Oil

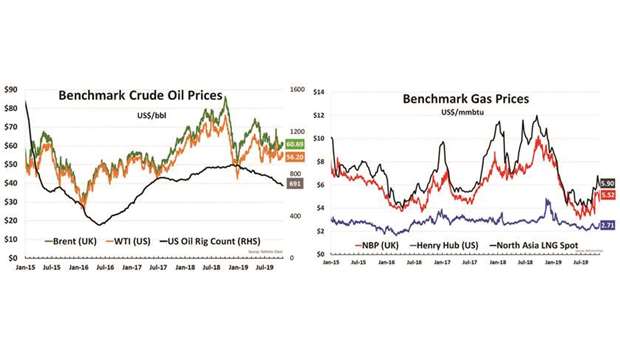

Oil prices rose nearly 4% on Friday on signs of progress in US-China trade talks and stronger-than-expected economic data in both countries, including US employment and Chinese manufacturing activity numbers. Brent crude ended Fridays’ session up 3.5% at $61.69 a barrel, but notched a drop of about 0.4% for the week. West Texas Intermediate crude settled 3.7% higher at $56.20 a barrel, but fell 0.8% in the week.

Both benchmarks had fallen earlier in the week after a hike in US crude inventories, especially at the Cushing, Oklahoma, delivery hub for WTI, and as the trade war weighed on prices, stimulating fears that slowing economic growth could dent demand for oil. However, prices drew large support after the US and China on Friday said they made progress in talks aimed at defusing a nearly 16-month-long trade war that has harmed the global economy. US officials said a deal could be signed this month. US President Trump said he hoped to sign an agreement with Chinese President Xi Jinping at a US location, perhaps in the farming state of Iowa, which will be a key state in the 2020 presidential election.

Prices were also supported on Friday by expansion in China’s factory activity at the fastest pace since 2017, raising optimism over the health of its economy. US jobs growth also slowed less than expected in October. However, even with the additional supporting factors, a Reuters survey suggests oil prices are likely to remain pressured this year and next, as low demand from a slowing global economy and a surge in US shale output offset support from Opec production cuts and supply risks.

Gas

Asian spot prices for LNG dropped last week as floating storage cargoes started unloading into an already oversupplied market. The average LNG price for December delivery into northeast Asia was estimated at $5.90 mmBtu, $0.40/mmbtu down from the previous week. Vessels floating with cargoes on board waiting for a higher price have started discharging, with most of the volumes expected to be unloaded this month. Traders suggest this could further pressure prices. Floating cargoes were unloaded this week in Greece, Poland, Spain, The Netherlands, India and Japan. Spot LNG demand also remained scarce last week. Korea Gas Corp (KOGAS) is facing a situation of full LNG storages, but sources said KOGAS might have bought up to 15 cargoes for January and February delivery.

In the US, Natural gas markets broke higher during the week, slamming into the $2.75 level. At this point, the market looks likely to continue to see buyers looking for value in a market that cyclically should be strong this time of year anyway. With temperatures in the US starting to fall rather drastically, more demand for natural gas will be seen in the coming weeks.

In Europe, there has been an influx of cargo arrivals in October as spot LNG demand from Asia has been tame, with strong deliveries over the whole past year, which has contributed to the current low-price level. Several vessels with cargo onboard are floating around the shores of Europe, likely waiting to be discharged in November.

n This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development.

.