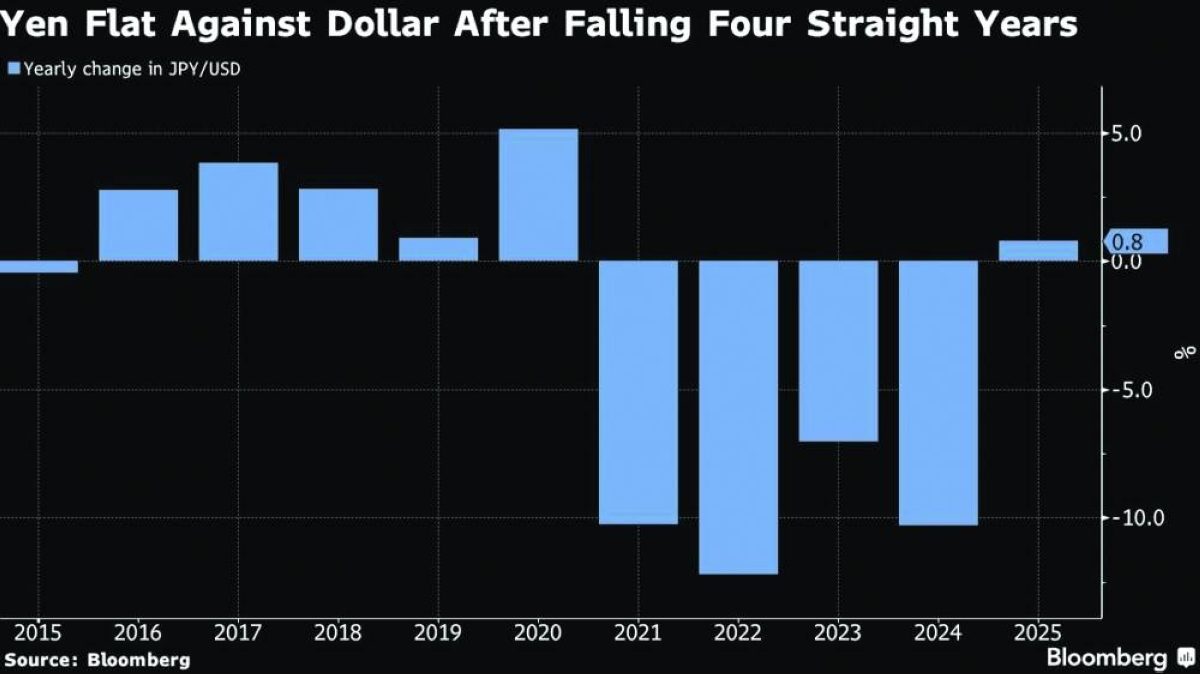

Japan’s stocks are expected to extend gains in 2026, with Prime Minister Sanae Takaichi’s aggressive fiscal plans building on the momentum of the past year.Tokyo’s benchmark Topix index has weathered tariff shocks, two Bank of Japan (BoJ) rate hikes and a change of prime minister to gain about 23% this year, putting it on track for its biggest outperformance versus the S&P 500 since 2022. The rally — which led Japan’s benchmarks to multiple record highs — has laid the foundations for further gains, strategists say.Construction, infrastructure and energy shares are set to shine next year as Takaichi’s government pledges trillions of yen in domestic funding. Robot makers may win out, too, as tech focus shifts toward physical AI. Banks, among this year’s top performers thanks to higher interest rates, are also expected to extend their rally.Here are themes expected to drive Japanese stocks in 2026:Takaichi tailwinds2026 stocks to watch: Construction, infrastructure, energy, consumer2025 winner: Toyo Engineering Corp, the nuclear plant constructor, has gained over 261% year-to-dateJapan’s first female prime minister unveiled around ¥18tn ($115bn) in extra stimulus funding in November, fuelling investor optimism. Her plan focuses on spending to bolster 17 “strategic industries,” including quantum computing and nuclear fusion.The impact from Takaichi’s growth strategy “has got to be net positive for the economy, especially for the equity market,” said Naoya Oshikubo, chief market economist at Mitsubishi UFJ Trust & Banking Corp. “Semiconductors, infrastructure, construction companies will all see tailwinds.”Takaichi’s utility subsidies and cash handouts should also boost retail stocks by giving consumers more disposable income, said Chris Smith, a portfolio manager at Polar Capital LLP.But Takaichi brings downside risks too, Smith warned. “She needs to be careful, because her aggressive fiscal policy has been a source of pressure on the yen and bond rates,” he said. Japan’s ongoing diplomatic spat with China, which was triggered by Takaichi’s comments on Taiwan, could also weigh on equities if it escalates, Smith added.Corporate reform2026 stocks to watch: Cash-rich firms2025 winner: Auto-care product maker Soft99 Corp, which gained 172%. Activist fund Effissimo Capital Management launched a bid to rival management’s buyout offer in September, and ultimately succeeded.Japan’s corporate governance code is due for an update in 2026, driving anticipation for juicier shareholder returns. The revisions are likely to target idle cash holdings, an area Takaichi has said she wants to address.“We think the Financial Services Agency and Tokyo Stock Exchange are going to start putting pressure on companies who have over a certain level of cash on their balance sheet,” said Polar Capital’s Smith. If cash-rich companies boost shareholder payouts or invest in growth, Japanese stocks will become more attractive, he said.Some companies may reallocate cash to mergers and acquisitions. That would further fuel Japan’s ongoing deals boom, wrote Morgan Stanley MUFG Securities Co strategists including Sho Nakazawa in a report. “We hope to see not only a review of balance-sheet management but also an acceleration of initiatives to raise profitability,” including M&A, R&D and wage increases, they wrote.M&A activity this year attracted domestic and global activist investors seeking hidden value. Japan saw 171 activist campaigns in 2025, the most ever, according to Bloomberg Intelligence. Continuing AI boom2026 stocks to watch: Robotics firms like Fanuc Corp, Yaskawa Electric Corp.2025 winner: Memory chip-maker Kioxia Holdings Corp, which has risen 558% year-to-date, making it the Topix’s best performerDemand for AI and data centres is set to keep growing next year, despite jitters over tech giants’ heavy spending. Those concerns dragged some of 2025’s biggest AI winners, notably SoftBank Group Corp, which was lower in recent months, though Masayoshi Son’s investment powerhouse remains up 90% year-to-date.“The theme of AI will continue to attract attention, but the main battleground may start to shift,” said Rina Oshimo, senior strategist at Okasan Securities Group Inc. Firms that can harness AI in areas like robotics and medical technology will be investor favourites next year, she predicted. Robot maker Fanuc has already gained 20% since announcing an AI tie-up with Nvidia Corp earlier this month.But next year’s AI rally may be harder to navigate as Japan’s benchmarks are now heavily weighted toward the sector, said Chen Hsung Khoo, a portfolio manager at Franklin Templeton Investments.“We are very careful what we pay for,” said Khoo. “AI is so capital-intensive, but the opportunities are so far out — the uncertainty is high.” He’s betting on firms with diversified AI exposure, like Ebara Corp., which makes equipment for both semiconductors and energy generation. Yen and BoJ2026 stocks to watch: Carmakers and other exporters2025 winner: Megabank Mitsubishi UFJ Financial Group Inc, which rose more than 30% and was among the biggest contributors to the Topix’s gainsThe yen is ending 2025 far weaker against the dollar than many expected, providing a strong tailwind for exporters such as automakers and trading houses. That trend will likely endure in 2026, said Mitsubishi UFJ Trust’s Oshikubo. The yen has risen less than 1% against the dollar year-to-date as of December 25.“The BoJ’s hikes don’t really impact the yen, as the market has already priced in two hikes a year,” he said. “I expect the yen will still be around the 150-160 level this time next year.”That bodes well for large-cap exporters, which Oshikubo expects to outperform the benchmark in 2026.However, JPMorgan Chase & Co strategists including Rie Nishihara warned that “excessive yen depreciation” poses a “major risk” for equities, noting 165 per dollar marks a breakeven for real income growth.Gradual BoJ rate hikes may not revive the yen, but together with climbing government bond yields, they remain a tailwind for Japan’s banking stocks, said Franklin Templeton’s Khoo.“The earnings power of banks continues to be underestimated by the market,” Khoo said. “They’re undervalued, so remain a compelling case for us.”