Food-delivery startup Deliveroo Holdings Plc started taking investor orders in a share sale of as much as 1.77bn pounds ($2.45bn), marking the largest initial public offering in the UK since September.

Deliveroo is selling shares at 3.90 pounds to 4.60 pounds apiece, according to a statement Monday, valuing the company at 7.6bn pounds to 8.8bn pounds.

The offering is the biggest float on the London Stock Exchange since THG Plc’s 1.88bn-pound offering in September, according to data compiled by Bloomberg. The company will take investor orders through March 30, with the stock set to start trading a day after, according to terms seen by Bloomberg News.

The sale consists of as many as 384.6mn shares, and that amount could be increased by as much as 10% if there’s enough demand. Besides the 1bn pounds of new shares the company aims to raise, existing shareholders will also offer stock in the IPO, Deliveroo said, without providing details. It plans to invest its proceeds to fuel growth.

Deliveroo had gathered enough investor demand to cover the full deal size throughout the price range within hours of opening the book, according to terms seen by Bloomberg News.

It is coming to the market at a time when coronavirus restrictions have caused soaring demand for food delivery. Gross transaction value – the total value of purchases on its platform – rose 121% in January and February versus the same period last year, the company said yesterday, after a 64% increase in 2020.

In its last full-year results, Deliveroo said that it had been profitable “at the operating level” for more than six months in 2020. Still, the company posted an underlying loss for the year of 223.7mn pounds. “Bringing the food category online represents an enormous market opportunity,” it said, adding that less than one of 21 meals a week including breakfast lunch and dinner are ordered online now.

Competition: Market opportunity for the sector “has always been there,” but there’s also competition, said Shaunak Mazumder, a global equities fund manager at Legal & General Investment Management, adding that he would have preferred for the offering “to come in slightly below the range to give more of an IPO discount and to account for possibly slower growth as we transition out of lockdown.”

Deliveroo competes with the likes of Uber Technologies Inc’s Uber Eats and Just Eat Takeaway.com NV, besides a host of smaller grocery delivery apps. And progress in vaccine rollouts across the UK, Deliveroo’s biggest market, also threaten to lead to a drop in at-home dining later this year. Still, if the company manages to hold onto its lockdown gains and keeps up with new restaurant signings, it would be “attractive,” Mazumder said.

Food-delivery companies also face increasing questions about the gig economy model, especially after a watershed ruling in Britain’s Supreme Court last week, under which Uber will reclassify all of its 70,000 drivers in the country as “workers,” who are guaranteed specific benefits under UK law. Although this won’t apply to its Uber Eats brand, “winds of change are blowing through the sector,” Hargreaves Lansdown Plc analyst Susannah Streeter wrote.

“It’s clear the challenge to Deliveroo’s contractor model is likely to continue,” she said, noting that the European Commission is set to draw up new legislation governing how the gig economy model works across the bloc. Just Eat Takeaway has already pledged to offer UK workers hourly wages, sick pay and pension contributions.

Deliveroo this month announced plans to create a fund to help restaurants and grocers in rebuilding their businesses after the pandemic, and also will give its “longest-serving and hardest-working riders” individual payments of as much as 10,000 pounds. The company will also make 50mn pounds of shares available to its customers as part of a “community offer.”

Dual-class structure: Deliveroo is listing with two classes of shares, which will give Chief Executive Officer Will Shu outsized voting rights for three years. The offering comes after a government-backed report this month made a slew of recommendations to reform UK listing rules, including allowing such governance structures on the premium segment of the LSE, but it could be months before these are implemented.

The proposals are part of London’s attempts to retain its clout as a major financial centre in a post-Brexit world and attract fast-growth technology companies to its stock exchange. About 4.8bn pounds has been raised in the UK through IPOs in the first three months of the year, according to data compiled by Bloomberg, in what might end up as the busiest-ever first quarter for listings in the City.

Even at the low end of the price range, Deliveroo would have the highest valuation upon admission of any company go public in London since Allied Irish Banks Plc listed in June 2017 with a market value of €12bn ($14.3bn).

Deliveroo’s shareholders include Amazon.com Inc, which holds a 16% stake, venture capital firms DST Global and Index Ventures, who own about 10% each, and US mutual-fund company T Rowe Price Group Inc with a 8.1% interest.

Goldman Sachs Group Inc and JPMorgan Chase & Co are joint global coordinators on the offering, while Bank of America Corp, Citigroup Inc, Jefferies and Numis Securities Ltd are joint bookrunners.

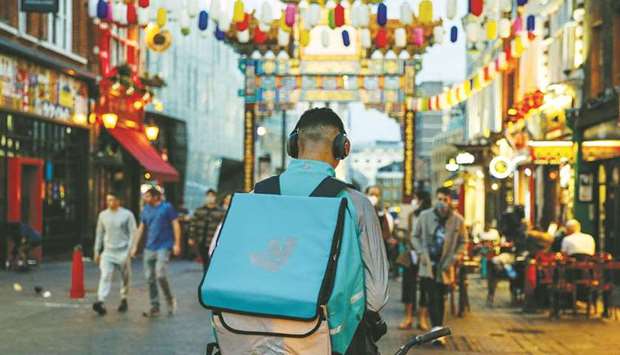

A takeaway food courier, working for Deliveroo, operated by Roofoods, stops in the Chinatown district of London. Deliveroo started taking investor orders in a share sale of as much as $2.45bn, marking the largest initial public offering in the UK since September.