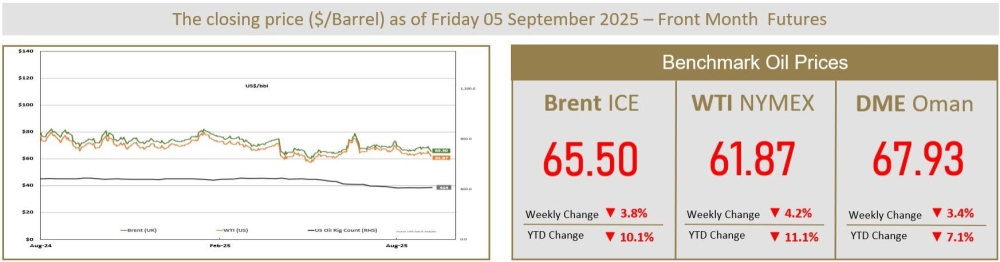

The global oil market faces an even bigger surplus next year of as much as 4.09mn barrels per day as Opec+ producers and rivals lift output and demand growth slows, the International Energy Agency said on Thursday.The outlook from the IEA, which advises industrialised countries, is the latest warning that the oil market is heading for oversupply. A surplus of 4.09mn bpd would be equal to almost 4% of world demand, and is much larger than other analysts’ predictions.“Global oil market balances are looking increasingly lopsided, as world oil supply is forging ahead while oil demand growth remains modest by historical standards,” the IEA said in its monthly report.Opec+, or the Organisation of the Petroleum Exporting Countries plus Russia and other allies, has been boosting output since April. Other producers, such as the US and Brazil, are also increasing supply, adding to glut fears and weighing on prices.Oil prices edged higher to around $63 a barrel after the IEA report to recoup some of the 2% drop on Wednesday after Opec shifted its 2026 outlook to a small surplus, having earlier seen a sizeable deficit.Global oil supply will grow by around 3.1mn bpd in 2025, and 2.5mn bpd next year, each up by around 100,000 bpd on the month, the IEA said.Supply is rising faster than demand in the IEA’s view even after upward revisions on Thursday. The agency now expects oil demand to rise by 770,000 bpd next year, up 70,000 bpd from last month, citing increased needs in petrochemical plants.The short-term outlook in the IEA’s monthly report contrasts with the agency’s annual outlook on Wednesday, which sees global oil and gas demand potentially rising until 2050.Opec sees a surplus of just 20,000 bpd next year according to Reuters calculations based on its own monthly oil market report on Wednesday, although this marks a further retreat from its forecast of a sizeable deficit.Global oil output was 6.2mn bpd higher in October than at the start of this year, divided evenly between Opec+ and non-Opec producers, the IEA said. Top Opec producer Saudi Arabia contributed 1.5mn bpd of the increase, while Russia added just 120,000 bpd amid sanctions and Ukrainian attacks.Russian oil exports have continued largely unabated despite new US sanctions on Russian firms Rosneft and Lukoil, which still may have the most far-reaching impact yet on global oil markets, the IEA said.The IEA added that new entities have already started handling Russian exports as it adapts to sanctions. In October, companies MorExport, RusExport and NNK, which have only been active since May, lifted around 1mn bpd of Russian crude and fuels, it said.The Paris-based IEA also drew attention to a sharp rise in global oil inventories, which rose to their highest since July 2021 in September at just under 8bn barrels.The increase was driven by a sharp increase in waterborne oil in storage, which rose by 80mn barrels in September.Preliminary October data shows further rises for global stocks, again driven by increasing waterborne barrels, the agency added.