The United Kingdom is hosting the 26th Climate Change of the Parties (COP26) in Glasgow on October 31 to November 12, 2021. The Conference of the Parties (COP26) summit will bring parties together to accelerate action towards the goals of the Paris Agreement and the UN Framework Convention on Climate Change. The UK is committed to working with all countries and joining forces with civil society, companies, and people on the frontline of climate change to inspire climate action ahead of COP26. Coinciding with COP26, I am elucidating the solutions for carbon reduction.

The top four carbon emitters in were China, the US, the European Union, and India. Greenhouse gas emissions need to be estimated for major economic sectors in areas of operation to determine the carbon footprint. Based on the carbon footprint in various economic sectors, various initiatives should be proposed to promote green economies, such as lending for green projects, CDM scheme, and paperless banking. The banking environment operates within the global standards of lending or investing, and such standards have been revised after the global financial crisis both in terms of liquidity and capital adequacy.

The going concern and gone concern capital has been redefined and suitable buffers have also been developed taking into consideration the liquidity and systematic issues. However, in addition to above banks as socially responsible citizens have a role to play on protecting environment and contribute to sustainable development. Hence every bank should earmark minimum 10% of Tier 1 capital subject to a cap of 10% of risk weighted capital towards green banking or clean development mechanism or any sustainable development projects taking into consideration the carbon emissions prevailing in the economy in which the bank operates. The initiatives may be in the form or lending or investing. This forms the basis for green banking and brings prudency into the capital framework.

Doha Bank has promoted paperless banking, Internet banking, SMS banking, phone banking and ATM banking as well as online channels such as Doha Souq, E-remittances and online bill payments. It has launched Green Credit Card and Green Account. It also has a dedicated Green Banking Website which integrates the bank’s initiatives in promoting environmental safety with the community by reaching out to both the public and private sectors.

Doha Bank conducted Green Quiz with global warming and climatic changes as a central theme to spread awareness in various countries. Doha Bank has brought many initiatives on Green Banking. Doha Bank was involved in project financing for supporting the construction of Qatar General Electricity & Water Corporation’s Water Security Mega Reservoirs Project. Due to Doha Bank’s unwavering commitment to carbon neutrality, the bank has signed a Memorandum of Understanding (MOU) with Gulf Organisation for Research and Development (GORD) to explore areas of mutual collaboration in sustainability and carbon neutrality.

Doha Bank, a pioneer in Qatar for annual sustainability disclosures, has been publishing these disclosures for more than a decade. Our sustainability reporting is guided by the Qatar Stock Exchange (QSE) ESG reporting methodology since 2016. Doha Bank was the first listed company on the Qatar Stock Exchange to be included in the FTSE4Good Index and the bank also received an MSCI ESG Rating of BB.

The policy framework on sustainable development goals will be much more global in the world. We must reduce income equality, promote human values, and thereby create a better world. CSR also enables organisation to balance its objectives, goals, and risk management by factoring the society and environmental dimension. The ESG framework aids on this. Green economies are the growth models for global sustainability. Green banking plays a crucial role in reducing carbon emissions, promoting green economies and thereby increases their goodwill and brand image.

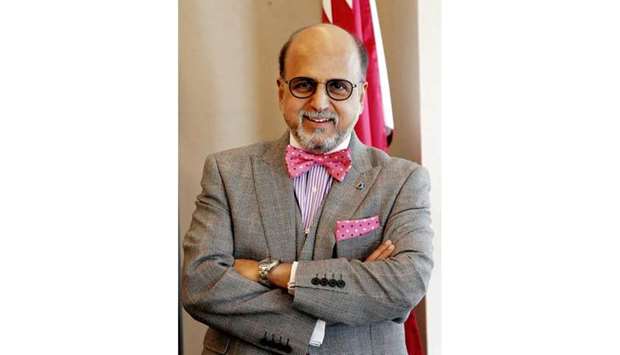

Dr R Seetharaman is Group CEO of Doha Bank.

By Dr R Seetharaman