Global bond and equity markets have been particularly volatile in recent weeks as the general sell-off that started early this year deepened with the deterioration of the macro outlook, QNB said in an economic commentary.

The main reason for such moves was the multitude of negative prints coming from inflation figures in key advanced economies. In fact, the headline consumer price index (CPI) for the US and the Euro area accelerated further in May.

The main reason for such moves was the multitude of negative prints coming from inflation figures in key advanced economies. In fact, the headline consumer price index (CPI) for the US and the Euro area accelerated further in May. At 8.6% for the US and 8.1% for the Euro area, the CPI prints came well above the 2% target of their respective monetary authorities.

Importantly, the inflation figures for May were significantly higher than what was expected by both policymakers and investors. This was particularly relevant in the US, where a debate about “peak inflation” was gaining ground before new figures were released.

Higher than expected inflation led to even more pressure on the Fed and the ECB to pivot away from an excessively accommodative stance and accelerate the pace of monetary policy normalisation.

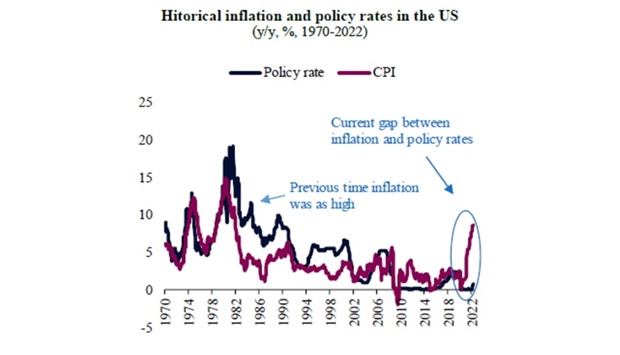

In the US, the Fed is “behind the curve,” having to tighten policy rates more rapidly to contain inflation. Last time US inflation reached the May 2022 highs was in early 1982, when the Fed policy rate was 15%, versus the current level of 1.75%.

In the past, every time US inflation breached the 5% mark, the price spiral problem was not contained before policy rates were aggressively hiked to a level that was at least as high as peak inflation. Every single time that this happened, the monetary tightening contributed to a recession, QNB noted.

This time, however, it seems extremely unlikely that US policy rates would move above existing inflation rates. The level of overall indebtedness in the US public and private sector, at around USD 85 trillion or 350% of GDP, would make it very difficult for the Fed to sustain policy rates much above 3.5% to 4%.

Doing so, QNB said “would increase the debt burden too much too quickly, increasing the risk of a financial crisis or a sudden stop in consumption and investment.”

Thus, if inflation does not moderate over the next few months, the Fed will have to face some difficult choices in terms of what aspect of its mandate it should prioritise – price stability, full employment or financial stability. This could be one of the most difficult trade-offs of the history of the Fed, QNB noted.

In the Euro area, policy choices for the ECB are equally difficult. After several quarters in the doldrums with the deflationary effect from the pandemic, prices spiked sharply in the second half of 2021, surprising most analysts and investors. In fact, this became the most severe inflationary shock the Euro area has ever experienced in its more than twenty three years of history.

Taking Germany as a proxy for inflation for the region during the pre-Euro era, last time inflation reached the May 2022 highs was in mid-1973, when the Bundesbank policy rate was 7%, versus the current ECB policy rate of -0.5%. The negative gap between inflation and policy rates is multiple times anything seen over the last two generations.

This suggests that the ECB has a lot of “catch up” to do in terms of rate hikes, particularly as a widening interest rate differential against the US would place more pressure on the EUR. In the absence of a meaningful cycle of ECB rate hikes, the EUR could depreciate further against the USD, adding to inflation pressures as the cost of imported goods increase.

However, QNB noted monetary tightening in the Euro area could be “costly”. The macro situation differs across countries within the Euro area, particularly when it comes to employment rates, fiscal needs and debt levels.

Mediterranean countries of the South or the “periphery” of the Euro area, such as Greece, Spain and Italy, have higher unemployment rates, fiscal deficits and debt levels than the stronger economies of the North (Germany, Austria, Belgium and the Netherlands).

Hence, QNB noted Southern European economies are more vulnerable to a “hawkish” pivot from the ECB. This is already starting to transpire as intra-EUR bond spreads widen, making it more expensive to fund Southern economies.

If this continues, higher rates could cause another regional debt crisis in the “periphery” of the Euro area. This problem could be amplified by the escalation of the conflict with Russia, which could develop into an acute energy scarcity in some Western European countries, causing a sudden stop in manufacturing activity.

“All in all, both the Fed and the ECB are under pressure to deliver lower inflation as part of their mandates. However, this requires more aggressive policy actions that could lead to severe unintended consequences, such as deep recessions and more financial instability.

“If inflation does not moderate significantly over the coming months, this is likely to become to reality and could create the most difficult environment for monetary policymaking since the “stagflationary” period of the 1970s,” QNB added.