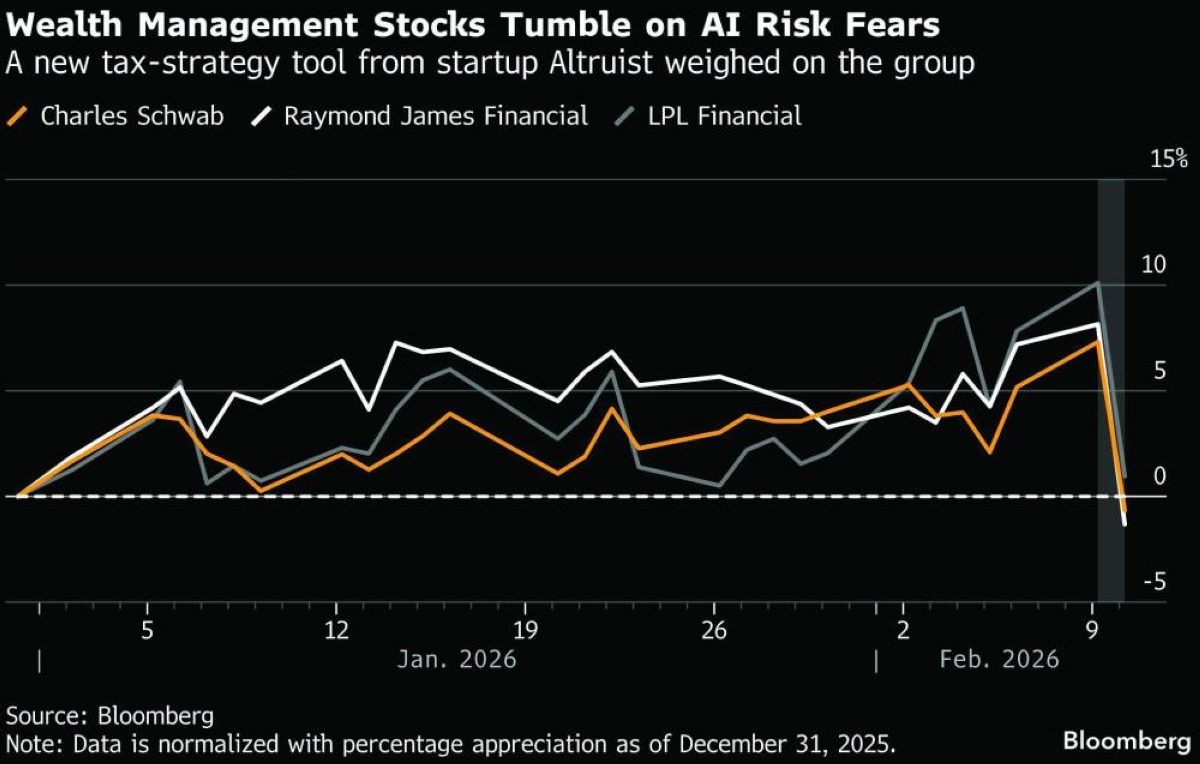

On Wall Street, rising fears about artificial intelligence keep pummeling shares of companies at risk of being caught on the wrong side of it all, from small software makers to big wealth-management firms.The latest selloff was triggered by a tax-strategy tool rolled out by a little-known startup, Altruist Corp. The perceived threat the sent shares of Charles Schwab Corp, Raymond James Financial Inc and LPL Financial Holdings Inc down by 7% or more, before going on to hit European companies, too.It was the deepest slide for some of those stocks since the market’s trade-war meltdown in April. But it was only the most recent example of a sell-first, ask-questions-later mentality that has rapidly taken hold as new products emerge from the hundreds of billions of dollars poured into AI, sowing anxiety about how the technology may upend entire industries.“Every company with any sort of potential disruption risk is getting sold indiscriminately,” said John Belton, a money manager at Gabelli Funds.The advances in AI have been at the forefront of Wall Street over the past few years, with tech stocks leading the charge. As the rally pushed share prices to record highs, questions persisted about whether it was a bubble about to burst — or would set off a productivity boom that will remake corporate America.But since early last week, a trickle of AI product rollouts unleashed a stark sea change. Instead of focusing on picking the winners, investors instead are quickly trying to avoid getting caught owning any company with the slightest risk of being displaced.“I have no idea what’s next,” said Will Rhind, the CEO of Graniteshares Advisors.“The story from last year was we all believe in AI — but we’re searching for the use case,” he said. “And when we keep discovering the use cases that seemingly are more and more powerful and more and more compelling, it’s now leading to disruption.”The software industry has been dogged by worries about AI for some time. It started shifting more broadly to other sectors last week, when new tools from Anthropic PBC sparked a deep rout in stocks across the software, financial services, asset-management and legal-service sectors.The same fears hammered shares of US insurance brokers on Monday after the online marketplace Insurify unveiled a new application that uses ChatGPT to compare auto-insurance rates. On Tuesday, wealth-management stocks were the next casualty, pulled down by Altruist’s product, Hazel, which helps financial advisers personalize strategies for clients.Altruist CEO Jason Wenk said even he was surprised by the scale of the stock market’s reaction, which wiped billions of dollars off the market values of a number of investment firms. But he said it sends a strong signal about his company’s potential.“It’s dawning on people — this architecture we’re using to build Hazel, it can replace any job in wealth management,” he said in an interview. “Usually these are jobs done by entire teams. And they’ll be done with AI effectively for $100 a month.”Charles Schwab President and Chief Executive Officer Rick Wurster told Bloomberg Television on Wednesday that was “disappointed and surprised” by the company’s stock slide. Rather than being threatened by AI, he said the company is already embracing the technology to make its financial advisers more efficient and expand its ability to serve customers.“The market is missing that we are a natural winner in the AI space, because of all the advantages we have, because of our size, our scale, our data,” he said.AI companies like OpenAI and Anthropic have made solid inroads into software engineering with products that help developers streamline the process of writing and debugging code, stoking anxiety about the impact on legacy software makers. On Wednesday, French software company Dassault Systemes tumbled as much 22% after it reported results that JPMorgan Chase & Co analysts said were “worse than even the most negative had feared,” playing into worries that the company will be hit by competition from AI.Yet there are plenty of questions about how the technology will be adopted as AI companies push into other industries. Banking, for one, has seen periodic challenges from crypto, electronic services and other technology that ultimately have done little to chip away at its dominance.Belton, the fund manager with Gabelli, is among those who are skeptical of how Wall Street has gone from worrying about an AI bubble to fears that it’s poised to disrupt huge segments of the economy.“There’s going to be winners and losers in every industry,” Belton said. But, he added, “one rule of thumb is tech-disruption tends to take longer than expected to play out.”The pullbacks may also reflect the general anxiety about how much stocks have rallied over the past few years on the back of the AI spending boom and a surprisingly resilient US economy. That has stretched valuations and made investors sensitive to fears of a reversal.“It certainly is a case of, shoot first, ask questions later,” Kerry Craig, JPMorgan Asset Management’s global market strategist, told Bloomberg Television.To Ross Gerber, the CEO of Gerber Kawasaki, the angst about AI losers that has been battering parts of the market for the past week is premature. He said it’s still far too early to say what exactly the fallout will be.“We can try to extrapolate out what the world will look like in five years with AI, but we just don’t know,” he said. “Markets are trying to make these calls on it when we’re still in the beginning of this infancy.”

Friday, February 13, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.