The Great Pandemic Reflation (2020-21), a stimulus-induced recovery that brought the US economy back to life from the depths of a sharp downturn, will likely go down in history as one of the most dramatic macroeconomic events on record, QNB said in its latest report.

After the US nominal GDP collapsed by more than 33% annualised in Q2 2020, it rebounded strongly, printing annualised nominal growth rates of 38%, 6%, and 11% in the three following quarters to Q1 this year.

In the process, US markets enjoyed extraordinary rallies, with equity indices staging strong performances and cyclical commodities paring previous losses or even making new highs, QNB said.

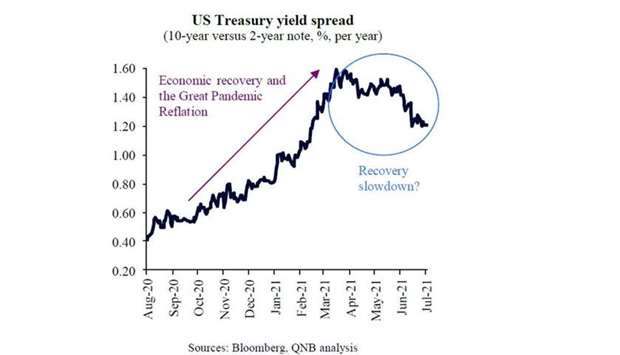

Importantly, macro-sensitive bond markets confirmed the positive backdrop. In fact, from August 2020 to March 2021, bond yields pointed to continuous tailwinds for the US economy. The benchmark spread between 10-year and two-year Treasuries widened, producing a healthy steepening of the yield curve.

This was a positive sign for the economic expansion as lower yields at the short-end of the curve implied monetary stimulus and higher yields at the longer-end of the curve implied stronger growth or inflation expectations. Moreover, the price ratio between high-yield corporate bonds and US Treasury bonds increased, suggesting elevated risk appetite from bond investors or a “risk-on” environment for months, according to QNB.

After March 2021, however, bond markets started to act differently, with the yield curve flattening and risk appetite diminishing. This process accelerated after the most recent Fed Open Market Committee (FOMC) meeting in June. Then, policymakers communicated both their willingness to start discussing a reduction in quantitative stimulus and projections for two policy rate hikes in 2023, coming from zero hikes projected in March 2021.

“In our view, bond markets are sending two messages about the US economy. First, bonds are predicting that US growth has probably already peaked in Q2 2021, after several quarters of hyper-strong activity. In other words, bond markets are pointing to a significant slowdown of the US economic recovery, with nominal growth rates set to return to a more normal ballpark of around 4% per year.

“This insight from bond markets seems to be supported by a plethora of other data, including weakening money supply, personal income, and retail sales growth. This is also consistent with a more risk averse stance from bond investors in recent months,” QNB stated.

“Second, the bond market is discounting current inflationary pressures as merely temporary, probably driven by pandemic-related supply constraints for goods. A flattening yield curve (short rates up and long rates down) suggests that inflation is only a short-term worry.

“In fact, 10-year bond implied inflation expectations (breakeven inflation rate) have gone down substantially by 25 basis points last month to stand at a contained 2.3%, significantly below the current consumer price inflation of 5% for May 2021. Hence, bond markets believe inflation is going to moderate moving forward.”

QNB added: “All in all, bond markets are sending a strong contrarian message to investors and economists, challenging the dominant narrative of continued strong growth and unanchored inflationary pressures in the US. It is also indicating that the Fed should be cautious not to withdraw stimulus too early.”

In the process, US markets enjoyed extraordinary rallies, with equity indices staging strong performances and cyclical commodities paring previous losses or even making new highs, QNB said.

Importantly, macro-sensitive bond markets confirmed the positive backdrop. In fact, from August 2020 to March 2021, bond yields pointed to continuous tailwinds for the US economy. The benchmark spread between 10-year and two-year Treasuries widened, producing a healthy steepening of the yield curve.

This was a positive sign for the economic expansion as lower yields at the short-end of the curve implied monetary stimulus and higher yields at the longer-end of the curve implied stronger growth or inflation expectations. Moreover, the price ratio between high-yield corporate bonds and US Treasury bonds increased, suggesting elevated risk appetite from bond investors or a “risk-on” environment for months, according to QNB.

After March 2021, however, bond markets started to act differently, with the yield curve flattening and risk appetite diminishing. This process accelerated after the most recent Fed Open Market Committee (FOMC) meeting in June. Then, policymakers communicated both their willingness to start discussing a reduction in quantitative stimulus and projections for two policy rate hikes in 2023, coming from zero hikes projected in March 2021.

“In our view, bond markets are sending two messages about the US economy. First, bonds are predicting that US growth has probably already peaked in Q2 2021, after several quarters of hyper-strong activity. In other words, bond markets are pointing to a significant slowdown of the US economic recovery, with nominal growth rates set to return to a more normal ballpark of around 4% per year.

“This insight from bond markets seems to be supported by a plethora of other data, including weakening money supply, personal income, and retail sales growth. This is also consistent with a more risk averse stance from bond investors in recent months,” QNB stated.

“Second, the bond market is discounting current inflationary pressures as merely temporary, probably driven by pandemic-related supply constraints for goods. A flattening yield curve (short rates up and long rates down) suggests that inflation is only a short-term worry.

“In fact, 10-year bond implied inflation expectations (breakeven inflation rate) have gone down substantially by 25 basis points last month to stand at a contained 2.3%, significantly below the current consumer price inflation of 5% for May 2021. Hence, bond markets believe inflation is going to moderate moving forward.”

QNB added: “All in all, bond markets are sending a strong contrarian message to investors and economists, challenging the dominant narrative of continued strong growth and unanchored inflationary pressures in the US. It is also indicating that the Fed should be cautious not to withdraw stimulus too early.”