to local-currency bonds.Stock traders in Asia this month had a first-hand experience of the risks that come with extreme valuations and crowding, when the region’s high-flying AI shares took a sudden nosedive. While tech stocks sold off globally, analysts have cautioned that the risk in some Asian markets are even more pronounced given the sector’s relatively higher weighting in their indexes.One notable example is South Korea’s Kospi — the world’s top-performing major equity benchmark in 2025, with an almost 70% jump. As volatility spiked, the gauge plunged more than 6% in one session before paring half of the losses by the close. “Positioning in Korea’s AI-memory trade is extremely tight,” said Charu Chanana, chief investment strategist at Saxo Markets in Singapore.Rohit Chopra, an emerging-market equity portfolio manager at Lazard Asset Management in New York, has turned cautious after the tech rout.“From a factor perspective, lower-quality companies have been outperforming higher-quality peers,” he said. “Historically, this divergence has not been sustained, suggesting the potential for a reversal if positioning remains concentrated.”Chopra co-manages the Lazard Emerging Markets Equity Portfolio, which has returned 23% over the past three years, beating 95% of peers, according to data compiled by Bloomberg.Options traders appear to be turning bearish on the Brazilian real, which has delivered carry trade returns of around 30% this year. Three-month risk reversals rose to a four-year high earlier this month.The real is the best example of an asset that has had a good run this year and where positioning has now become crowded, said Alvaro Vivanco, head of strategy at TJM FX. There are renewed fiscal concerns for Brazil, which is another reason to be more cautious, he said.Other Latin American currencies such as Chile’s, Mexico’s and Colombia’s are also “looking a little rich,” said Wells Fargo’s McKenna.The trade-weighted value of the Colombian peso is at the highest in seven years, according to data from the Bank of International Settlements, and is one standard deviation above the 10-year average. The same gauge for the Mexican peso is 1.4 standard deviations above the average.Bonds in some frontier markets also emerged as beneficiaries when a broader investor shift away from US assets gathered pace this year. Asset managers such as Fidelity International are now sounding caution on them.“More concerning to me are trades where a sudden rush for an exit can overwhelm the natural buyer base,” said Philip Fielding, a portfolio manager for Fidelity. Markets such as Egypt, the Ivory Coast or Ghana “can also be illiquid in times of higher volatility,” he added.Fielding is the lead manager for the $538mn Fidelity Emerging Market Debt Fund that has returned about 12% in the past three years, beating 84% of peers, data compiled by Bloomberg show.

Saturday, February 14, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.