Most emerging stock markets rose yesterday, tracking Wall Street’s rally in the prior session, although a surprise drop in Chinese exports checked larger gains, with the focus turning to an upcoming deadline on further US tariffs on Chinese goods.

Global stocks tracked Wall Street’s Friday rally, although gains were checked by weak trade data from China providing a stark reminder of the economic impact of a prolonged trade war.

With US tariffs on Chinese goods due to come into effect on Sunday, investors are likely to make cautious plays in anticipation of a “phase-one” trade deal between the two.

“The contrasting US and Chinese data should swing the trade negotiation pendulum back to neutral from the Chinese side amongst the worlds trade watchers (i.e. all of us),” Jeffrey Halley, senior market analyst at OANDA, wrote in a note.

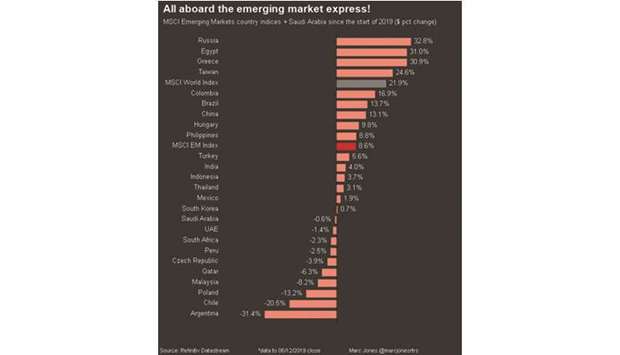

“One gets the sense that this Sunday’s next round of tariffs on China is no longer the line in the sand it once was perceived to be.” The MSCI’s index of emerging market stocks ticked up to a near two-week high, and was likely to gain for a third straight day.

The Saudi Arabian stock index was among the best performers, ahead of the listing of State-owned oil group Saudi Aramco on Thursday.

Aramco’s initial public offering was the largest in the world, raising about $25.6bn.

Russian stocks pared early gains to trade flat as stronger oil and gas stocks were offset by weaker financials.

Energy stocks, which rank among the heaviest on the Russian index, were propped by large gains in oil prices last week.

However, oil prices ticked lower for the day as markets perceived weaker growth resulting in softer demand from China.

Chinese stocks ended slightly lower, while the yuan weakened marginally.

The MSCI’s emerging market currency index holding its ground against the dollar, which ended last week lower despite the strong jobs showing.

.