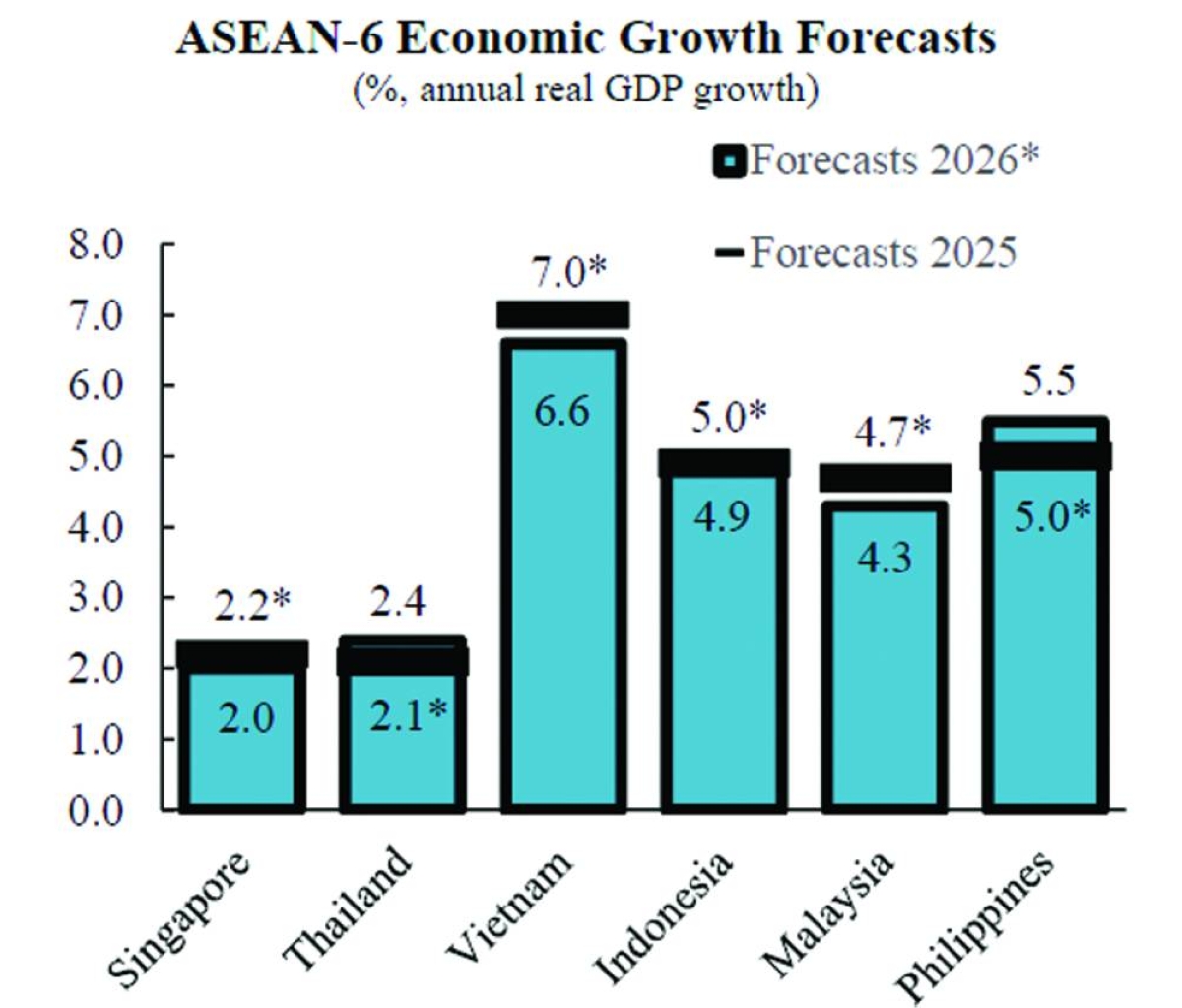

Qatar National Bank (QNB) discussed the key factors that will support economic growth in the ASEAN-6 economies during 2026 and contribute to a positive growth outlook, including the stabilization of the global trade environment and the decline in the severity of risks associated with trade protectionism, along with the easing of monetary conditions in advanced economies as well as within the ASEAN-6 countries.In recent decades, Southeast Asia has been the most dynamic region in the world, showcasing the brightest economic growth performance, QNB added in its weekly economic commentary.Within this region, the six largest countries of the Association of Southeast Asian Nations (ASEAN-6), which includes Indonesia, Thailand, Singapore, Malaysia, Vietnam, and the Philippines, have been among the fastest growing economies, with Singapore already reaching the status of an advanced economy.Trade is a major pillar of the economic growth model for the ASEAN-6 countries, and significant disruptions in international commerce can have a large impact on their performance.Trade and growth forecasts initially deteriorated sharply on fears of the impact of supply-chain disruptions, rocketing uncertainty, and potentially escalating trade wars. But despite a still-uncertain environment, the growth outlook for the ASEAN-6 group has been stable, with real GDP growth rates in 2026 expected to remain overall strong, similar to those of 2025.First, the global trade environment has begun to stabilize, as the U.S. reached agreements with an increasing number of trade partners, and there is no evidence of a negative impact of trade in the ASEAN-6 countries. The initially unyielding protectionism of the U.S. administration shifted towards pragmatism as agreements were reached with the U.K., Japan, and the E.U., among many others.Importantly, for the ASEAN-6, agreements were reached with Vietnam, Malaysia, Thailand, Indonesia, and Philippines, establishing a general tariff of 19% and lower rates for selected goods, while for Singapore the levy stands at 10%. Although these rates are higher than before Liberation Day, the end of the negotiations largely reduced the levels of uncertainty discarding the more extreme negative scenarios, and are still within a manageable range, especially as other competitors are also affected by new U.S. tariffs.Even as the U.S. has become more protectionist, the rest of the world is pursuing further integration via new or deeper trade agreements. In October, the ASEAN member states signed two major agreements: one improving cross-border flows within the group, and an upgrade of the ASEAN-China Free Trade framework. At the same time, negotiations began for an ASEAN-South Korea agreement. Furthermore, some ASEAN-6 countries appear to be benefiting from trade diversion as firms shift supply chains away from China.The impact of tariffs after Liberation Day on the ASEAN-6 economies has so far been negligible, with exports continuing to show monthly growth rates in the range of 10 to 20% in USD in annual terms. Even as the world adjusts to a more protectionist U.S., the outlook on global trade is improving, contributing to a more supportive growth scenario for the ASEAN-6 economies.Second, lower policy interest rates in the major advanced economies (AE), as well as in the ASEAN-6 countries, provide a better global environment for economic growth. Since 2024, the U.S. Federal Reserve has already lowered its policy rate by 175 basis points (bp) to 3.75% and is likely to bring it further down to a neutral level of 3.5%. In a similar period, the European Central Bank has lowered its benchmark policy rate by 200 bp to 2% and is likely to keep it unchanged during next year. Thus, policy interest rates in major AE are set to stabilize at lower levels than in recent years, providing better financial conditions for emerging economies.Similarly, central banks in the ASEAN-6 countries have implemented their own monetary easing cycles after inflation was brought under control following the post Covid-pandemic recovery. In these economies, the average increase in policy rates was 260 basis points (bps), to levels above those at the onset of the Covid-pandemic. As tight monetary policy brought inflation rates down to their target ranges, central banks reached a turning point and began to cut policy interest rates, reducing the cost of credit and boosting credit growth. Overall, looser monetary conditions in the AE as well as from the ASEAN-6 central banks provide better credit conditions for growth in the region.All in all, the growth outlook for the ASEAN-6 economies remains stable on the back of an improvement in the trade environment and more supportive monetary.

Tuesday, February 17, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.