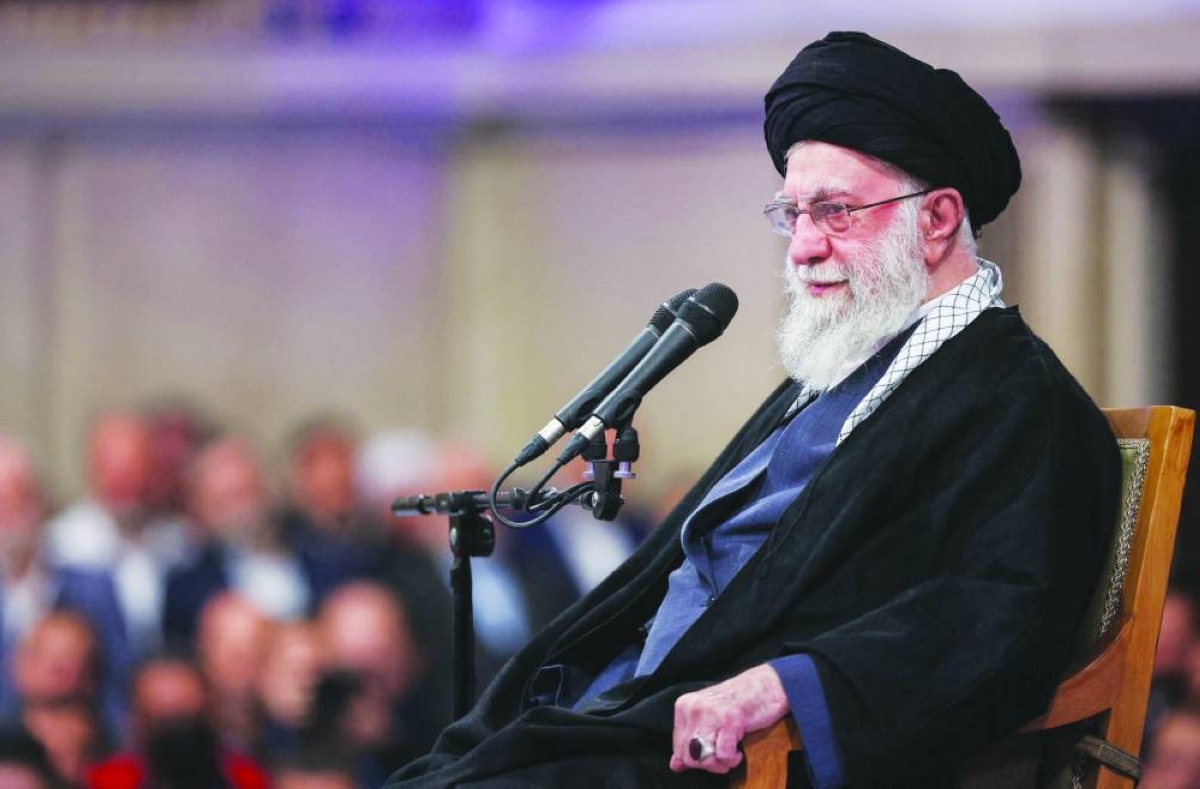

Supreme leader Ayatollah Ali Khamenei Saturday acknowledged the economic demands of protesters in Iran, where demonstrations have spread to more than two dozen cities, even as he warned there would be no quarter for “rioters”. The protests began last Sunday as an expression of discontent over high prices and economic stagnation, but have since expanded to include political demands.Iranian media have reported localised violence and vandalism in the west of the country in recent days. “During clashes in Malekshahi, Latif Karimi, a member of the IRGC, was killed while defending the country’s security,” Mehr news agency said. Malekshahi is a county of about 20,000 residents with a large Kurdish population, where “rioters attempted to enter a police station”, according to separate news agency Fars, which added that “two assailants were killed”. Mehr earlier reported a member of the Basij paramilitary force was also killed during another protest in western Iran after being “stabbed and shot” by “armed rioters”. The protests have affected, to varying degrees, at least 30 different cities, mostly medium-sized, according to an AFP tally based on official announcements and media reports. At least 12 people have been killed since Wednesday in clashes, including members of the security forces, according to a toll based on official reports. Speaking to worshippers gathered in Tehran for a religious holiday, Khamenei said the protesters’ economic demands in the sanctions-hit country were “just”. “The shopkeepers have protested against this situation and that is completely fair,” he added. But Khamenei nonetheless warned that while “authorities must have dialogue with protesters, it is useless to have dialogue with rioters. Those must be put in their place.”The first deaths were reported on Thursday as demonstrators clashed with authorities. The Tasnim news agency, citing a local official, also reported a man was killed on Friday in the holy city of Qom, south of Tehran, when a grenade he was trying to use exploded “in his hands”.

Tuesday, February 10, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.