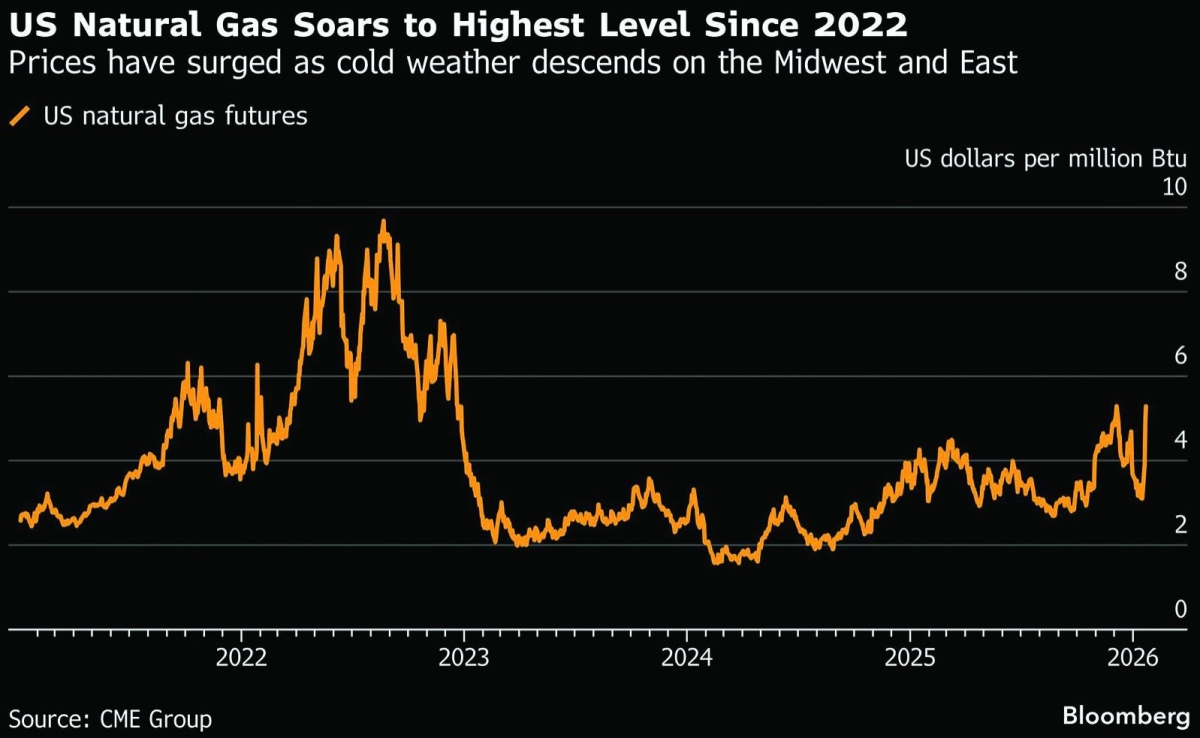

US and European natural gas futures have posted multiday rallies this week as freezing weather sweeps across major markets for the fuel, sparking a wave of short-covering amid risks of stronger heating demand and disrupted production.Front-month contracts in the US jumped to the highest since 2022 and are on track for a weekly gain of more than 70%, the biggest such move in records going back to 1990. European futures dipped Thursday after rising around 40% this year.Americans are bracing for a severe winter storm that could cause unusually low temperatures across two-thirds of the nation and disrupt major gas production facilities in the south due to a freeze-off, where water solidifies inside pipelines. Consumption is expected to rise as households crank up their heaters, potentially draining inventories.“This is a textbook winter-driven squeeze: fast, violent, and sentiment-shifting,” Ole Hvalbye, an analyst at SEB AB, wrote in a note to clients.The shift in US weather forecasts came days after hedge funds turned more bearish on gas at the end of last week, leaving the market poised for a rally as traders rushed to close out those wagers. In Europe, bearish bets have been elevated since the start of the heating season, before rapid storage withdrawals in recent weeks upended market sentiment.While surging prices are a boon to US gas producers, they spell trouble for consumers struggling with high energy bills, which are a problem for governments around the globe.Europe is also getting ready for another cold snap in the next few days, and relies on the US for liquefied natural gas imports ever since it lost most Russian pipeline flows during the 2022 energy crisis. Stockpiles are already at unusually low levels after a challenging stockpiling season last summer and repeated cold spells this winter.“What’s currently happening is a bidding war between the Henry Hub and the TTF, each fighting to keep/move the gas in its market,” according to a note from Engie SA’s EnergyScan, referring to the main gas trading points in the US and Europe. The continent is realising that the competition to attract LNG cargoes “isn’t just with Asia, but also with the US.”Asia’s gas benchmark also jumped this week to the highest level since late-November, according to traders, as the weather in the region turned colder, lifting demand. While the region has ample inventories — unlike Europe — a prolonged cold snap could raise global competition for the fuel.The rally across global gas markets comes after a period of relative calm, as new LNG projects slated to come online in 2026 and later this decade raised expectations of a looming glut that could dampen gas prices for years to come. SEB’s Hvalbye said the immediate trigger has been the weather, rather than any structural shock or change in long-term fundamentals.Still, he said the price reactions underline a shift that has taken place in the gas market, particularly in Europe.“Gas has become a far more global and flexible commodity, where traditional European seasonal logic matters less than before,” Hvalbye said. “That also means that when weather or global flows shift, price reactions can be faster and sharper, exactly what we are now seeing play out.”

Saturday, February 14, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.