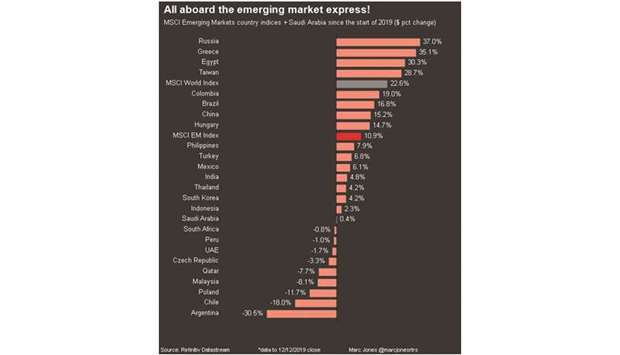

Developing world stocks topped an over seven-month peak yesterday as reports of a Sino-US trade deal, as well as the prospect of a smooth Brexit, saw risk appetite running rampant across the globe.

Positive headlines over two prolonged pain points for markets saw widespread moves into risk assets, with the MSCI’s emerging markets stock index jumping as much as 1.5%.

Asian stocks tracked overnight gains on Wall Street following reports of the deal, although no official statement was received from either Washington or Beijing.

The news came just days before a December 15 deadline on further US tariff action against China.

European equities were also stronger after a landslide election victory for British Prime Minister Boris Johnson, which implies a smooth exit for London from the European union.

The emerging market stock index was set for its best week since mid-June, having also been supported by buying in the face of a dovish US Federal Reserve.

Russian stocks rose ahead of a likely interest rate cut by the country’s central bank, while the rouble touched its strongest to the dollar since August 2018.

The Russian central bank is expected to cut rates by at least 25 basis points later in the day, according to a Reuters poll.

The cut would be the bank’s fifth this year, as improving laggard inflation in the country remains a key focus.

“Given that the market is pricing in at least 25 basis points cut, the worst-case outcome would be if the bank leaves the policy rate unchanged,” Credit Suisse analysts said in a note.

“There is a small likelihood that the bank will cut the policy rate by 50bps (we think that there are more than enough reasons in favour of this step), but probably it would not fit the bank’s reaction function.”

Chinese stocks marked their best day in nearly four months, while the yuan firmed to above the key 7 to-a-dollar level.

South Africa’s rand was at its strongest level against the dollar since early August, despite data showing that the country logged less foreign direct investment in the third quarter as compared to the second.

.