During one of the most volatile years for US stocks in decades, the least-loved strategy in the $1tn world of smart-beta is one aiming to protect investors from the turmoil.

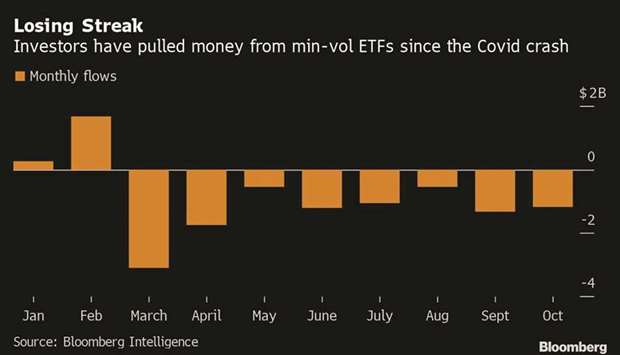

Exchange-traded funds that buy low-volatility stocks are bleeding cash. Not quickly, not in huge amounts, but relentlessly. With more than $1bn pulled from ETFs using the strategy in October, they’re set for an eighth consecutive month of outflows.

Like so much in markets this year, thank Covid-19 for the eye-opening struggle of products meant to protect against turbulence.

Valuations of these vehicles were at a decade-high coming into the pandemic-fuelled crash, yet the strategy failed when needed most – minimum-volatility shares tumbled even further than the broad stock market in the rout.In the rebound that followed, many allocators turned their attention toward growth and quality equities.

“If you’re going to add something to your portfolio with the thought that this is going to show up for you in a certain market environment and it doesn’t, that’s a significant strike against that position,” said Matt Miskin, co-chief investment strategist at John Hancock Investment Management. “It was such a beloved factor and now it’s just not as popular.”

It’s a stark change in fortunes for the quant strategy that suggests investors overvalue volatile equities and undervalue stocks that swing less. Buyers flocked because the funds largely delivered. For instance, in 2018’s fourth quarter selloff, low-vol ETFs shed less than half of the S&P 500 Index’s 14% decline.

From July 2018 until February 2020, minimum-volatility ETFs suffered just a single month of outflows en route to amassing $82bn, according to data compiled by Bloomberg Intelligence. By February 2020, valuations for the factor were the highest in at least a decade.

But throughout this year’s massive swings in the pandemic-induced meltdown, low-volatility stocks actually experienced larger moves, an unusual development sparked by indiscriminate selling in combination with plummeting interest rates.

The S&P Low Volatility Index ended March down 13.4% compared with 12.5% for the S&P 500 Index. That sparked a $3.1bn exodus from low-vol ETFs that month, and outflows haven’t let up since. “Investor sentiment changes,” said Hai Vu, portfolio manager for Brentview Investment Management. “That’s the one factor you can’t always capture in all these quantitative measures.”

Under the hood: Investors peering under the hood could see that the top holdings in low-vol ETFs weren’t the names pushing the S&P 500 Index back to all-time highs.

For instance, State Street’s SPDR SSGA US Large Cap Low Volatility Index ETF counts Republic Services Inc as its largest holding. It’s down 0.2% this year, while the Invesco S&P 500 Low Volatility fund’s top stock Verizon Communications Inc has lost 6.6%.

“The fault is it’s not fundamentally based,” said John Hancock’s Miskin. “It’s on the surface in terms of analysis, it’s not about the earnings recovery that’s developing, it’s not about the rotation that’s happening.”

With economic shutdowns crippling certain industries while boosting big tech, investors are paying greater attention to metrics like cash reserves and future earnings potential.

Funds focused on growth and quality have added cash this year, along with value, which has attracted $1.1bn in October alone.

Rocky future: Given the uncertainties on the horizon – the risk of a contested US presidential election, further waves of infections – min-vol may yet come back into style. The Cboe Volatility Index spiked to a seven-week high on Tuesday as a stalemate on stimulus added to virus fears.

But low-vol’s inability to capitalise earlier this year limits the chances of a comeback, according to Scott Knapp.

“The thesis was a good one,” said the chief market strategist of CUNA Mutual Group. “The experience hasn’t been good.”

Meanwhile, a new category of products called buffer funds have been quietly taking up the slack. Offered by issuers like Allianz Investment Management and Innovator ETFs, these funds shield holders against a certain percentage of declines in exchange for a cap on gains. They’ve gathered billions this year.

“You’re getting a much more deliberate downside cap,” said Jillian DelSignore, principal at Lakefront Advisory. “As investors look for more defined outcome type of investments, those sorts of products are going to continue to be quite popular.”

..