Global trade has been a critical component of the economy over the last few decades, reaching around 43% of global GDP last year, QNB said in its latest report.

Traditionally, there is no expansion or contraction of global GDP without meaningful changes in the overall value and volume of trade amongst nations. Therefore, trade is a good barometer of the overall health of the global economy, QNB said.

Earlier this year, when the global spread of the Covid-19 pandemic produced unprecedented negative shocks, global trade dried up, with flows plummeting to 17% below its peak.

However, as lockdowns and social distancing measures eased in Q3 and governments around the world supported commercial activity with aggressive monetary and fiscal stimulus, global trade stabilised again, said QNB.

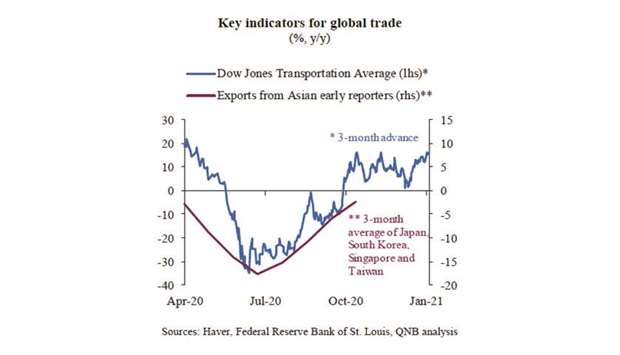

“Higher frequency data from early reporting Asian exporters point to a significant recovery of trade growth. But the pandemic is not over yet. A new wave of new cases is now taking over Europe and the US again, affecting mobility and activity. While this will likely lead to another slowdown of global trade, we expect this headwind to be short-lived, with an acceleration of the recovery in 2021. Three reasons underpin our views,” QNB said.

First, a major tailwind for the global economy emerged last month in the form of rapid advances of a Covid-19 vaccine development, which created positive prospects for activity and demand. After months of research, given outstanding results from phase 3 efficacy trials, several Covid-19 vaccines are now set to obtain emergency use authorisation in different countries.

Assuming no major problems in the mass production and distribution of approved vaccines, the global economy is expected to gradually re-open in the second and third quarters of 2021.

This should accelerate the recovery and limit potential damages from an eventual double dip recession, said QNB.

Second, the Dow Jones Transportation Average, an equity index comprised of airlines, trucking, marine transportation, railroad and delivery companies, whose performance leads exports by three months, is pointing to additional demand and exports in the future. The index is not only signalling for the beginning of a recovery but also a significant acceleration of trade growth over the next few months.

Third, according to the JP Morgan Global Purchasing Managers’ Index (PMI), the negative shock from the pandemic to services was significantly higher than to manufacturing, limiting demand destruction of physical goods.

“Moreover, in our view, part of the trade disruption earlier in the year was due to supply-side as well as logistical constraints on the production and distribution side of physical goods. As corporates and governments adapt to the pandemic, we are unlikely to see the same constraints as before, even if new waves of social distancing measures and lockdowns tighten in Europe and the US.

“All in all, global trade is set to continue its recovery into 2021. Eventual headwinds are likely to be short-lived and limited, due to an expectedly rapid rollout of Covid-19 vaccines and the more contained impact of lockdowns and social distancing measures on trade,” QNB said.