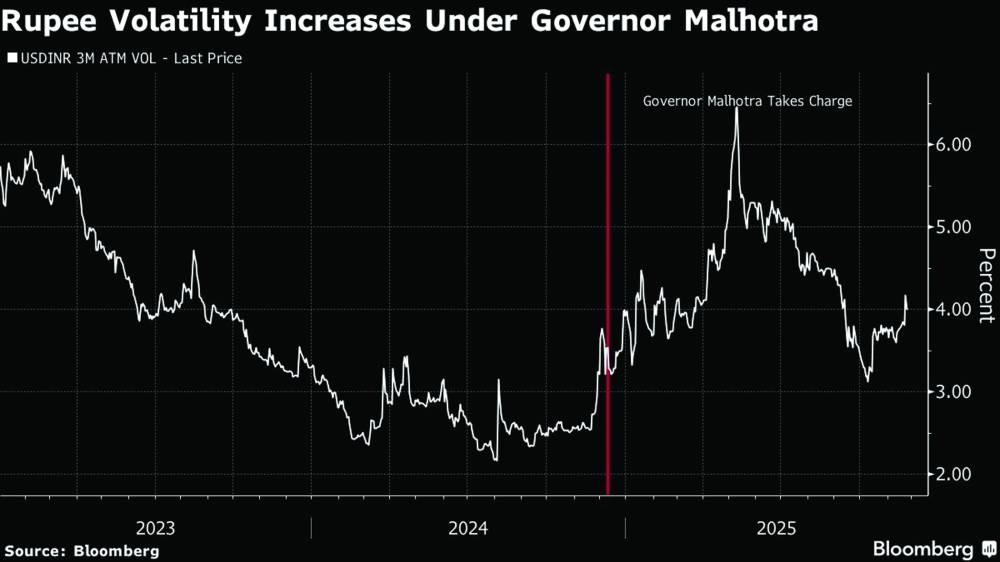

The Indian rupee is currently Asia’s worst-performing currency of 2025. It is also on track for its largest annual decline since 2022 — the year Russia’s invasion of Ukraine sent oil prices soaring past $100 per barrel, dealing a major blow to India, which imports about 90% of its crude. This year’s weakness, however, has been driven by higher US tariffs on Indian exports and an exodus of foreign investors from the local stock market. In a bid to stabilise the rupee, the Reserve Bank of India has sold more than $30bn of foreign-currency assets since the end of July, according to Bloomberg Economics estimates, and in doing so managed to avert a new low in mid-October. But on November 21, the rupee slumped to 89.4812 against the US dollar, which suggests the central bank stopped defending the currency. Analysts suspect the RBI wants to conserve its reserves in the event of delayed trade talks with the US. The currency is now at a crucial juncture. Possible improvements in US-India trade ties and a lower tariff rate could ease pressure on the currency. But if that doesn’t eventuate, the RBI may be forced to support the rupee further. What caused such a weak rupee this year? The rupee first dipped in January before it eked out slight gains against the dollar in March and April. At its strongest, in early May, the currency traded at 83.7538 per dollar. This was around the same time investors were betting India would be among the first to clinch a trade deal with the US. Expectations of lower tariffs on Indian exports fuelled optimism that foreign capital would flow into the country as companies sought manufacturing hubs outside of China. The tide turned in July, when President Donald Trump announced plans to impose higher-than-anticipated tariffs and threatened to penalise India for purchasing Russian energy and weapons. The levies dashed New Delhi’s hopes of preferential treatment over its Asian peers and the rupee suffered its worst monthly loss since 2022. In August, the US set tariffs on most Indian exports at 50% — the highest across Asia — which included a “secondary” 25% penalty tariff for India’s trade with Russia. The rupee fell to a series of record lows, breaching 88 per dollar. In September, the currency weakened further after reports that President Trump had urged European nations to impose similar Russia-related penalty tariffs on Indian imports, and that the US planned to raise the fee for its high-skilled H-1B visa — the vast majority of which go to Indian-born workers — from a few hundred dollars to $100,000. A frantic foreign exodus from Indian equities — driven by US tariffs, high stock valuations and concerns about economic growth and tepid corporate earnings — has piled additional pressure on the rupee. As of November 25, foreign investors had pulled out nearly $16.3bn from Indian shares this year, closing in on a record outflow set in 2022. Traders have speculated that the RBI has been intervening on and off this year to stabilise the currency, most notably in February and again in October. But on November 21, the rupee abruptly fell to an all-time low, suggesting that on that occasion the central bank chose not to step in. What is the central bank’s intervention strategy? The RBI intervenes only when it needs to contain excessive volatility, rather than targeting any specific value relative to the dollar, the central bank’s governor has said repeatedly. It typically does so by selling US dollars from its foreign-exchange reserves — which helps curb the dollar’s rise and supports the rupee — or through offshore derivatives contracts in which it commits to sell dollars at a predetermined price at a future date. Those reserves now stand at about $693bn — among the largest in the world and enough to cover about 11 months of imports. While the RBI has stepped in strongly many times over the years, it is now said to be taking a more hands-off approach under its new chief, who was appointed in December 2024. On November 26, the International Monetary Fund offered some insight into India’s intervention strategy when it classified India’s exchange-rate regime as a “crawl-like arrangement,” which indicates the central bank makes small, gradual adjustments to its currency to reflect inflation gaps with the US or other trading partners. That marks a change from its previous classification, which indicated strong levels of intervention by the central bank. Despite its new hands-off approach, when the rupee approached 89 to the dollar in mid-October the RBI grew alarmed and vowed to intervene until the currency firmed. That helped the rupee to stabilise until it fell in the last week of October, pointing to sustained pressure on the currency. Some analysts have suggested that the RBI’s defence of the rupee around 88.8 per US dollar is unsustainable amid wider trade deficits, weak portfolio inflows and a drawdown in foreign-exchange reserves. According to Bloomberg Economics, the move was likely a tactical one — intended to preserve firepower for what could be a long and volatile stretch while the US and India negotiate a trade deal. The RBI is estimated to have already spent about $32.8bn of foreign currency since the end of July. Why has the rupee been faring worse than other currencies? The rupee’s overall depreciation this year hasn’t come as a huge surprise; the currency has lost value every year since 2018. In fact, the RBI Governor Sanjay Malhotra downplayed the rupee’s weakness in an interview on November 24, saying it was to be expected given the inflation gap between India and advanced economies. What has made its weakness stand out is that the US dollar itself has been slipping, while many emerging-market currencies — such as the Taiwan dollar, Malaysian ringgit, and Thai baht — have strengthened. One reason is that those countries face far less US tariffs on their exports. India’s economy — though largely driven by its domestic market — has been hit particularly hard because the US is its largest export market. Another drag on the rupee has been India’s persistent current account deficit, which means it imports more than it exports. India must buy foreign currency — normally US dollars — to pay for those imports, which weakens demand for the rupee. By contrast, Taiwan, Malaysia, Thailand and South Korea are all running current account surpluses, which means they export more than they import, earning foreign currency from their sales abroad. Fears that the US dollar will continue to fall amid trade frictions, policy uncertainties and potential Federal Reserve rate cuts have also prompted exporters elsewhere in Asia to sell more of their dollar holdings than usual and convert the proceeds back into their local currencies, further amplifying their value. What are the pros and cons of a weak rupee? A weaker rupee makes Indian goods and services cheaper abroad, boosting export competitiveness. This helps to offset the tariff pressures facing exporters, as India seeks to expand its markets by signing trade deals with countries such as the UK. It’s also a boon for families of Indian workers abroad who send money home. India is the world’s largest recipient of remittances, with a record $137bn flowing into the country in 2024, according to the World Bank. A softer currency means every dollar remitted buys more rupees, lifting household incomes and consumption. On the flip side, a weaker rupee makes imports more expensive, pushing up the cost of essential items such as oil, fertilisers and electronics, most of which India buys from overseas.

Saturday, February 14, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.