Emerging market assets jumped to their highest in more than a month yesterday as the prospect of an accommodative US Federal Reserve pushed money into equities and undercut the dollar.

At its final meeting for 2019, the Fed held on rates and said it was likely to do so in the near term.

That helped distract most markets from an impending deadline for further US tariff action against China, which could potentially derail trade talks between Washington and Beijing.

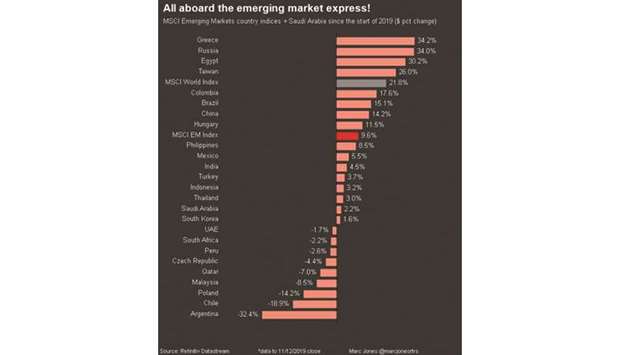

The MSCI’s emerging markets stock index rose as much as 1% to a near five-week high, while the currencies index added up to 0.3%.

Turkish stocks surged ahead of a widely expected interest rate cut by the central bank, its fourth this year, according to a Reuters poll.

The bank is expected to trim rates by 150 basis points to 12.5%.

The expected cut, and three others before it, have been part of an easing cycle to revive the economy from a currency crisis in 2018 that almost halved the value of the lira at one point.

Turkish inflation has also slowed substantially since the crisis and stood near three-year lows in November, reinforcing expectations for a sizeable policy rate cut at today’s meeting.

“Consumer spending is still relatively low, there is no substantial risk that demand-led pressure on inflation may increase significantly in the coming months,” said Piotr Matys, an emerging markets FX strategist with Rabobank in London.

The lira strengthened slightly to 5.7933 against the dollar, by 0944 GMT.

“Assuming that the lira stays relatively stable next year, (central bank) governor Murat Uysal will continue cutting interest rates.

The pace of easing (next year) is going to be significantly slower,” Matys added. Russian stocks and the rouble both climbed to near one-month highs, supported chiefly by gains in oil prices as Opec forecast a supply deficit next year.

South African stocks extended gains into a third straight session, while the rand also rose.

Chinese stocks were unnerved by the looming US tariff deadline, snapping a 5-day winning streak to end lower.

The yuan was little changed.

Polish stocks rose, while the zloty was marginally higher to the euro.

.