QNB foresees a “continued but modest and gradual weakening” in the value of the dollar over the next few years as the global economy recovers from the impact of Covid-19.

The main risks to this view, however, is that the global outlook could deteriorate again as a result of a second virus wave and renewed lockdowns. That could lead again to a strengthening of the dollar as a safe-haven currency, QNB noted.

The global spread of Covid-19 has produced a wild ride in financial markets since the beginning of 2020, with risk sentiment swinging from rampant optimism to fear and back again on a number of occasions. Historically, this has tended to favour safe-haven assets, including high quality government debt, precious metals and currencies of wealthy countries.

The DXY index measures the value of the United States Dollar (USD) relative to a weighted basket of six currencies:

* Euro (EUR) 57.6% weight

* Japanese yen (JPY) 13.6% weight

* Pound sterling (GBP) 11.9% weight

* Canadian dollar (CAD) 9.1% weight

* Swedish krona (SEK) 4.2% weight

* Swiss franc (CHF) 3.6% weight

Many of the currencies in the DXY basket are also safe-haven currencies themselves, and this led to sharp swings in DXY during March for a number of reasons that QNB explained at the time.

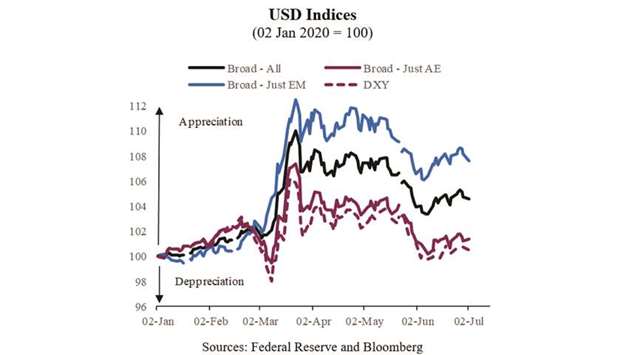

This week, QNB takes a step back and consider the strength of the USD against a broader range of currencies using the Federal Reserve’s (Fed’s) Broad Index of the Foreign Exchange Value of the Dollar. Considering the strength of the USD against a broader range of currencies (including EM) is important as the centre of mass of the global economy is shifting towards Asia.

Having made this change, QNB said it “can more clearly see the USD acting as a safe-haven, with a very notable strengthening of the USD during the peak of the market turbulence in March.” Then, during April and May, the dollar drifted lower as lockdowns across the globe were effective at slowing the spread of Covid-19 and reducing perceptions of risk from extreme levels. Indeed, effective policy responses have allowed economies in Asia, such as China and Vietnam to return to growth.

More recently, the USD weakened during June as lockdown measures were eased, even as a period of social unrest contributed to a resurgence of the virus in a number of US states.

“We will now put these movements into a longer-term context, considering three factors, which will act as headwinds to the USD during the rest of the year and over the longer-term,” QNB said.

First, the USD has benefited from persistent portfolio inflows into US markets over the past few years, reflecting high yields compared with other developed market economies.

Indeed, fundamental models of equilibrium value of the dollar suggest that it was around 20% over-valued during April, before its modest recent weakening.

Now that the Fed has slashed US interest rates back down to zero, there is a much smaller spread in risk free interest rates between the USD and other major global currencies like the EUR and JPY.

Second, as already mentioned above, the economic rebound in Asia and Europe is more advanced by a few months relative to the US, thanks to extensive stimulus measures and the effectiveness of measures taken to reduce the spread of the virus.

As long as it is sustained, the rebound should lead to a pickup in asset values and returns to investors, supporting the value of Asian currencies and therefore weakening the dollar.

Third, heavy issuance of US government debt in the coming years will put downward pressure on the USD. Foreign investors already have large holdings of USD assets, and would need to be incentivised to increase their holdings further.

That could come in the form of higher interest rates, but if the Fed keeps rates low over the coming years (as QNB expects), it may instead require lower prices in foreign currency terms—i.e., through dollar depreciation.

“Taken together, we foresee a continued but modest and gradual weakening in the value of the USD over the next few years as the global economy recovers from the impact of Covid-19. The main risks to this view is that the global outlook could deteriorate again as a result of a second virus wave and renewed lockdowns. That could lead again to a strengthening of the USD as a safe-haven currency.

“Time will tell which of the factors driving the USD will dominate over the next few months,” QNB added.

Business / Business

Continued but modest and gradual weakening of dollar seen as global economy recovers: QNB

QNB graph