Covid-19 pandemic is bringing about a “rocky path to a new-normal for the global economy”, QNB said and noted the IMF’s expectation is for only a “partial and uneven” global recovery in 2021.

The International Monetary Fund (IMF) recently published the October 2020 update of its World Economic Outlook (WEO).

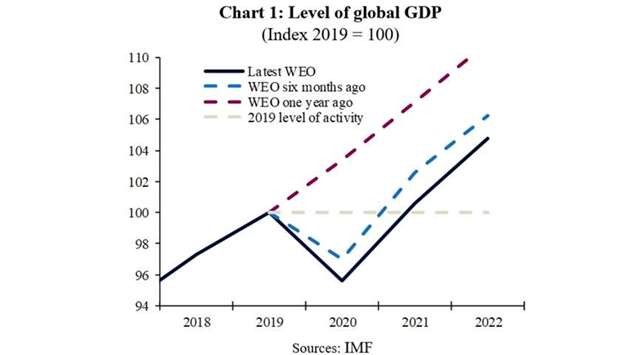

The WEO highlights the unprecedented fall in global GDP in Q2 2020, when around 85% of the global economy was under lockdown, referring to it as “The Great Lockdown”, QNB said in its weekly economic commentary.

The global economy is coming back from the depths of the crisis. But this pandemic is far from over. Going, forward the IMF’s expectation is for only a partial and uneven recovery in 2021, which marks the beginning of what they call “The Long Ascent.”

“We broadly share this outlook but we consider it more of ‘a rocky path to a new-normal’ as we dislike the idea of an equally long descent,” QNB said.

The new-normal is a world of extraordinary policy measures that are required to put a floor under the global economy, it said.

With central banks’ balance sheets and interest rates still not recovered from the 2008 Global Financial Crisis, attention has turned to fiscal policy.

Indeed, the IMF estimates that “governments have provided around $12tn in fiscal support to households and firms.”

Central banks have not been idle, either, responding to the crisis by slashing interest rates back to zero in many cases and injecting unprecedented amounts of liquidity into banks and credit markets. This has maintained the flow of credit, helping millions of firms to stay in business.

However, QNB noted there is “significant variation” across countries in both the effectiveness of measures to contain the pandemic and their capacity to provide policy support.

For many advanced economies, including the US and the European Union, the downturn remains painful while China’s recovery is progressing in a less disrupted but stable manner.

The path ahead is clouded with extraordinary uncertainty. Faster progress on vaccines and treatment could help reduce both infection and mortality rates and smooth the path to a new-normal.

However, things could also get worse, especially if the current rise in infection rates across many countries continues to get worse.

Risks remain elevated, including rising bankruptcies, job losses and the potential over-valuation in some financial markets. At the same time, many countries have become more vulnerable.

Debt levels have increased because of the fiscal response and the substantial reduction in revenues across firms in many sectors of the economy. The IMF estimates that global public debt will reach a record-high of about 100 percent of GDP in 2020.

QNB highlights three priorities for policy makers.

First, protect people’s health. Effective treatment, testing, and contact tracing are vital. Public funding as well as better international co-operation to co-ordinate vaccine manufacturing and distribution would help.

As the IMF says: “Only by defeating the virus everywhere can we secure a full economic recovery anywhere”.

Second, prematurely withdrawing policy support is a clear risk. In countries and regions where the pandemic persists, it is important to maintain lifelines for the most vulnerable firms and workers, including tax deferrals, credit guarantees, cash transfers, and wage subsidies.

Continued monetary stimulus and liquidity support are still required to ensure the flow of credit and liquidity to maintain jobs and financial stability.

Third, flexible and forward-thinking fiscal policy still seems required for a sustainable recovery. This crisis has hastened profound structural transformations that necessitate the reallocation of capital and labor. Fiscal policy can help to stimulate the creation of new jobs.

“The IMF’s projections assume that policymakers deliver on these priorities, which are reasonable in a base case, but will not be easy. Therefore, we judge risks to remain skewed to the downside and expect both firms and consumers to remain cautious until the path ahead becomes clearer and less rocky,” QNB noted.

The WEO highlights the unprecedented fall in global GDP in Q2 2020, when around 85% of the global economy was under lockdown, referring to it as “The Great Lockdown”, QNB said in its weekly economic commentary.

The global economy is coming back from the depths of the crisis. But this pandemic is far from over. Going, forward the IMF’s expectation is for only a partial and uneven recovery in 2021, which marks the beginning of what they call “The Long Ascent.”

“We broadly share this outlook but we consider it more of ‘a rocky path to a new-normal’ as we dislike the idea of an equally long descent,” QNB said.

The new-normal is a world of extraordinary policy measures that are required to put a floor under the global economy, it said.

With central banks’ balance sheets and interest rates still not recovered from the 2008 Global Financial Crisis, attention has turned to fiscal policy.

Indeed, the IMF estimates that “governments have provided around $12tn in fiscal support to households and firms.”

Central banks have not been idle, either, responding to the crisis by slashing interest rates back to zero in many cases and injecting unprecedented amounts of liquidity into banks and credit markets. This has maintained the flow of credit, helping millions of firms to stay in business.

However, QNB noted there is “significant variation” across countries in both the effectiveness of measures to contain the pandemic and their capacity to provide policy support.

For many advanced economies, including the US and the European Union, the downturn remains painful while China’s recovery is progressing in a less disrupted but stable manner.

The path ahead is clouded with extraordinary uncertainty. Faster progress on vaccines and treatment could help reduce both infection and mortality rates and smooth the path to a new-normal.

However, things could also get worse, especially if the current rise in infection rates across many countries continues to get worse.

Risks remain elevated, including rising bankruptcies, job losses and the potential over-valuation in some financial markets. At the same time, many countries have become more vulnerable.

Debt levels have increased because of the fiscal response and the substantial reduction in revenues across firms in many sectors of the economy. The IMF estimates that global public debt will reach a record-high of about 100 percent of GDP in 2020.

QNB highlights three priorities for policy makers.

First, protect people’s health. Effective treatment, testing, and contact tracing are vital. Public funding as well as better international co-operation to co-ordinate vaccine manufacturing and distribution would help.

As the IMF says: “Only by defeating the virus everywhere can we secure a full economic recovery anywhere”.

Second, prematurely withdrawing policy support is a clear risk. In countries and regions where the pandemic persists, it is important to maintain lifelines for the most vulnerable firms and workers, including tax deferrals, credit guarantees, cash transfers, and wage subsidies.

Continued monetary stimulus and liquidity support are still required to ensure the flow of credit and liquidity to maintain jobs and financial stability.

Third, flexible and forward-thinking fiscal policy still seems required for a sustainable recovery. This crisis has hastened profound structural transformations that necessitate the reallocation of capital and labor. Fiscal policy can help to stimulate the creation of new jobs.

“The IMF’s projections assume that policymakers deliver on these priorities, which are reasonable in a base case, but will not be easy. Therefore, we judge risks to remain skewed to the downside and expect both firms and consumers to remain cautious until the path ahead becomes clearer and less rocky,” QNB noted.