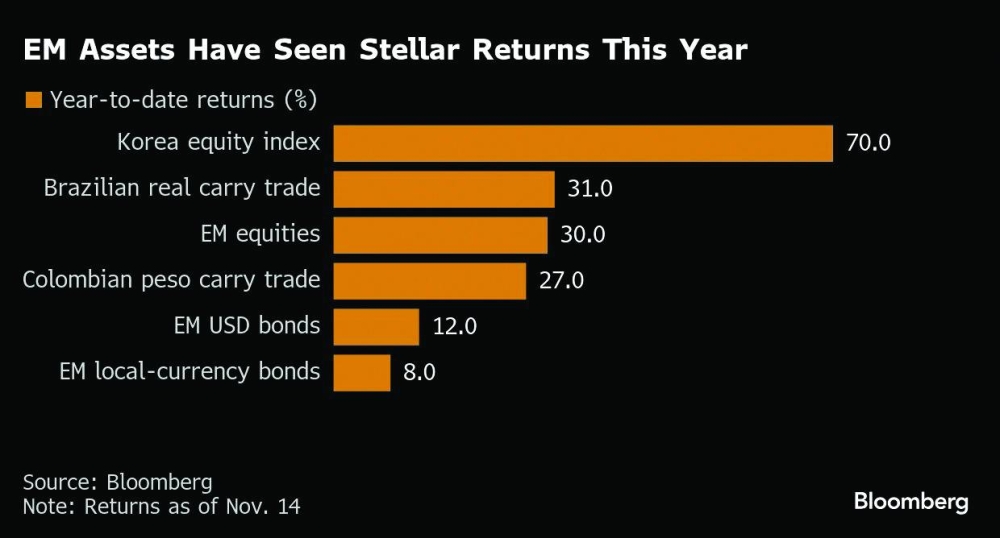

Asia is back on top. The region’s stock markets have beaten the US and Europe this year, credit markets are strong, currencies are strengthening, and investors expect the momentum to carry into 2026.In dollar terms, the MSCI Asia Pacific Index of the region’s equities is up 27% this year including dividends. It’s also the first time since 2020 that Asian shares have outpaced both US and European benchmarks in the same year.The resurgence reflects Asia’s expanding appeal to investors seeking faster growth as the US and Europe slow. A weaker dollar has made Asian assets more attractive, while the region’s deep links to the technologies shaping the global economy have strengthened the investment case.“Asia’s outstanding performance isn’t just a cyclical bounce — it reflects where global growth and policy momentum are converging, giving the region a credible runway into 2026,” said Hebe Chen, senior market analyst at Vantage Global Prime Pty. “While the US still dominates the top end of the tech stack, Asia — especially China, Taiwan, Korea, and Japan — now anchors critical parts of the AI value chain, often without US-style valuation strain.”The rally’s breadth is striking. Japan, South Korea, Taiwan and China have all posted double-digit gains this year. South Korea’s Kospi index alone has climbed 71%, making it one of the top-performing major markets globally.In China, stocks are heading for their strongest year since 2020, driven by the excitement around artificial intelligence. DeepSeek’s AI advances have helped revive interest in Chinese technology, an area that had been heavily discounted after years of regulatory pressure.Jonathan Armitage, chief investment officer for Australia-based Colonial First State, said the renewed focus on Chinese tech has strengthened the money manager’s outlook for emerging-market stocks into 2026.To be sure, the rally comes with risks. China’s economic recovery has been uneven and any renewed strength in the dollar could hurt returns for foreign investors. There’s also concern that the rally in AI-related tech stocks is getting crowded, which may leave prices vulnerable if growth slows or sentiment flips.Even so, some investors say those risks don’t change the broader story. The region’s cross-asset rally is seen as the early stage of a longer re-rating — a period when markets are valued more highly as growth prospects improve.“With a hotter and more diverse growth engine than the US or Europe, 2025 looks less like a peak for Asia and more like the early stage of a longer re-rating cycle,” Vantage Global’s Chen said.Investor interest is spreading beyond the biggest markets, with Vietnam emerging as a favourite. Stocks there are up about 38% this year, and some investors say the rally could extend.“We are most bullish on Vietnam, which has attractive value and growth characteristics,” said Nick Ferres, chief investment officer for Vantage Point Asset Management in Singapore.A weakening greenback has boosted the value of Asian assets for dollar-based investors, making returns look more attractive just as most Asian currencies are strengthening.China’s offshore yuan is trading close to its strongest level in more than a year, and the Australian and New Zealand dollars have advanced as traders begin to price in tighter monetary policy. Meanwhile, the Malaysian ringgit and Thai baht are close to a 10% gain.“Despite the volatility surrounding tariffs, Asia FX — including the Australian dollar — have done well broadly,” said Wee Khoon Chong, a senior Asia-Pacific market strategist at BNY. “The weak US dollar, resilient regional trade growth and the AI-led optimism has benefited Asia this year and likely to continue into 2026.”The bullish mood extends to corporate debt. An index of Asia’s dollar-based investment-grade debt has beaten its US counterpart and is on track for its biggest year gain since 2019. Spreads are slightly above the record lows hit in November, while high-yield spreads have held near a seven-year low reached in September.“We’re talking about a high credit quality market, particularly when it comes to investment grade, which is backed by strong fundamentals,” said Omar Slim, co-head of Asia fixed income at PineBridge Investments.Outside of China, defaults have been minimal, while issuance “is under control and being sought after by a growing money pool,” Slim said.