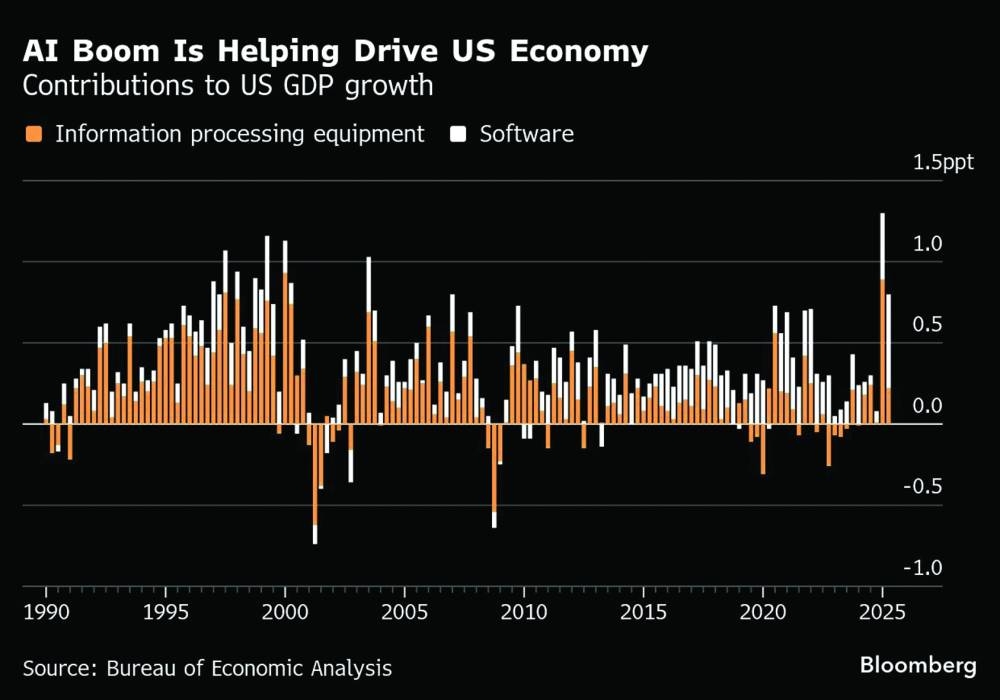

Like everyone else, policymakers at the Federal Reserve are increasingly obsessed with artificial intelligence and its promise of a turbocharged economy. They’re just not ready to make a big call that the revolution is under way.Analysts across the financial world are scouring data for signs AI is making the economy more productive – the holy grail of new technology. The last sustained boost of that kind was the 1990s internet boom. Back then it shaped Fed policy: Chair Alan Greenspan reckoned innovation would allow faster growth without triggering inflation, and used that argument to keep interest rates down.Right now, US central bankers are in agreement that AI will be transformative — but essentially in “too early to tell” mode when it comes to how the effects will land. A more immediate concern is above-target inflation, leaving many policymakers opposed to rate cuts. Others put more weight on weak job markets and support further easing: AI’s ability to replace workers is part of that case, but not front-and-centre.Caution is par for the course, because technological leaps often take years to work their way through the economy and show up in data. But the Fed is under pressure at a pivotal time.Chair Jerome Powell’s term ends in six months. President Donald Trump says he’ll pick a successor committed to lower borrowing costs. Treasury Secretary Scott Bessent, who’s in charge of the selection process, says whoever gets the job should be open to making a Greenspan-style early call.In the first half of 2026, “AI implementation is just really going to start biting in terms of productivity,” Bessent told CNBC last month. “It would’ve been easy for Alan Greenspan to kill the internet boom, not be open to the idea that there was a productivity boom and slam on the brakes,” he said – adding that the next Fed chief should have “an open mind” on the topic.There are five names on Bessent’s shortlist. In recent weeks four of them signalled they’re receptive to his case.**media[385850]**Kevin Hassett, head of Trump’s National Economic Council, said AI is lifting worker productivity at a “remarkable rate”. BlackRock Inc executive Rick Rieder said “we are in a productivity revolution”. Former Fed Governor Kevin Warsh wrote in the Wall Street Journal that “AI will be a significant disinflationary force, increasing productivity and bolstering American competitiveness”.Current Governor Christopher Waller sounded a little more cautious, saying he has “no doubt” AI will boost the economy and is “hoping” for sustained productivity growth. The fifth candidate, Vice-Chair for Supervision Michelle Bowman, has tended to discuss AI more in the context of regulatory work she oversees.All of this suggests AI is set to take up an ever-growing share of Fed attention – and of course its implications for the economy go far beyond the central bank’s interest rates.The rush to develop AI is already driving a large portion of US growth, not to mention a stock market that many believe is in bubble territory. Businesses and consumers are rapidly adopting the technology. For the economy, as well as for equity valuations, the big question is: what’s the output from all these inputs?That boils down to productivity, or how much workers can produce using the available tools. Numbers are volatile and notoriously hard to parse, but they’ve picked up lately and some economists think it’s an early AI effect.The St Louis Fed has been asking workers in regular surveys how many hours they saved by using generative AI. Researchers found it may have boosted labour productivity by as much as 1.3% since the release of ChatGPT three years ago.“What surprised me was how clearly the signal is already appearing at the industry level,” says co-author Alexander Bick. “The correlation is already there.”For anyone trying to answer this key question — whether it’s Fed officials, corporate chiefs or investors — there’s a fundamental problem, according to Kristina McElheran of the University of Toronto, who studies AI and the future of work. There’s a lack of “nuanced, high-fidelity data on AI use by firms”, she says, while many of the headline-grabbing studies are based on “really questionable information”.“We are flying blind into this AI revolution,” McElheran says. “We don’t have the statistics that we need for policy. We don’t have the statistics we need for managers.” As a result, all modellers can do is “take past trends and try to fit them onto stuff that’s happening super-fast right in front of us”.Business owners who are adopting AI get the real-time view, and many see dramatic gains in productivity.Peter Capuciati’s company Bluon Inc has been building an AI model with a database that covers generations of HVAC equipment, using insights amassed by its own technicians answering several years’ worth of calls, as well as tens of thousands of manuals. Around 160,000 technicians now use the free version and some 13,000 pay for the full service. Capuciati reckons it can save them up to eight hours a week.“Techs don’t like to admit that they have a problem or they don’t know something,” Capuciati says. “So if they can go to an AI source and either confirm their assessment or be guided elsewhere, that’s a very time-saving process.”Christopher Stanton at Harvard Business School has been tracking Bluon’s deployment of AI. He sees it as a winning formula for higher productivity in an industry running low on skilled workers.“The machine is simply augmenting that human with information about how to do those things,” he said. “It’s a very powerful driver, especially in places where we think there are labour shortages.”There’s a darker flipside to that idea, which taps into some of the fears around AI. A technology that allows fewer workers to generate the same output could be an effective way to fill labour-market gaps — or a job-killer that leaves workers with nowhere else to go.Typically when the economy takes a technological leap forward it finds ways to redeploy labour. While the 1990s internet boom ended in a stock-market bust, its productivity legacy ran for around a decade and has yet to be matched.Back then, according to Julia Coronado, founder of Macropolicy Perspectives LLC, companies were taking advantage of innovations to expand employment. Now she says they’re more likely to be using AI to reduce their workforce.The Fed’s recent Beige Book surveys cite evidence that AI is a drag on hiring demand, especially for entry-level jobs. A Capital Economics study points out that the information tech industry, not surprisingly an early adopter of AI, has been chipping in a bigger chunk of US growth even as its payrolls shrink — evidence of productivity gains, but also of risks as the technology spreads.That’s something on the mind of Robert Gordon, a professor at Northwestern University and author of “The Rise and Fall of American Growth.” Gordon, who’s among the most-cited scholars of long-run economic trends, has often been sceptical about the ability of new inventions to deliver a growth payoff on the scale that older ones did.