Asian governments are starting to do their bit to revive economic growth as central banks gradually pull back on monetary policy easing. Japan’s government announced a stimulus package worth some ¥26tn ($239bn), with about half coming from government spending.

That came a day after Hong Kong announced additional steps to shore up businesses suffering from months of political unrest. “We’re going to see more of this,” said Hak Bin Chua, a senior economist at Maybank Kim Eng Research in Singapore. “The space for monetary policy has narrowed, given how close interest rates are to the zero bound. There’s an increasing recognition that you can’t just depend on central banks; governments have to provide support through fiscal policy.”

That may be easier said than done. Unlike interest-rate decisions generally made by a small central bank committee, fiscal stimulus needs approval from governments and sometimes parliaments, and may run up against debt limits anchored in law.

In addition, the impact of fiscal policy may appear only with a considerable lag – a disincentive for leaders who might be out of office by then. Still, policy makers “are starting to accept that something more needs to be done,” said Tuuli McCully, head of Asia Pacific economics at Scotiabank in Singapore. “I think the reality is kicking in that they need to loosen their purse strings.”

Here’s an overview of what various Asian countries have done to date: Japan Prime Minister Shinzo Abe described the new stimulus as a three-pillared package to boost disaster relief, protect against downside risks and prepare for longer-term growth after the 2020 Tokyo Olympics.

It should boost real growth by about 1.4 percentage point, according to a draft of the package obtained by Bloomberg. What Bloomberg’s economists say: Monetary policy is fast moving, technocratic, and – especially when rates are on the way down – enjoys broad political support.

That’s what makes it so effective as a tool for demand management. It also explains why it’s now all but used up. Fiscal policy, in contrast, is slow moving, mired in ideological debates, and hemmed in by political constraints. Sometimes a blunt instrument is the only one there is.

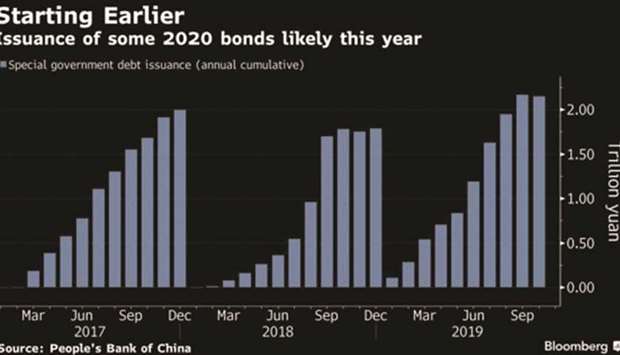

Tom Orlik, chief economist, China: The centrepiece of China’s “proactive” fiscal policy this year has been about 2tn yuan ($284bn) in tax cuts. While those reductions helped swell the deficit, they haven’t arrested the economy’s slowdown, and growth is projected to slip below 6% next year.

A key meeting to set economic policy this month will detail the balance between monetary and fiscal settings for 2020.

Meanwhile, officials are bringing forward from next year the use of some off-balance-sheet infrastructure spending financed by local government debt. India Prime Minister Narendra Modi’s administration has taken a series of steps to halt a slump in the economy, adding to the monetary stimulus from five interest-rate cuts this year.

Measures include a $20bn corporate tax cut, a $1.4bn fund to salvage stalled residential projects and a $7bn stimulus for exporters. Finance Minister Nirmala Sitharaman is open to doing more, but room is limited with the government to breach its deficit goal.

As economic growth slumps to a decade low, South Korea’s government proposed a record 513.5tn won ($431bn) budget for next year, a 9.3% increase from this year’s main budget. Finance Minister Hong Nam-ki called the budget “as expansionary as possible.”

The Bank of Korea has already cut its benchmark rate to match a record low. Government spending has been a key source of support for the economy, offsetting a pullback in private investment.

The proposal to raise 2020 spending came after the government implemented a supplementary budget in the second half of this year.

Hong Kong’s embattled government has responded to recession with a range of fiscal measures aimed at shoring up business confidence and households. The HK$4bn ($511mn) package announced brings the total since June to about HK$25bn. The government now expects to run a rare budget deficit this fiscal year.

.