Iron ore will sink back to the $60 a tonne in 2020 as a pick-up in supply eases a global crunch, the world’s biggest shipper warned, while cautioning investors that the expected slump won’t be immediate.

Prices will average $63 next year as global mine output rebounds following disruptions in Brazil and Chinese steel production contracts, the Australian government said in a quarterly report. While that’s up slightly on a September forecast, it represents a 21% slump from this year’s average, it said.

Iron ore has endured a tumultuous year as supply woes in Brazil and Australia spurred a rally to more than $120 in July, before prices fell back as exportspicked up, then pushed into the $90s this month. Australia joins others in flagging that while the recent climb isn’t at risk of an imminent collapse, there is likely to be a significant retreat over the full course of 2020. “Bouts of restocking by Chinese steel mills have helped support the price as global supply steadily recovers,” the Department of Industry, Innovation and Science said, adding prices aren’t likely to retreat much in the short term as the market remains tight. Over 2020, iron ore is forecast to fall as seaborne supply recovers further and Chinese steel output drops, it said.

Lower prices would crimp revenue and income at the country’s top miners, including BHP Group, Rio Tinto Group and Fortescue Metals Group Ltd, although their margins on producing the raw material will remain substantial.

The department predicts that prices will extend declines in 2021, averaging $60.50. Its projections refer to spot ore with 62% iron content, free-on-board Australia. Benchmark spot ore landed in China was at $92.55 on Wednesday, while on Thursday futures in Singapore were little changed at $91.59.

The view from Australia echoes recent predictions from major banks. Citigroup Inc expects iron ore to fall in 2020, although a significant drawdown in inventories this year and challenges around a supply recovery in Brazil mean a sudden collapse isn’t likely. Morgan Stanley has said prices may remain elevated in early 2020, but decline through the year as tightness unwinds, with iron ore the least-favored commodity over 12 months.

Global seaborne supply is set to expand 3.6% in 2020 after shrinking this year due to Brazil’s supply problems, according to the Australian report. Exports from the South American country will surge 7.4% next year, while shipments from Australia will increase 3.7%. Chinese imports will be flat at 1.06 billion tons in 2020 and rise 5.5% in 2021, the report said. The country’s crude-steel output will fall 1.2% next year as consumption drops 2.3%. The steel industry has faced headwinds from slowing auto production and persistent uncertainty around the global economy, it said. In other steel and iron ore forecasts:

The premium for high-grade ore has eased in recent months, possibly reflecting an attempt by Chinese mills to reduce costs. However, production is likely to stay elevated, with steel output high at most facilities and winter production cuts likely to be modest.

China’s use of scrap steel has eased in recent months as falling iron ore prices and low steel margins drove a shift back toward cheaper pig iron and lower-grade ores. China continues to fund infrastructure to collect and process scrap, but consumption is not yet widespread. India has become a pivotal player in global steel production over the last five years although it faces an array of challenges, including tight margins, ample international supply, domestic economic slowdown and global trade tensions. Near-term output may also be disrupted by the expiration of mining leases in March 2020.

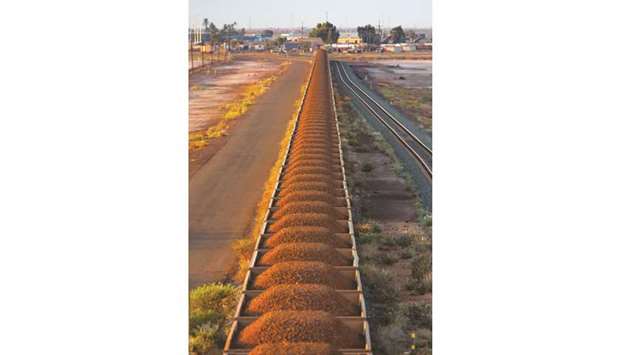

A freight train carrying iron ore travels along a rail track towards Port Hedland, Australia. Iron ore prices will average $63 next year as global mine output rebounds following disruptions in Brazil and Chinese steel production contracts, the Australian government said in a quarterly report.