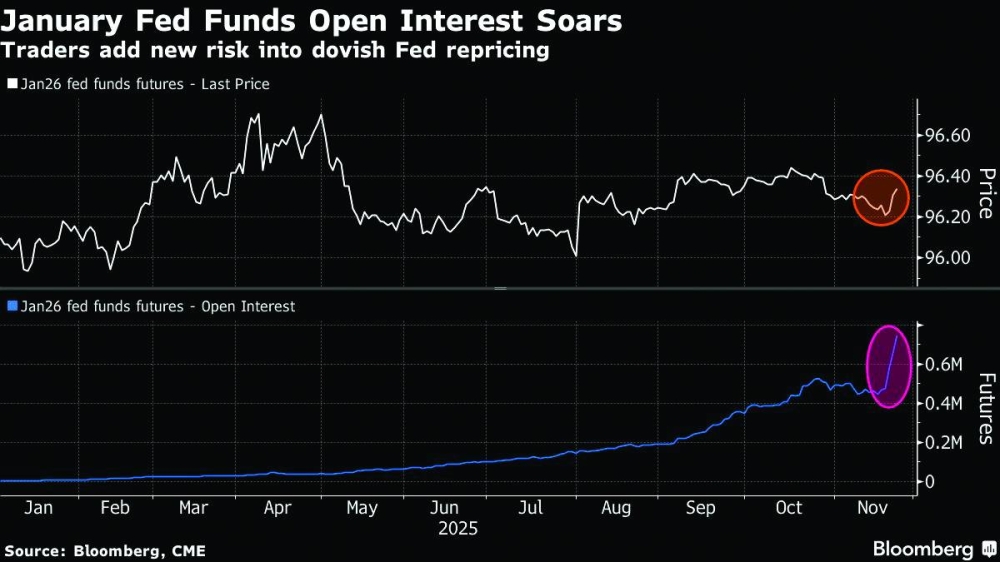

Investors are betting big that the Federal Reserve will cut interest rates again when policymakers meet next month, erasing doubts that had tipped the odds against a move as recently as last week and setting the stage for gains in US bonds.The amount of new positions held by traders in futures contracts tied to the central bank’s benchmark has surged in the past three trading sessions, with back-to-back record daily volumes seen in the January contract last week. Market pricing now signals roughly 80% certainty of a quarter-point move at the Fed’s December meeting, compared with 30% odds just days ago.The shift in rate sentiment started after last week’s delayed September jobs data, which painted a mixed picture. It then picked up steam on Friday after New York Fed President John Williams signalled he sees room for a reduction “in the near term” amid labour market softness.“The Fed is very divided,” but it looks like “doves have outnumbered hawks,” said Tracy Chen, a portfolio manager at Brandywine Global Investment Management.This week, San Francisco Fed President Mary Daly backed lowering rates at the next meeting, while Governor Stephen Miran on Tuesday reiterated his case for large interest-rate cuts even as inflation remains stubbornly above the central bank’s preferred level.Fed Chair Jerome Powell and his allies on the policy-setting committee are “on board with a cut,” despite pushback from other officials who are more concerned about inflation, said Subadra Rajappa, a strategist at Societe Generale. With recent soft economic data, including the labour market, “Powell will be able to convince the rest of the committee.”The dovish tone in futures is echoed in the cash Treasuries market, where this week’s client survey from JPMorgan showed net long positions rising to the most in about 15 years.On Tuesday, the 10-year US yield fell below 4% for the first time in a month, after White House National Economic Council Director Kevin Hassett emerged as the front-runner to serve as the next Fed chair, boosting expectations for lower rates over the next year. The yield was little changed at 4% on Wednesday.It’s normal for Fed officials to guide Wall Street toward their ultimate decision ahead of the meetings to avoid surprises. Only three times in more than two years — covering a total of 20 Fed meetings — have traders not fully priced in an outcome this close to a policy decision.The combined amount of new positions added in January fed funds futures has been close to 275,000 contracts since Thursday. That’s equivalent to approximately $11.5mn per basis point of risk, or 37% of the total open interest in the tenor as of Tuesday’s close. The contract rallied from as low as 96.18 Thursday to as high as 96.35 on Monday, signalling new long positions added.“The market largely viewed the comments from Williams as Powell playing his hand, so to speak,” said Blake Gwinn, the head of US interest rate strategy at RBC Capital Markets. “Data this week has leaned that way too.”While most Wall Street strategists are now calling for a December reduction, not all are as convinced as traders that it will happen. Those at Morgan Stanley last week scrapped their prediction for the central bank to ease, while JPMorgan Chase & Co also leans toward the Fed holding next month, “though December should remain a very close call.”“We continue to think they will cut in December, but I think after that the outlook is a little bit more uncertain,” said Tiffany Wilding, economist at Pacific Investment Management Co, on Bloomberg Television. “Overall the economy has held up remarkably well from a growth perspective this year, but nevertheless there are down side risks to the labour market and inflation appears to be kind of around 3%, clearly above the target.”Here’s a rundown of the latest positioning indicators across the rates market:JPMorgan Survey: For the week ended November 24, investors’ outright long positions rose 4 percentage points, to the most since April, pushing the net long positioning to the most since October 2010. Shorts dropped 1 percentage point on the week.New risk in SOFR options: In SOFR options out to the Jun26 tenor there has been a surge in open interest in the 96.25 strike, largely due to a big jump in positioning via Dec25 calls over the past week. The strike has been used across multiple structures targeting hedging around a 25bp rate cut at the December FOMC meeting, including SFRZ5 96.125/96.25 call spreads and SFRZ5 96.25/96.3125 call spreads. There has also been continued demand for SFRZ5 96.1875/96.25/96.3125/96.375 call condors. The SFRZ5 96.1875/96.25 call spreads have also been popular plays over the past week.Treasury options premium: The premium paid on options to hedge Treasuries over the past week has been steady around neutral level across the futures strip. Premium in the front and intermediates of the futures strip continues to slightly favour calls over puts, indicating traders paying more to hedge a Treasuries rally in the front end and belly of the curve versus a selloff. The December Treasury options expired November 21.