China’s fast recovery will allow for a gradual withdrawal of its policy stimulus, QNB has said in an economic commentary.

China has been for years one of the main engines of growth for the global economy. In fact, China’s expansion amounted to more than 40% of total global growth over the last ten years. More recently, as the world started to move towards a post-pandemic economic recovery, China continued to lead the way. After a sudden collapse in demand and activity in Q1 2020, when China’s GDP contracted by 6.8% year-on-year, the country performed an impressive recovery.

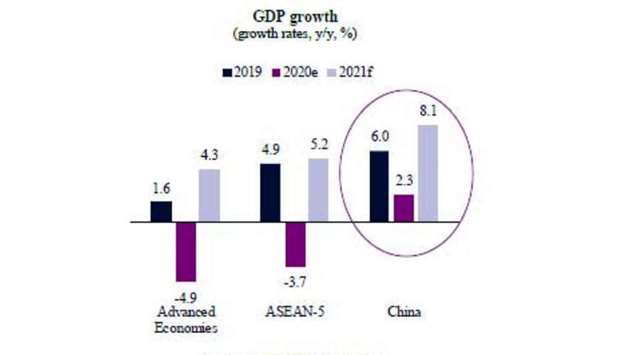

According to the IMF, China is estimated to have been the only large economy to present positive GDP growth last year. Moreover, positive momentum from the last few quarters is expected to continue and the country is set to show a significant performance in 2021, with GDP expanding by 8.1%. China is therefore not only going to outperform the major economies of the G7 (US, Japan, Germany, France, UK, Italy and Canada) but also the dynamic emerging market economies of the Asean-5 (Indonesia, Thailand, Malaysia, Philippines and Vietnam).

China’s economic strength can be explained by several factors, including an outstanding capacity in handling the health crisis through mass testing, virus tracking and effective social distancing as well as resilient exports, driven by strong demand for pharmaceuticals, personal protective equipment and work-from-home related electronics.

Another key element of the Chinese recovery was the massive policy stimulus launched last year. Fiscal policy became paramount. The government decided to promote real estate growth and invest in public infrastructure in order to offset the negative effects of the Covid-19 crisis on household consumption and private investments. As such, the public sector deficit increased, reaching 16% of China’s GDP in 2020.

While public investments were important to support the economy during the pandemic, they are not expected to be a sustainable source of long-term growth. China’s infrastructure is already highly developed and additional investments in the sector tend to be less efficient, often contributing to create inadequate levels of indebtedness and overcapacity. Thus, economic authorities are keen to look for and to promote new drivers of growth.

Moving forward, we expect to see two new drivers of growth in China.

First, as Covid-19 restrictions are lifted and domestic travelling between Chinese provinces resumes, migrant workers will be able to move around more easily again in search for higher-paying urban jobs. This will support a recovery in domestic consumption and ease the labor shortage in some urban areas, favouring both the retail and manufacturing sectors.

Second, the “great global post-pandemic open-up” will buoy Chinese exports, as rising demand from general consumer products should more than offset any decline in demand from Covid-19 related goods.

These new growth drivers are expected to support weaker segments of the Chinese market, allowing economic authorities to gradually tighten up accommodative policy measures. In 2021, the public sector deficit is expected to contract to 13.3% of GDP, which will be a step towards an economic policy “normalisation.”

All in all, with new drivers of growth and less policy stimulus, the Chinese recovery will likely continue. We expect China’s GDP to grow by 8.1% in 2021 and over 6% in the coming years, contributing to boost global economic activity.

China has been for years one of the main engines of growth for the global economy. In fact, China’s expansion amounted to more than 40% of total global growth over the last ten years. More recently, as the world started to move towards a post-pandemic economic recovery, China continued to lead the way. After a sudden collapse in demand and activity in Q1 2020, when China’s GDP contracted by 6.8% year-on-year, the country performed an impressive recovery.

According to the IMF, China is estimated to have been the only large economy to present positive GDP growth last year. Moreover, positive momentum from the last few quarters is expected to continue and the country is set to show a significant performance in 2021, with GDP expanding by 8.1%. China is therefore not only going to outperform the major economies of the G7 (US, Japan, Germany, France, UK, Italy and Canada) but also the dynamic emerging market economies of the Asean-5 (Indonesia, Thailand, Malaysia, Philippines and Vietnam).

China’s economic strength can be explained by several factors, including an outstanding capacity in handling the health crisis through mass testing, virus tracking and effective social distancing as well as resilient exports, driven by strong demand for pharmaceuticals, personal protective equipment and work-from-home related electronics.

Another key element of the Chinese recovery was the massive policy stimulus launched last year. Fiscal policy became paramount. The government decided to promote real estate growth and invest in public infrastructure in order to offset the negative effects of the Covid-19 crisis on household consumption and private investments. As such, the public sector deficit increased, reaching 16% of China’s GDP in 2020.

While public investments were important to support the economy during the pandemic, they are not expected to be a sustainable source of long-term growth. China’s infrastructure is already highly developed and additional investments in the sector tend to be less efficient, often contributing to create inadequate levels of indebtedness and overcapacity. Thus, economic authorities are keen to look for and to promote new drivers of growth.

Moving forward, we expect to see two new drivers of growth in China.

First, as Covid-19 restrictions are lifted and domestic travelling between Chinese provinces resumes, migrant workers will be able to move around more easily again in search for higher-paying urban jobs. This will support a recovery in domestic consumption and ease the labor shortage in some urban areas, favouring both the retail and manufacturing sectors.

Second, the “great global post-pandemic open-up” will buoy Chinese exports, as rising demand from general consumer products should more than offset any decline in demand from Covid-19 related goods.

These new growth drivers are expected to support weaker segments of the Chinese market, allowing economic authorities to gradually tighten up accommodative policy measures. In 2021, the public sector deficit is expected to contract to 13.3% of GDP, which will be a step towards an economic policy “normalisation.”

All in all, with new drivers of growth and less policy stimulus, the Chinese recovery will likely continue. We expect China’s GDP to grow by 8.1% in 2021 and over 6% in the coming years, contributing to boost global economic activity.