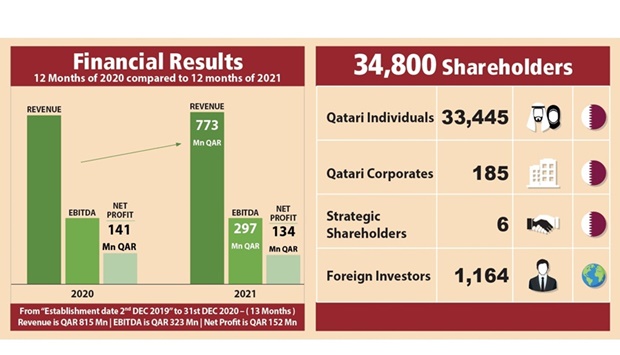

Baladna Q.P.S.C. (Baladna) recently announced its results for the year ended December 31 2021. Following its strong operational performance in the year 2020. Revenue of QR773 million and net profit of QR134 million for the year 2021 compared to QR759 million revenue and QR141 million net profit in the last year same period. Maintained industry leading net profit margin of 17% in year 2021. Increased market share in most of the categories.

During the fourth quarter of 2021, Baladna managed to achieve a revenue of QR210 million and net profit of QR32 million. This represents a revenue growth of 16% and net profit growth of 106% compared to the previous quarter. Earnings per share (weighted average) equated to QAR 0.070 for the year ending 31st December 2021.

Baladna managed to adapt these adverse market conditions through the introduction of new product lines and by growing our market share in existing segments through several marketing programs. We introduced 44 new products during the year expanding our total product portfolio to 268 products by end of 31st December 2021.

Through maintaining strategic inventories, effective buying and increase of our production and sales volumes helped to manage the effect of higher global material prices specially feed, raw material and packaging materials. Our own research and development teams along with the introduction of more sophisticated industry technology have played a major role in launching new, high-quality products and facilitating our increased production and market requirements. One of the most significant factors in our manufacturing progress is the construction of evaporated milk and sterilized cream factory which is expected to completed by end of 2022.

Baladna continued to achieve operational efficiencies across the value chain, in particular managing 37 milk yield per cow/day during extreme hot and humid weather conditions is a significant achievement.

In line with the Company’s corporate strategy to expand in the strategically important markets outside Qatar, we have initiated discussions with our foreign partners of Indonesia and Philippines and expected to proceed with the feasibility studies during 2022. In addition, the feasibility study for the project in Malaysia is under progress and expected to be completed during the year.

Proposed Dividends for 2021

With the above-mentioned strong results, the Board of Directors decided to propose QR101 million (QR0.053 per share) dividends to the upcoming General Assembly for approval.

“The above commentary is based on year-on-year results of the same period for better comparison. However, comparative information presented in the consolidated financial statements is since the date of establishment (02nd December 2019) as per the regulatory requirements”

For the complete financial statements, please visit