Stocks in the developing world scaled 18-month highs yesterday on growing hopes a trade deal between the United States and China will soon be inked, while the Russian rouble strengthened against a weaker dollar.

Market players took comfort in comments from Beijing that it was in close contact with Washington about an initial trade agreement, shortly after US President Donald Trump talked up a signing ceremony for the recently struck “phase one” deal.

“So in 2020, we see a higher level of confidence about those things,” said Chris Bailey, strategist at Raymond James.

“Markets need a surprise to the upside.

To get that, you’re going to need to see a phase one deal signed, and some positive comments continuing around trade.”

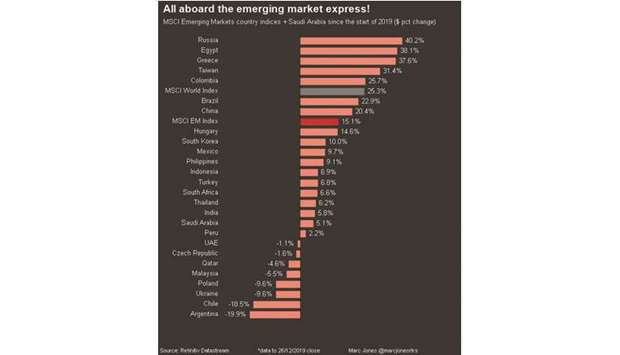

A recent cooling in tensions between the world’s two biggest economies has encouraged investors to place heavier bets on risky emerging market assets, with the MSCI’s index for developing world stocks poised for its strongest monthly gain in 11 months.

The index was up 0.7% yesterday, touching its highest since June 2018, and was on track for its fourth straight weekly gain.

Also providing support was data from China which showed profits at industrial firms grew at the fastest pace in eight months in November.

However, broad weakness in domestic demand remains a risk for company earnings next year.

MSCI’s index for emerging market currencies edged 0.1% higher, with the Russian rouble outperforming.

The Russian central bank is developing new criteria for a maximum debt level for domestic companies to prevent any possible systemic risk at an early stage, Elizaveta Danilova, head of the bank’s financial stability department, told Reuters.

For the decade, emerging market stocks have underperformed developed market peers, despite a strong start in 2010.

Factors such as the Chinese market sell-off, debt crises in Turkey and Argentina and the Sino-US trade war, have weighed on equities.

.