Dubai property developer Limitless, one of the biggest casualties of the emirate’s financial crisis in 2009, may end up taking close to two decades to complete its debt restructuring under the timeline of its new plan.

Limitless gave secured lenders – both banks and trade creditors – two options, according to a recent presentation to creditors that shows the company owes around 2.8bn dirhams ($762mn). People familiar with the matter confirmed the details of the proposal, asking not to be identified because the information is private.

Creditors either receive an upfront 50% payment on the money they’re owed to settle or agree to a seven-year restructuring of 2bn dirhams worth of debt facilities, according to the terms outlined in the document.

Limitless told creditors last year it was hiring advisers for its third restructuring as the company defaulted on certain earlier agreements it had struck with its banks in recent years.

A spokeswoman for Limitless said “discussions with our lenders are ongoing, but, as the talks are private and confidential, we are not at liberty to share details.”

Limitless was once the poster child for Dubai’s rise on the global property and finance scene. Before the onset of the property crash and crisis that followed, the Dubai developer was behind several mega-projects including a man-made canal that would have cut through the desert but was never completed.

But as global markets turned sour, Limitless was unable to repay its debts and had to restructure on several occasions, similarly to other state entities such as its then-owner Dubai World and the government conglomerate’s subsidiaries including property firm Nakheel.

The United Arab Emirates central bank and Abu Dhabi, the oil-rich capital of the UAE, stepped in to provide $20bn of support to Dubai, whose near default rocked global markets.

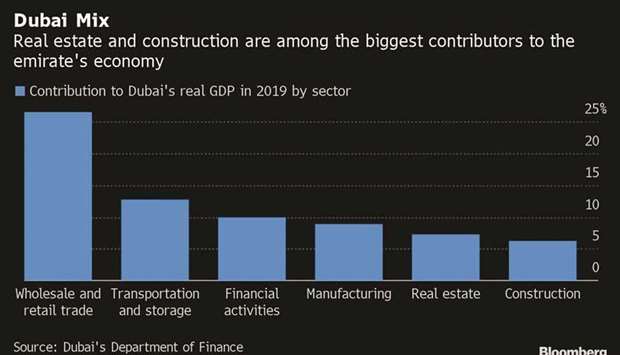

Dubai – where property prices have mostly been in decline for over half a decade – is now grappling with the fallout from the global pandemic. Despite an uptick in visitors after a gradual reopening, the disease outbreak has damaged sectors vital to the city’s economy, such as tourism and construction.

The economic headwinds have hurt the prospects of Limitless, also providing a reminder that the emirate has yet to fully turn the page on its financial crisis over a decade ago.

The company said in the proposal that “the challenges faced” by it “have been exacerbated by market-related events across the last year,” resulting in a reduction of about 31% “in key asset values since year end 2019.”