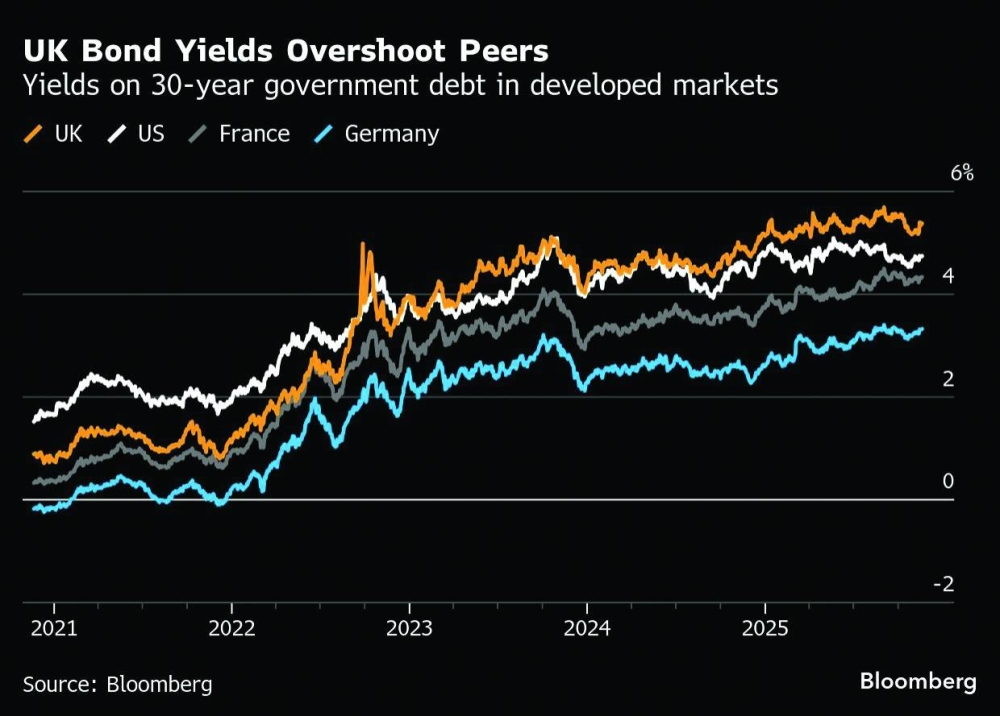

When Chancellor of the Exchequer Rachel Reeves unveils the UK budget on November 26, bond markets will quickly pass judgment, with investors deciding whether she’s done enough to put the country’s debt on a sustainable path.**media[385501]**The budget lays out the government’s plans for the economy, including how much it wants to tax and spend. This year, there’s extra tension. Reeves needs to raise around £30bn ($39.3bn) to plug a hole in government finances and establish a rainy day fund in case the fiscal outlook darkens again.Not everyone believes the chancellor can balance the books in a credible way, especially after recent reports that she has dropped plans to hike income taxes. This is where bond markets come in. If traders don’t find the budget convincing, they will sell UK debt, making it more expensive for the government to borrow and worsening its fiscal position.The stakes are high, both in terms of money and politics. Only three years ago, a budget-gone-wrong caused government borrowing costs to spike and the pound to crash, effectively ending the short-lived premiership of Liz Truss.Why are bonds key to government finances?UK government bonds, which are often called gilts because they used to be issued as paper certificates with a golden edge, play a vital role in public finances. When the government spends more than it receives in taxes, it borrows money from bond investors to make up the difference.In the first half of the year, borrowing totalled £100bn. It doesn’t come free. When the UK sells bonds, investors require the government to pay them interest. The higher the perceived risk, the higher the interest payments — or yield — have to be.When Reeves lays out her budget in parliament, investors will be trying to gauge the appropriate level of risk. If they think the chancellor’s plan puts state finances on a solid footing, they might buy gilts, pushing down yields. Likewise, a selloff in gilts would increase yields and signal that investors are losing confidence in the government’s ability to contain deficits.The amount of interest the government pays on gilts really matters. In the most recent fiscal year, it spent around £106bn paying interest on its debts, an increase from roughly £40bn a year before the pandemic, according to the Office for Budget Responsibility. That’s not far off what the government spends on education each year. The more money that goes to interest payments, the less there is for general spending.Why are UK bond yields higher than elsewhere?**media[385500]**While acting as a gauge of repayment risk, government bond yields are also influenced by a range of factors including inflation and central bank policy. If inflation is expected to remain elevated, investors will demand a higher yield on bonds to compensate for the drop in the value of their money in real terms. Similarly, expectations that the central bank will keep its base rate elevated will see investors demand higher yields as they compare potential returns in gilts to what they could earn from putting their cash to work elsewhere.Inflation has remained higher for longer in the UK than in other parts of the world, and because of this the Bank of England hasn’t cut interest rates as much as other central banks. This is part of the reason why UK yields are so much higher than other developed bond markets. Yields on 30-year gilts are trading around 5.4%, and the Bank of England’s base rate is 4%.Why are gilts so prone to sudden selloffs?The gilt market is relatively small, especially when compared to trading in US Treasuries. This means smaller traders can have an outsize impact on prices, heightening volatility.Some observers also blame the changing makeup of the gilt market. Steady demand from local pension funds, which tend to be stable, long-term investors, has fallen away as they pivot retirement pots toward risky assets like equities. The Bank of England has also switched from gobbling up large quantities of bonds to selling down its holdings. The market is now more exposed to the whims of hedge funds and foreign investors who are more likely to sell at the first sign of trouble.What’s Liz Truss got to do with all this?**media[385502]**Part of the nervousness around gilts stems from Truss’ 2022 mini-budget, which included £45bn of unfunded tax cuts at a time when the government was already paying billions of pounds to support households through an energy crisis. Her chancellor, Kwasi Kwarteng, poured fuel on the fire by promising even deeper tax cuts.The collapse was accelerated by so-called liability-driven investment strategies employed by pension funds, which were forced to sell gilts. The Bank of England needed to swoop in with government debt purchases to help restore calm.Since then, the gilt market has become more resilient. For example, pension funds using LDI strategies must now hold larger cash buffers to reduce the chance of another liquidity crisis. The Bank of England has also launched a new so-called repo facility to make it easier for these funds to raise cash in the event of future turbulence.Still, the UK’s borrowing costs are higher now than during Truss’ brief tenure. While the market expects further interest rate cuts, potentially as soon as December, this elevated starting point means a sharp rise in yields would be all the more punitive.A market gauge of volatility in long-dated interest rate swaps jumped in mid-November to the highest level since June, diverging sharply from the equivalent US metric, a sign that traders were bracing for big moves around the budget.What does history tell us?The UK doesn’t have an unblemished record when it comes to keeping its finances in check. Whereas the US, Germany and Japan have never been bailed out by the International Monetary Fund, the UK government had to ask it for a $3.9bn loan in 1976, after a surge in debt costs and sharp fall in the pound.This year, former Bank of England rate-setter Martin Weale and Conservative Party leader Kemi Badenoch drew parallels to that crisis, with Badenoch saying the UK may have to go “cap in hand” to the IMF to ask for money as long-term borrowing costs rose to the highest level since 1998. Reeves said the comparison was “not serious” and “irresponsible.”Since then, the gilt market has calmed. On Nov. 21, yields on 30-year bonds traded around 40 basis points below the 27-year high touched in September. If the package Reeves presents is seen as credible, that slide may continue, helped by reduced fiscal risk and the prospect of more Bank of England interest-rate cuts.