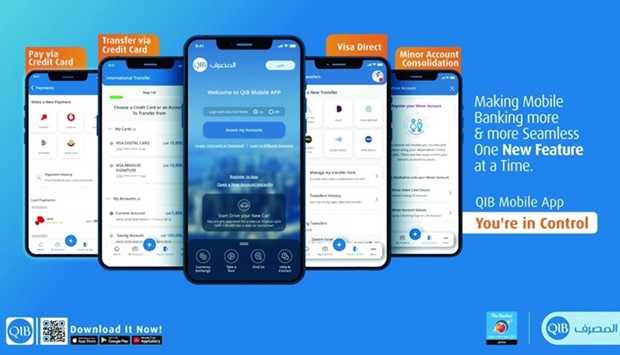

Qatar Islamic Bank (QIB) has launched three new features on its mobile app. These are minor account consolidation, the pay and transfer via credit cards and Visa direct cross border fund transfer to new countries.

Customers can now link their minors’ accounts to the app and have full control of their children’s accounts. This will allow them, as the guardians, to have a full view of their accounts as well as monitoring all the financial transactions.

To avail this service, customers will need to link their minors’ accounts to theirs by clicking on the “Link a Minor Account” option and follow the instructions.

The option to pay and transfer using QIB credit cards provides customers more flexibility in their payment options, with the opportunity to use their credit cards’ balance to make transfers and settle utility bill and other payments such as Ooredoo, Vodafone and Kahramaa.

The new feature employs the highest level of security, including high-level encryption and OTPs (one time passwords) for each transaction.

The Visa direct cross border fund transfer service allows QIB customers to transfer funds from their banking account to overseas Visa debit, credit, or prepaid cards through the mobile app.

This has now also been expanded to include seven additional countries - Egypt, India, Singapore, South Korea, South Africa, Nigeria, and Bosnia. Customers will only need to enter the Visa card details of the beneficiary and make the transfer in a fast and secured manner.

“The new features will allow customers more flexibility and more options to enjoy even more control of their finances anytime and from anywhere in the world,” said D Anand, general manager, Personal Banking Group.

Customers can now link their minors’ accounts to the app and have full control of their children’s accounts. This will allow them, as the guardians, to have a full view of their accounts as well as monitoring all the financial transactions.

To avail this service, customers will need to link their minors’ accounts to theirs by clicking on the “Link a Minor Account” option and follow the instructions.

The option to pay and transfer using QIB credit cards provides customers more flexibility in their payment options, with the opportunity to use their credit cards’ balance to make transfers and settle utility bill and other payments such as Ooredoo, Vodafone and Kahramaa.

The new feature employs the highest level of security, including high-level encryption and OTPs (one time passwords) for each transaction.

The Visa direct cross border fund transfer service allows QIB customers to transfer funds from their banking account to overseas Visa debit, credit, or prepaid cards through the mobile app.

This has now also been expanded to include seven additional countries - Egypt, India, Singapore, South Korea, South Africa, Nigeria, and Bosnia. Customers will only need to enter the Visa card details of the beneficiary and make the transfer in a fast and secured manner.

“The new features will allow customers more flexibility and more options to enjoy even more control of their finances anytime and from anywhere in the world,” said D Anand, general manager, Personal Banking Group.