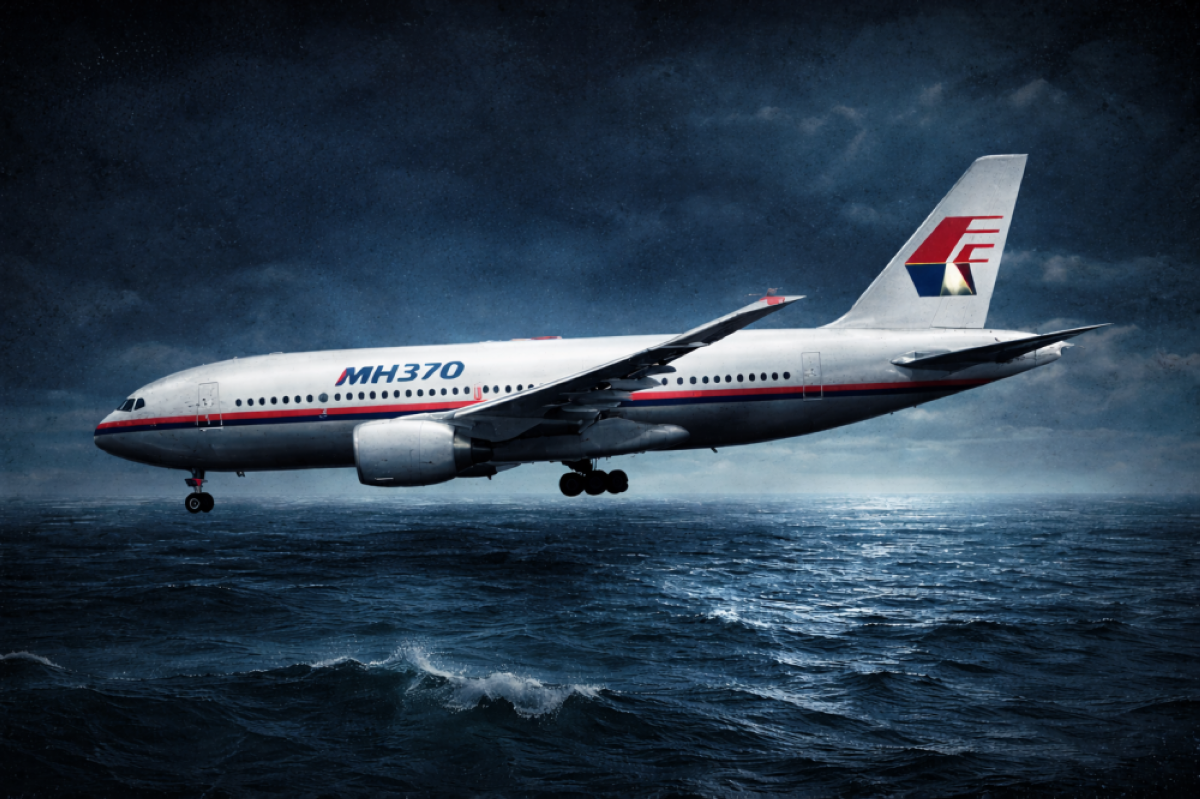

A new search for Malaysia Airlines Flight MH370 — one of the most enduring mysteries in aviation history — has resumed in the southern Indian Ocean, more than a decade after the aircraft vanished.The Boeing 777 disappeared on March 8, 2014, while en route from Kuala Lumpur to Beijing with some 239 passengers and crew on board.The aircraft lost contact shortly after takeoff, and despite extensive international searches and debris washing up thousands of miles away, the main wreckage has never been found.Most of those on board were Chinese nationals, alongside citizens of Malaysia, Canada, France and several other countries.Despite years of investigation, the circumstances surrounding the disappearance remain largely unknown.Satellite data analysis suggests the aircraft likely crashed in the southern Indian Ocean, and a small number of debris fragments believed to be from the aircraft have since washed ashore on the east African coast and Indian Ocean islands.The renewed seabed search is being conducted by Ocean Infinity, a UK- and US-based marine robotics company. An earlier attempt this year was suspended in April after 22 days due to adverse weather conditions.Malaysia's Ministry of Transport has now confirmed that the search will be carried out intermittently over a 55-day period beginning December 30.Ocean Infinity is operating under a “no find, no fee” agreement with the Malaysian government. Under the reported terms of the contract, the company will survey a newly defined 5,800-square-mile (15,000sq km) area of the ocean floor and will receive a reported fee of $70mn only if the wreckage is located.The company, however, has declined to comment publicly on the latest phase of the operation.The disappearance of MH370 triggered the largest underwater search in aviation history. A multinational effort led by Australia, alongside Malaysia and China, previously scanned more than 46,000 square miles of seabed in a remote part of the southern Indian Ocean before concluding in 2017 without locating the main wreckage.Ocean Infinity later took over the search in 2018 for a few months under a similar payment arrangement, also without success.Reports indicate that the current mission will deploy advanced underwater vehicles, deep-sea drones and high-resolution scanning technology across a focused area of approximately 6,000 square miles.The search focuses on a targeted zone — previously narrowed down using updated modelling of satellite, drift, and oceanographic data — where experts believe the aircraft debris is most likely to be found.It remains unclear whether the company is acting on new evidence regarding the aircraft’s final location. MH370 vanished from air traffic radar less than an hour after departing Kuala Lumpur, shortly after the pilot’s final transmission.No distress call was made, no ransom demand issued, and there was no indication of technical failure or severe weather. Minutes after the last communication, the aircraft’s transponder stopped transmitting.Over the years, only a few dozen pieces of suspected debris have been recovered. No human remains or large sections of the aircraft have been found, although all those on board are presumed dead.The prolonged absence of answers has fuelled numerous theories and conspiracy claims, while families of the victims have continued to seek closure.Legal proceedings have also continued, with a Beijing court ordering compensation for eight Chinese families in early December.The court ordered Malaysia Airlines to pay families of eight missing passengers onboard flight MH370 over 2.9 million yuan ($410,240) per case in compensation, according to Reuters.Another 47 cases have been settled and withdrawn, and the remaining 23 cases are still under trial, the agency said in a dispatch.For the families of the 239 victims and the wider global aviation community, the resumption of the search represents a renewed effort to finally locate MH370 and understand what happened.While it is too early to assess the outcome of the 55-day mission, the use of more advanced technology and a narrower search area has given experts cautious hope.

Sunday, February 22, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.