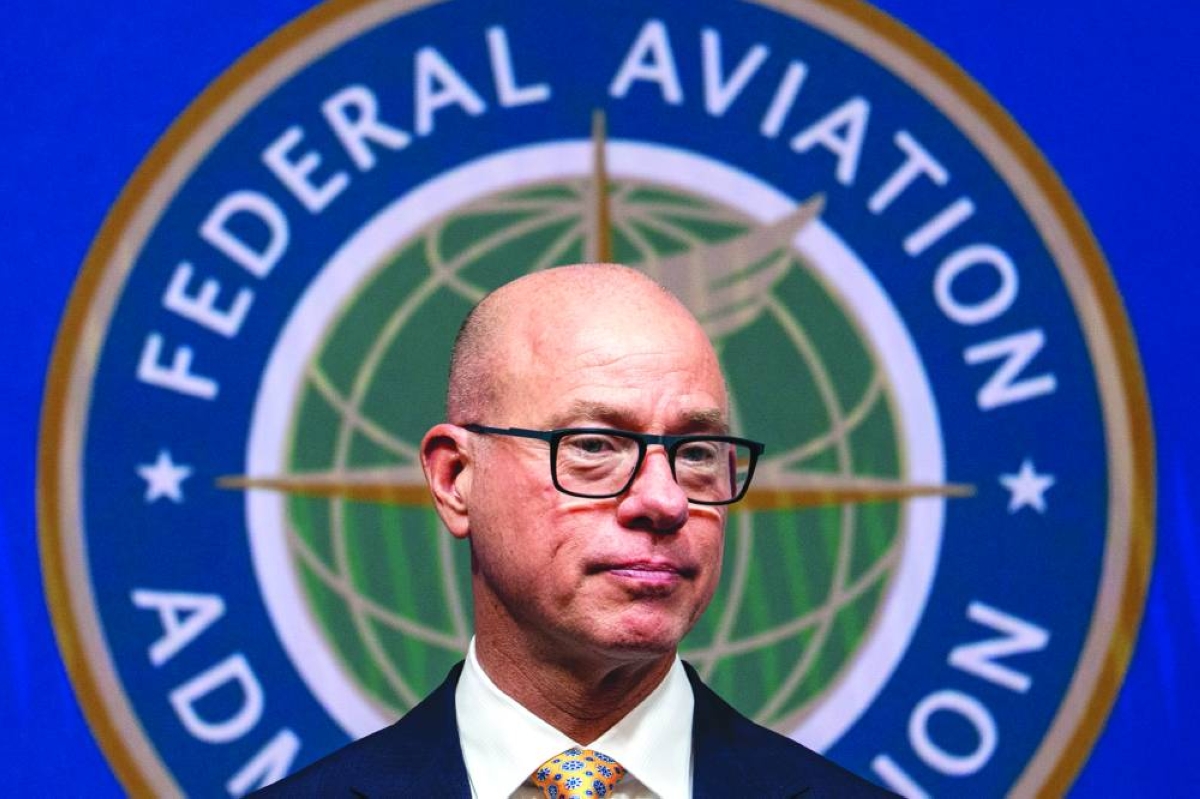

The US Federal Aviation Administration’s (FAA) decision to cut flights across 40 major airports during the government shutdown earlier this year was necessary to protect the safety of the flying public, the head of agency told lawmakers.FAA Administrator Bryan Bedford, in testimony prepared for a hearing held on Tuesday by the House Transportation and Infrastructure Committee’s aviation subcommittee, cited the need to identify risks sooner following January’s deadly midair collision between an American Airlines Group Inc passenger jet and a US Army helicopter near Ronald Reagan Washington National Airport.“I am confident that decreasing operations during an uncertain and stressful time was the right decision on behalf of the flying public and the United States,” he said in a letter to House and Senate lawmakers on Monday evening that was seen by Bloomberg.Bedford sent the letter in response to an inquiry Democrats on the House transportation committee — led by Ranking Member Rick Larsen — sent to Bedford and Transportation Secretary Sean Duffy last month seeking more information on the flight cut decision.“The connection between controller workload, system demand and operational risk was unmistakable,” Bedford added during Tuesday’s hearing.The hearing is Bedford’s first appearance before Congress since he was confirmed to lead the FAA. Prior to joining the regulator, he ran regional airline Republic Airways Holdings for more than 25 years.The FAA’s flight cut order during the shutdown required airlines to reduce capacity at the 40 airports by as much as 10%, exacerbating US flight disruptions and hitting carriers’ finances after a bruising year.The capacity reduction rate only reached 6% before Congress reached a deal to end the shutdown. The agency froze the rate at that level on November 12 and then rolled back the policy in the days after.The FAA and Transportation Department have said that they were seeing a record level of flight disruptions stemming from controller absences. They also said other data, including voluntary safety disclosure reports from pilots, indicated signs of strain on the system.The government hasn’t provided the full risk assessment it conducted.In the Monday letter, Bedford said the FAA determined traditional mitigation measures, such as slowing traffic in and out of airports, were no longer sufficient, given the “extraordinary” staffing issues the agency was seeing during the shutdown.In his prepared remarks for Tuesday’s hearing, Bedford also discussed the FAA’s work to overhaul its aging air traffic system — an effort that gained momentum after the deadly midair collision near Washington and a spate of technology outages affecting Newark Liberty International Airport.Congress already provided the agency with $12.5bn for the project, but Bedford and Duffy have said they need an additional $20bn.The government recently awarded Peraton Inc, a national security and technology company owned by private equity firm Veritas Capital, a contract to serve as the “prime integrator” overseeing the project, which will include upgrades to telecommunications systems and radar equipment.The FAA has already begun the modernisation work, including transitioning more than one-third of copper wire to new fibre optic lines, Bedford said.“These improvements will enable the Integrator to hit the ground running to create a more reliable, resilient infrastructure and serve as the foundation for the future National Airspace System,” the administrator said.When asked why the FAA chose Peraton over a joint bid from Parsons Corp and IBM Corp, Bedford said Peraton had unique expertise upgrading the telecommunications systems of the Defense Department and Nasa. “Peraton brought a competency that is relevant to what we need.”He said neither President Donald Trump nor Duffy interfered in the selection process and added that Trump actually demanded a $200mn reduction in Peraton’s fee.Bedford also told Congress the FAA plans to continue keeping a close eye on Boeing Co after a door-sized panel blew off one of its 737 Max jets in early 2024. The planemaker has been rebounding from the incident, which exposed quality lapses in its factories.Boeing recently won the regulator’s approval to raise production of the Max beyond a cap the FAA put in place after the midair blowout.“We continue to maintain our oversight of aerospace manufacturers, including Boeing, and how the company manages design, manufacturing, and quality across its programmes,” Bedford said in his prepared testimony. “We also continue to keep a close watch on the production system itself.”

Tuesday, February 10, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.