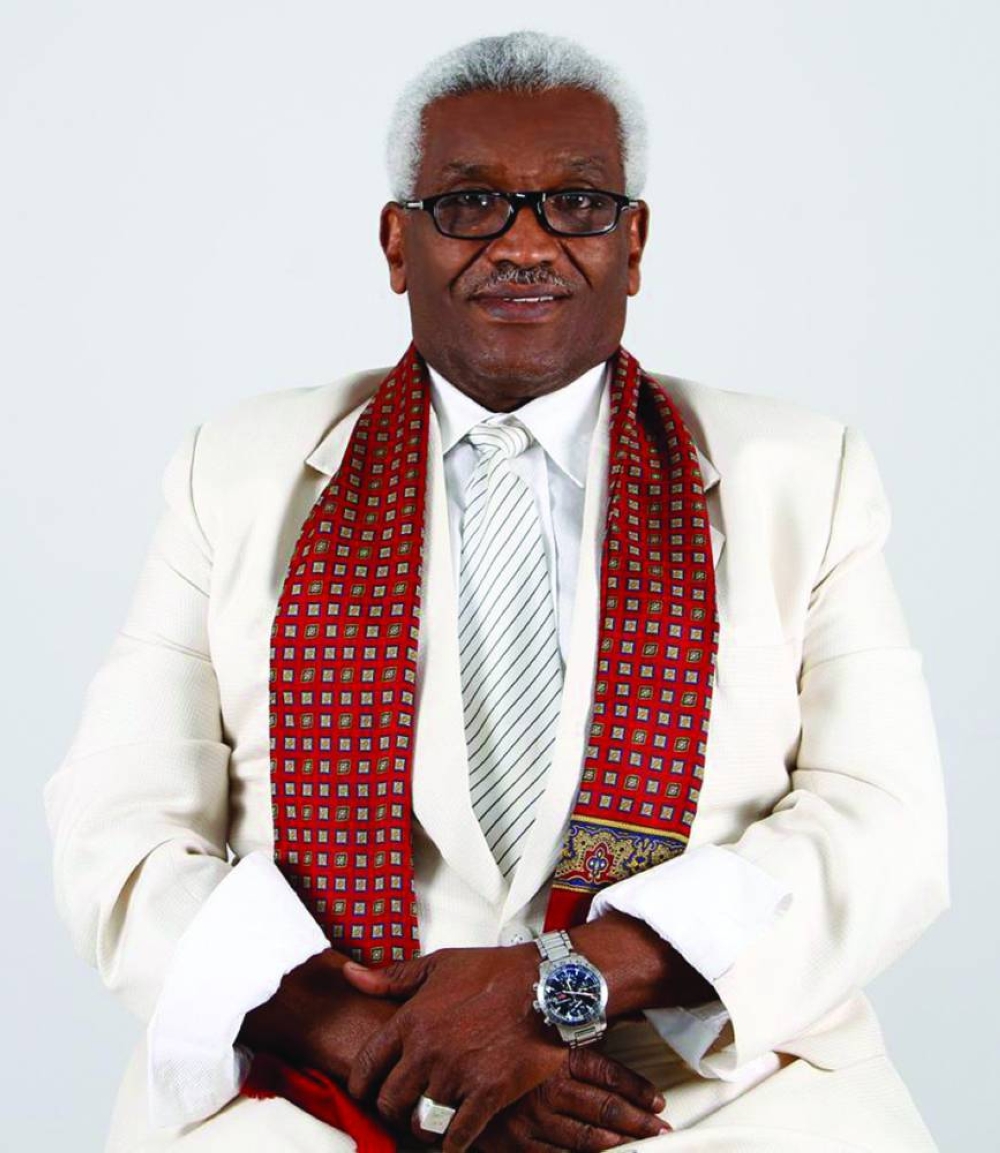

Legal PerspectiveCommercial banks play a pivotal role in most trade finance transactions. Herein, the banks can take different roles, such as the issuing bank, the confirming bank, the nominating bank, the advising bank or otherwise depending on the intention and interest of the bank in serving their different clients.I believe that the role of each of the above-mentioned banks is important and highly needed for such transactions. However, the role of the confirming bank could be more important and very essential to complete the smooth process of trade finance transactions.Therefore, we need to know more about confirming banks. Under the UCP 600, a confirming bank is a bank that adds its confirmation to a letter of credit (LC) at the initial request or authorisation of the issuing bank, undertaking obligations similar to the issuing bank's own. In other plain words, it is a kind of a “confirmer” that agrees to perform the principal duties of the issuing bank.This banking activity adds an extra layer of security for the exporter (beneficiary), ensuring the payment even if the issuing bank defaults. Moreover, the key responsibilities of a confirming bank include examining documents for compliance and ensuring payment or negotiation if the presentation is complying.According to the UCP (Uniform Customs and practices for Documentary Credits) 600, explain the meaning of “Confirming Bank”. Sub-article 37 (c) of UCP 600 states: “A bank instructing another bank to perform services is liable for any commissions, fees, costs or expenses (‘charges’) incurred by the bank in connection with its instructions”.Based on this and according to sub-article 8 (b) of UCP 600, the obligation of a confirming bank begins only when it adds its confirmation to the credit: “A confirming bank is irrevocably bound to honour or negotiate as of the time it adds its confirmation to the credit”.In trade finance transactions, the issuing bank is in fact open to confirmation being added, but not mandating it. The confirming bank can add its confirmation, however, it still retains the right to decline the confirmation, as stated in sub-article 8 (d) of the UCP 600. As a rule, if a bank authorised or requested by the issuing bank to confirm a credit, is not prepared to do so, it must inform the issuing bank without delay and may advise the credit without confirmation. All this is optional for the confirming bank as they deem appropriate and acceptable for them.Many people ask if the issuing bank can also take the role of a confirming bank. Generally, the answer is yes. An issuing bank can also act as the confirming bank, although typically these are separate entities. Normally, the issuing bank issues the LC, while the confirming bank adds its own guarantee of payment, which provides greater security to the beneficiary. However, in situations where the issuing bank is also the one performing the confirmation, it's acting in both capacities within the same transaction.Even though, the role of the confirming bank is very clear, however, there are many cases in Courts between the issuing banks and the confirming banks and or clients. It is important to be more vigilant and careful in such transaction as they may cause unnecessary troubles and legal obligations.Dr AbdelGadir Warsama Ghalib is a corporate legal counsel. E-mail: [email protected]

Tuesday, February 10, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.